3 ASX Dividend Stocks To Watch With Up To 8.4% Yield

The Australian stock market recently experienced a mixed performance, with materials dragging the indices down while discretionary stocks showed some resilience. In this fluctuating environment, dividend stocks can offer a stable income stream, making them an appealing choice for investors seeking consistent returns amidst market volatility.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Treasury Wine Estates (ASX:TWE) | 7.29% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 6.11% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.82% | ★★★★★☆ |

| Steadfast Group (ASX:SDF) | 3.79% | ★★★★★☆ |

| Smartgroup (ASX:SIQ) | 5.88% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.67% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 5.67% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 7.45% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.25% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 7.57% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top ASX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

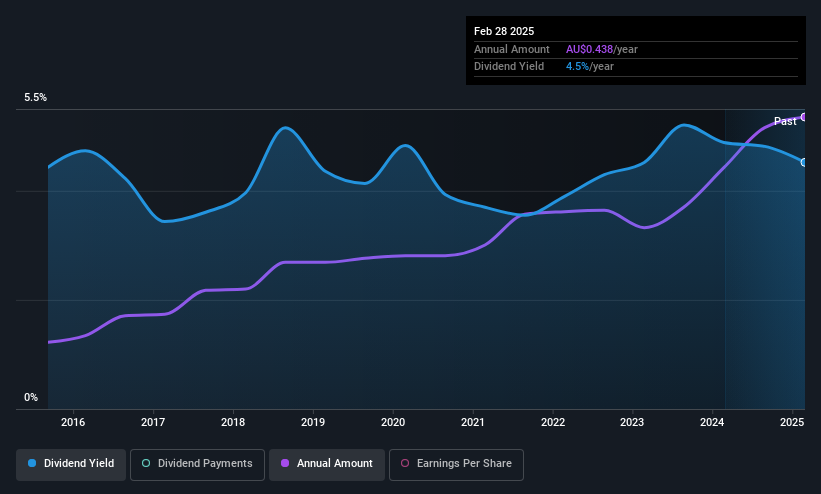

Fiducian Group (ASX:FID)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fiducian Group Ltd, with a market cap of A$366.50 million, operates in Australia through its subsidiaries to provide financial services.

Operations: Fiducian Group Ltd generates revenue through various segments including Funds Management (A$25.59 million), Corporate Services (A$17.67 million), Financial Planning (A$29.66 million), and Platform Administration (A$16.45 million).

Dividend Yield: 4.3%

Fiducian Group offers a reliable dividend profile, with stable and growing payments over the past decade. The dividend yield of 4.26% is modest compared to top-tier Australian payers but is supported by a reasonable cash payout ratio of 69.8% and an earnings payout ratio of 79.1%. The company's price-to-earnings ratio of 19.7x suggests it is fairly valued relative to the broader market, enhancing its appeal for income-focused investors seeking stability and growth potential in dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Fiducian Group.

- Insights from our recent valuation report point to the potential overvaluation of Fiducian Group shares in the market.

