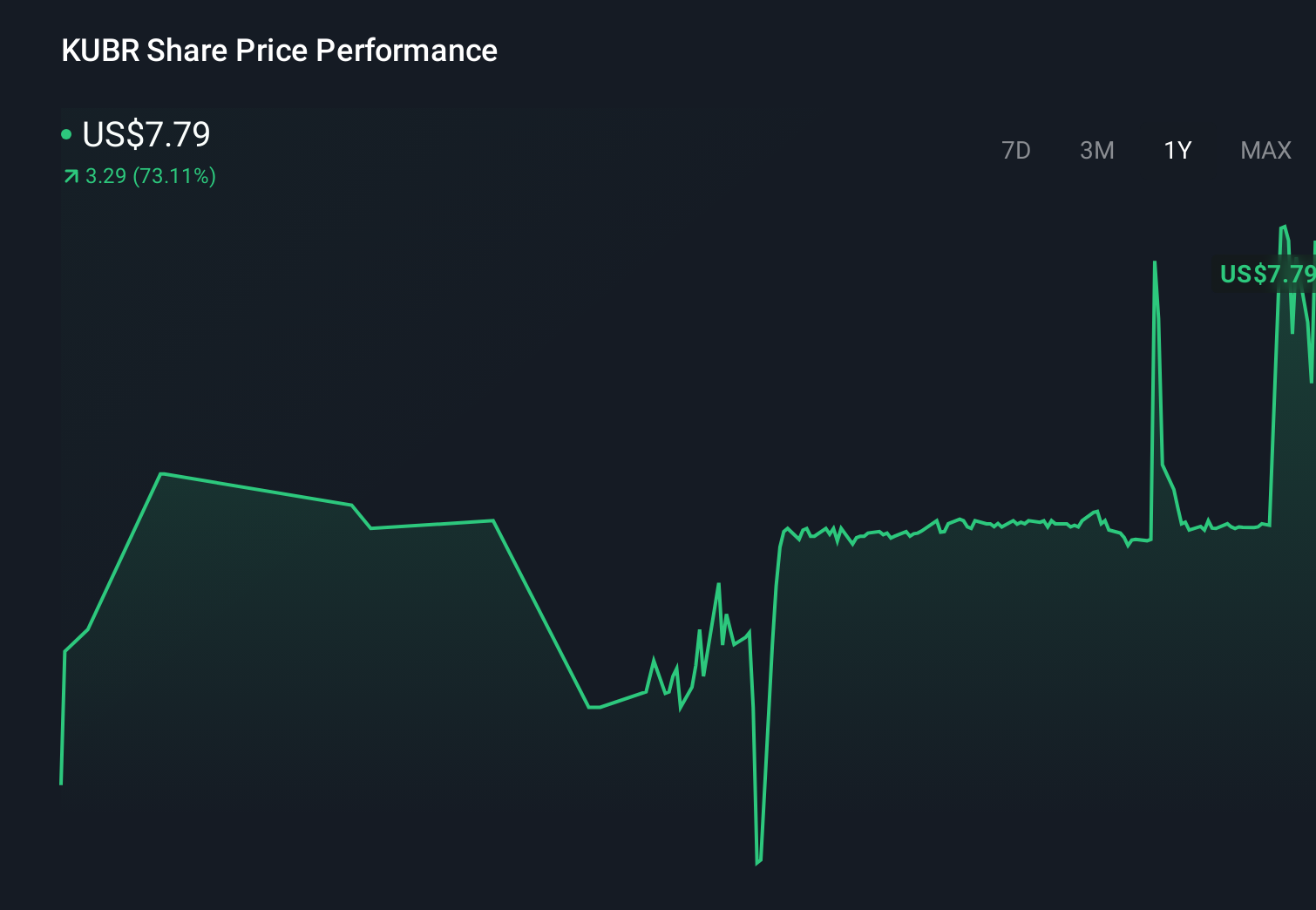

Is Kuber Resources (KUBR) Quietly Rewriting Its IP Strategy With Flexible New Financing Talks?

- Kuber Resources Corporation recently entered a non-binding cooperation framework agreement with Yuli Listing Operation Co. to explore up to US$30 million in potential financing for acquiring intellectual property assets such as patents and trademarks.

- By keeping the framework non-binding and subject to further negotiation and board approval, Kuber preserves flexibility and control over how it funds future IP-driven expansion.

- We’ll now examine how this flexible IP-focused financing exploration shapes Kuber Resources’ investment narrative and growth ambitions.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Kuber Resources' Investment Narrative?

For Kuber Resources, the big-picture belief is that a small, volatile company with limited revenue but improving profitability can turn an IP-centric model into something more durable. Recent quarterly numbers show uneven sales but positive net income, which already makes execution on the core business a key short term catalyst. The new non-binding framework with Yuli to explore up to US$30,000,000 in IP financing slots into that story as an option rather than a done deal, so the immediate impact on those catalysts looks more reputational than financial. The bigger swing factor, in my view, is whether any eventual IP acquisitions are disciplined and accretive, particularly given Kuber’s high price to book, prior shareholder dilution and repeated filing delays, all of which keep governance and capital allocation risk front and center.

However, one issue around compliance and market trust is hard to ignore for investors. Our valuation report unveils the possibility Kuber Resources' shares may be trading at a premium.Exploring Other Perspectives

Explore another fair value estimate on Kuber Resources - why the stock might be worth 40% less than the current price!

Build Your Own Kuber Resources Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kuber Resources research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free Kuber Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kuber Resources' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com