Healthcare Realty Trust (HR): Valuation Check After Cantor Backs Strategy and $1 Billion Asset Sale Plan

Healthcare Realty Trust (HR) is back in focus after Cantor Fitzgerald backed its ongoing strategic overhaul, highlighting that the REIT’s planned asset sales of more than 1 billion dollars align with falling cap rates in medical office deals.

See our latest analysis for Healthcare Realty Trust.

That backdrop helps explain why, even with the latest share price at $17.18 and a softer 1 month share price return, Healthcare Realty Trust still shows a positive year to date share price return and solid multi year total shareholder returns. This suggests momentum is rebuilding rather than breaking.

If this kind of repositioning in healthcare real estate has your attention, it might be a good moment to scan other opportunities across healthcare stocks and see what else fits your strategy.

Yet with shares still trading at a double digit discount to analyst targets and an even steeper gap to some intrinsic value estimates, investors now face a pivotal question: is Healthcare Realty Trust mispriced, or is the market already baking in a healthier future?

Most Popular Narrative: 11.9% Undervalued

With Healthcare Realty Trust last closing at $17.18 against a most popular fair value view of $19.50, the narrative leans toward gradual upside rather than a quick rerating.

Embedded value add opportunity in the lease up portfolio (targeting $50 million incremental NOI from increasing occupancy and rental rates through $300 million of internally funded capital projects) provides a clear path to outsized NOI and earnings expansion relative to current suppressed valuation.

Curious how shrinking share count, a turnaround in margins, and flat top line can still support a richer valuation? The narrative stitches those levers together in a way that challenges the headline forecasts and relies on a specific future earnings multiple to justify that higher fair value.

Result: Fair Value of $19.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower-than-expected lease-up progress or setbacks in shifting to a more operations-focused model could dilute those projected earnings gains.

Find out about the key risks to this Healthcare Realty Trust narrative.

Another View: Multiples Point to a Richer Price

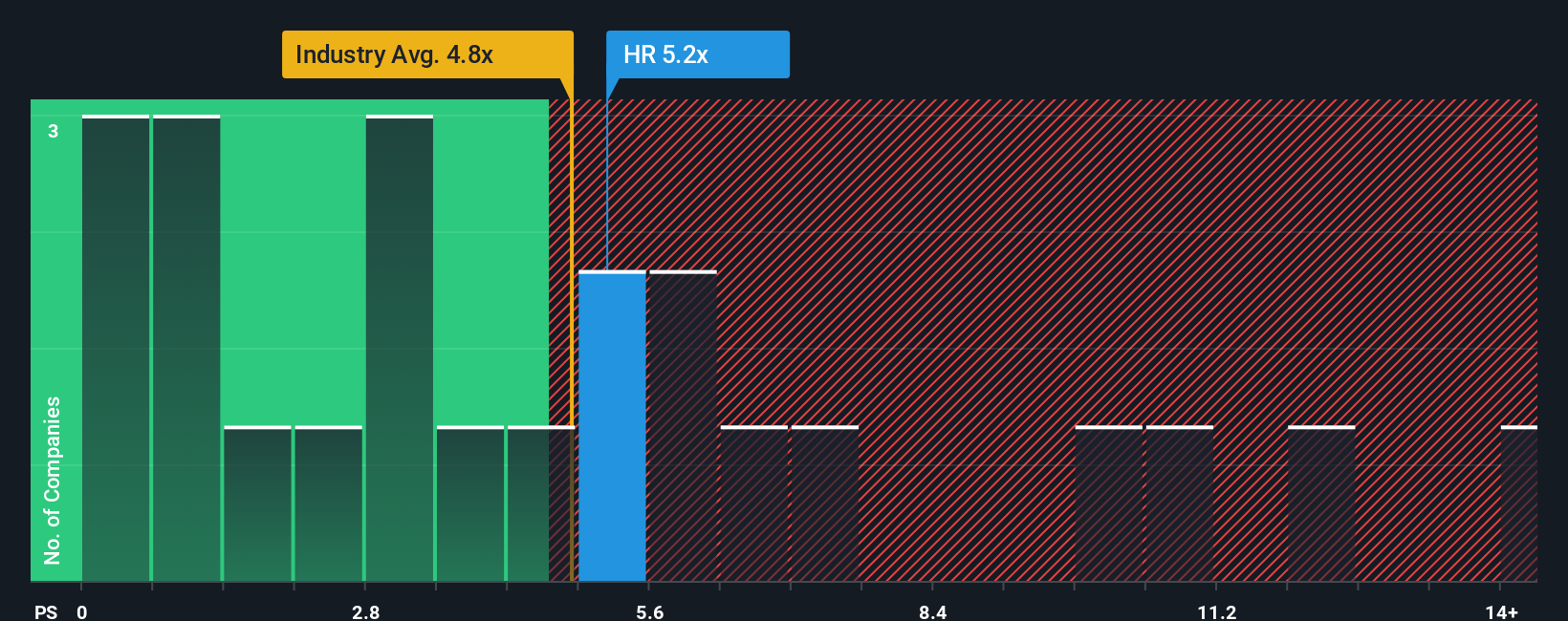

While the narrative leans on upside to fair value, the current price to sales ratio of 5 times paints a tighter picture. HR trades richer than the wider North American Health Care REITs at 4.6 times, and even above its own fair ratio of 4.7 times. This hints at less room for error if execution slips.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Healthcare Realty Trust Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way

A great starting point for your Healthcare Realty Trust research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Use the Simply Wall St Screener to pinpoint fresh opportunities beyond Healthcare Realty Trust so you stay ahead of the market instead of reacting to it.

- Capture early stage potential by scanning these 3612 penny stocks with strong financials that pair low prices with surprisingly robust fundamentals and upside that larger names can struggle to match.

- Capitalize on the AI revolution by targeting these 26 AI penny stocks positioned at the intersection of rapid innovation, scalable platforms, and accelerating demand for intelligent automation.

- Lock in income focused resilience through these 13 dividend stocks with yields > 3% that combine meaningful yields with businesses built to keep paying even when markets turn rough.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com