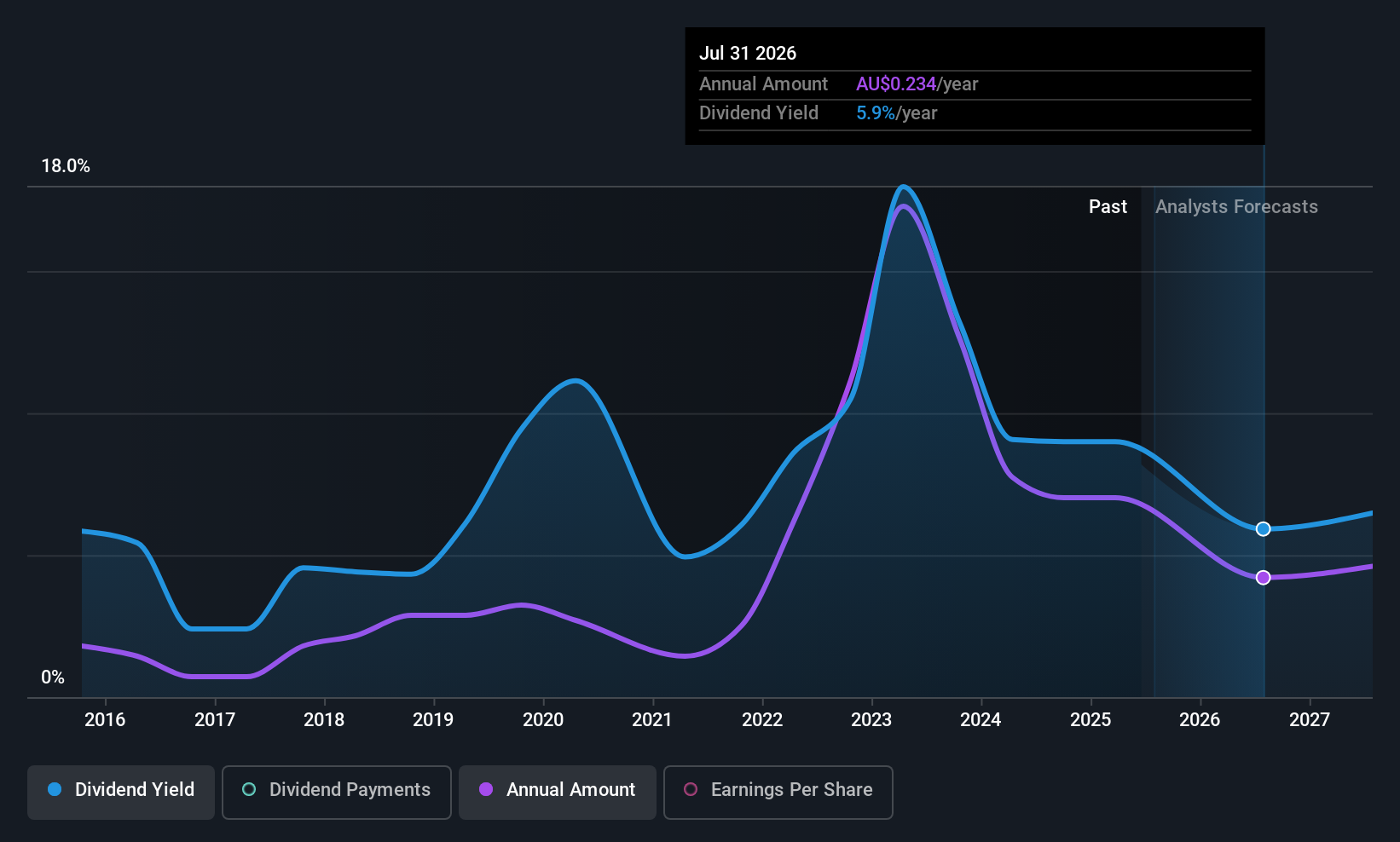

New Hope (ASX:NHC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Hope Corporation Limited is involved in the development and operation of coal mines, with a market capitalization of A$3.39 billion.

Operations: New Hope Corporation Limited's revenue primarily comes from its coal mining operations in New South Wales, generating A$1.33 billion, and Queensland, contributing A$395.34 million.

Dividend Yield: 8.5%

New Hope Corporation's dividend yield of 8.46% ranks it among the top 25% in Australia, yet its payments have been volatile over the past decade. The company's dividends are covered by earnings with a payout ratio of 65.3%, but not by free cash flow, which is concerning given the high cash payout ratio of 110.5%. Recent production guidance indicates stable coal output, although large one-off items affect financial results, impacting dividend reliability.

- Dive into the specifics of New Hope here with our thorough dividend report.

- Our valuation report here indicates New Hope may be undervalued.

