Leonardo (BIT:LDO): Assessing Valuation After Air Defence Breakthrough and New Space-Digital Initiatives

Leonardo (BIT:LDO) just checked three big innovation boxes at once, from a successful Michelangelo Security Dome air defence test in Italy to new lunar comms partnerships and a fresh digital asset initiative, OnLife.

See our latest analysis for Leonardo.

These moves come after a powerful run, with Leonardo’s latest share price at $48.15 and a year to date share price return of nearly 85 percent. A five year total shareholder return above 790 percent signals still strong long term momentum despite the recent pullback.

If this kind of defence and space innovation has your attention, it is also worth scanning other aerospace names through aerospace and defense stocks to spot similar long term stories early.

With earnings still climbing and the share price sitting about 16 percent below consensus targets but above many intrinsic value models, is Leonardo quietly undervalued here or already pricing in the next leg of growth?

Most Popular Narrative Narrative: 11.7% Undervalued

With Leonardo last closing at €48.15 against a narrative fair value near €54.56, the valuation story leans positive and leans heavily on structural growth.

Ongoing operational optimization, digitalization of manufacturing processes, and a company wide capacity boost program are yielding measurable gains in profitability and efficiency, evidenced by EBITA and free cash flow growing faster than revenues. This trajectory suggests improving net margins and cash conversion over the medium term.

Want to see what kind of growth path and margin rebuild could justify that higher price tag? The narrative quietly bakes in ambitious revenue expansion, fatter profitability and a premium multiple that assumes Leonardo keeps compounding its earnings engine. Curious how those moving pieces add up to that fair value call?

Result: Fair Value of €54.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case could unravel if Aerostructures’ turnaround drags on or if major integrations like Iveco Defence underdeliver on expected synergies.

Find out about the key risks to this Leonardo narrative.

Another Angle on Valuation

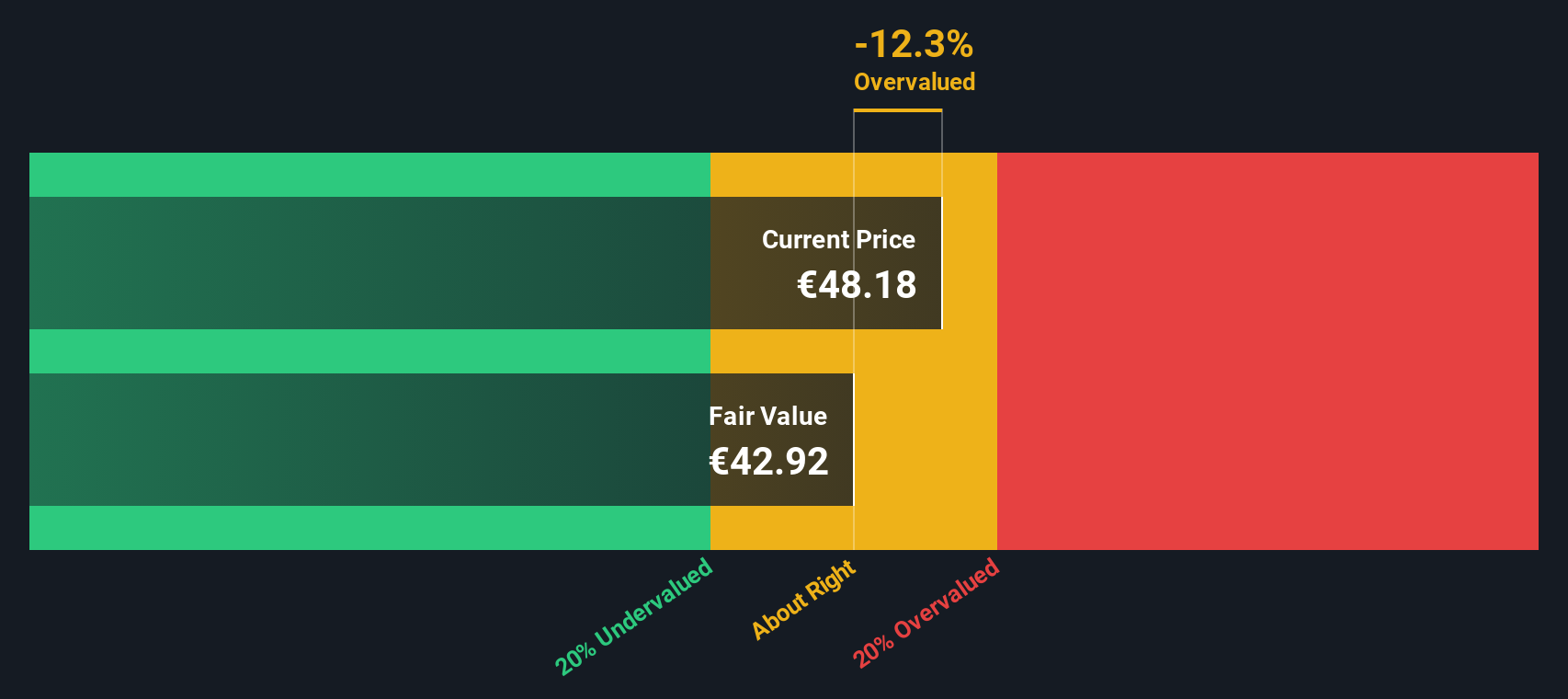

Our own SWS DCF model paints a cooler picture, with Leonardo’s current €48.15 share price sitting above an intrinsic value estimate near €42.92. This suggests it may be overvalued on cash flow terms. Is the market overpaying for growth, or is the model too cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Leonardo for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Leonardo Narrative

If you would rather question these assumptions and work through the numbers yourself, you can build a personalised view of Leonardo in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Leonardo.

Ready for more investment ideas?

If you stop with just one stock, you could miss the next big winner, so put Simply Wall St’s powerful tools to work finding your next opportunity.

- Capture early stage potential by reviewing these 3612 penny stocks with strong financials that combine market mispricing with improving balance sheets and tangible growth catalysts.

- Harness long term compounding from these 13 dividend stocks with yields > 3% focused on dependable income streams, resilient payouts, and room for future dividend growth.

- Position ahead of the next technological wave through these 80 cryptocurrency and blockchain stocks targeting companies building real world applications around digital assets and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com