Why lululemon (LULU) Is Up 12.0% After Q3 Beat, Outlook Hike, Buybacks and CEO Exit

- In the third quarter of fiscal 2025, lululemon athletica reported higher sales of US$2,565.92 million but lower net income of US$306.84 million year over year, raised its full-year outlook, expanded its share repurchase program, and confirmed that long-time CEO Calvin McDonald will step down in early 2026.

- The results underline a shift in growth drivers toward faster-expanding international markets such as China Mainland, even as the core Americas business softens and the company prepares for a leadership transition and index removal from the Nasdaq 100.

- We’ll now examine how lululemon’s earnings beat, raised guidance, and upcoming CEO change may reshape its existing investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

lululemon athletica Investment Narrative Recap

To own lululemon today, you need to believe that international growth and product reinvention can offset a cooling Americas business and tariff‑driven margin pressure. The most important near term catalyst remains whether its reset in U.S. product and merchandising can reaccelerate demand, while the biggest risk is that this soft U.S. trend persists despite higher innovation. The latest earnings beat and guidance raise support the catalyst, but index removal and leadership turnover add an extra layer of uncertainty rather than changing it.

The most relevant update here is lululemon’s raised full year 2025 outlook, with expected net revenue of US$10,962 million to US$11,047 million and diluted EPS of US$12.92 to US$13.02. That guidance, alongside stronger international growth, helps frame the U.S. slowdown as a fixable issue rather than a structural reset in the entire business, but it also raises the bar for how quickly product changes need to translate into healthier trends in the core market.

Yet even as guidance improves, the pressure on U.S. demand and gross margins is something investors should be aware of as...

Read the full narrative on lululemon athletica (it's free!)

lululemon athletica's narrative projects $12.8 billion revenue and $1.9 billion earnings by 2028.

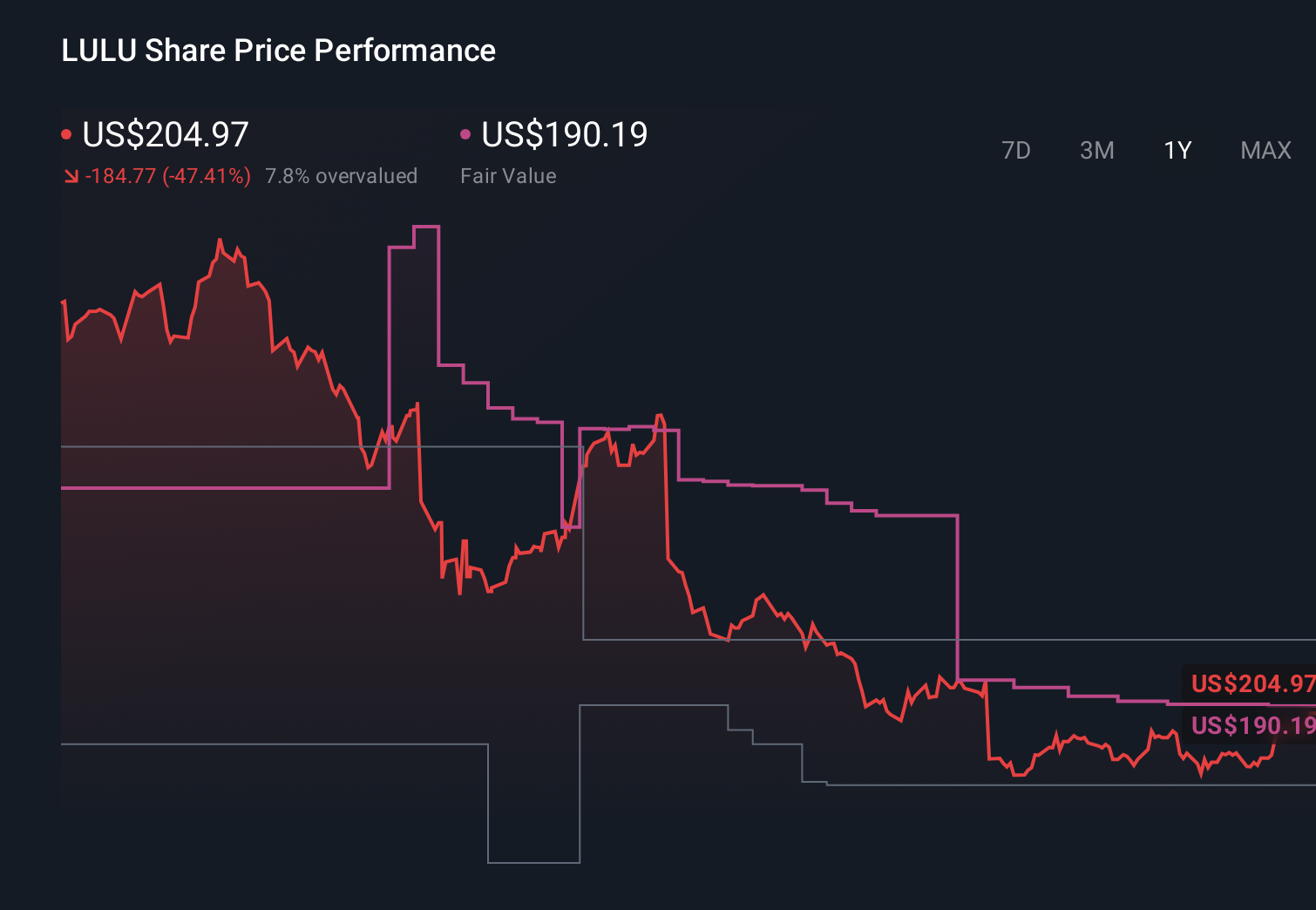

Uncover how lululemon athletica's forecasts yield a $190.19 fair value, a 7% downside to its current price.

Exploring Other Perspectives

Across 45 fair value estimates from the Simply Wall St Community, views range from US$117 to US$407, reflecting very different expectations around lululemon’s future. When you weigh these against the current reliance on a successful U.S. product reset amid margin headwinds, it becomes clear why exploring several contrasting viewpoints can matter for understanding the company’s potential path.

Explore 45 other fair value estimates on lululemon athletica - why the stock might be worth as much as 99% more than the current price!

Build Your Own lululemon athletica Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your lululemon athletica research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free lululemon athletica research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate lululemon athletica's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com