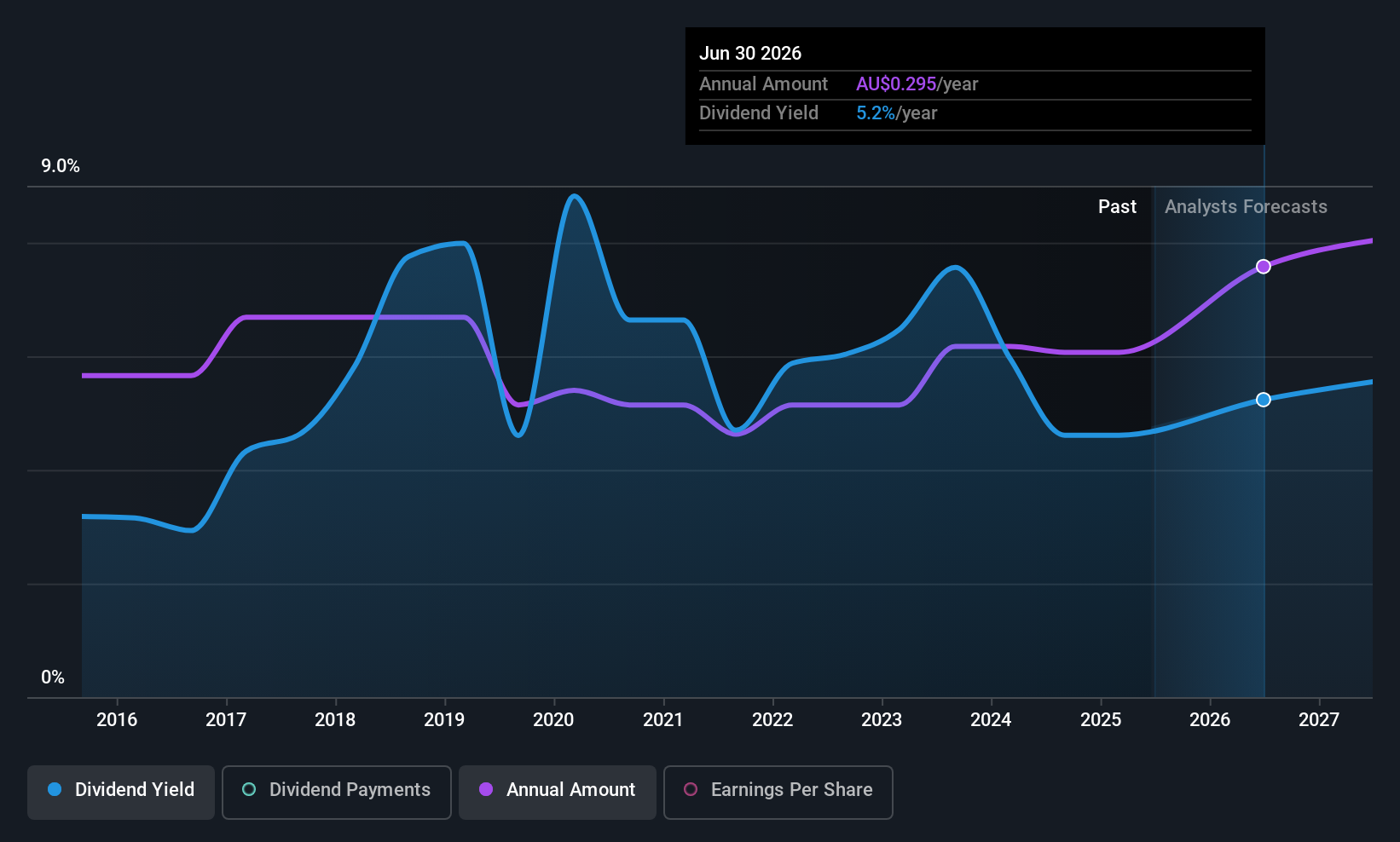

Servcorp (ASX:SRV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Servcorp Limited offers executive serviced and virtual offices, along with coworking, IT, communications, and secretarial services across various regions including Australia, New Zealand, Southeast Asia, the United States, Europe, the Middle East, and North Asia; it has a market cap of A$707.98 million.

Operations: Servcorp Limited's revenue is primarily derived from its real estate rental segment, amounting to A$349.86 million.

Dividend Yield: 3.9%

Servcorp's dividend payments, with a payout ratio of 52%, are well-covered by both earnings and cash flows, boasting a low cash payout ratio of 14.7%. While dividends have increased over the past decade, their volatility raises concerns about reliability. The current yield is 3.94%, lower than the top quartile in Australia. Despite trading at good value compared to peers and industry, its unstable dividend track record may deter some investors seeking consistent income streams.

- Click to explore a detailed breakdown of our findings in Servcorp's dividend report.

- The analysis detailed in our Servcorp valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Click here to access our complete index of 32 Top ASX Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com