Viavi Solutions (VIAV): Reassessing Valuation After Strong Q1 Beat and New Quantum Security, Timing Wins

Viavi Solutions (VIAV) is back on traders radar after a busy stretch, combining a stronger than expected fiscal first quarter with fresh wins in quantum safe security and next generation timing.

See our latest analysis for Viavi Solutions.

The flurry of quantum security partnerships, government timing contracts, and solid quarterly execution has come after a powerful run, with the share price delivering a roughly 48 percent 3 month share price return and a 61 percent 1 year total shareholder return. This suggests momentum is building even after this week pullback to 18 dollars.

If Viavi resurgence has you thinking about what else could be re rating on tech innovation, it is worth exploring high growth tech and AI stocks as potential next wave opportunities.

With shares now hovering just below analyst targets after a powerful run, the key question is whether Viavi still trades at a discount to its quantum and timing ambitions or if the market has already priced in the next leg of growth.

Most Popular Narrative Narrative: 2.3% Undervalued

Against a last close of 18 dollars, the most popular narrative pegs Viavi fair value only slightly higher, implying a modest upside if the thesis lands.

Viavi is experiencing robust and sustained demand across the data center ecosystem, with customers updating optical connectivity to 400G, 800G, and now 1.6T, which is enabling multi year upgrade cycles and expanding its total addressable market. This is expected to drive structural revenue growth through 2026 and beyond.

Curious how a seemingly small valuation gap leans on transformative margin expansion and multi year AI infrastructure upgrades, not just simple revenue growth lines? Dig into the full narrative to see which assumptions really move the dial.

Result: Fair Value of $18.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent wireless infrastructure weakness, and any stumble integrating Spirent or Inertial Labs, could quickly challenge expectations around margin expansion and AI driven growth.

Find out about the key risks to this Viavi Solutions narrative.

Another Take On Value

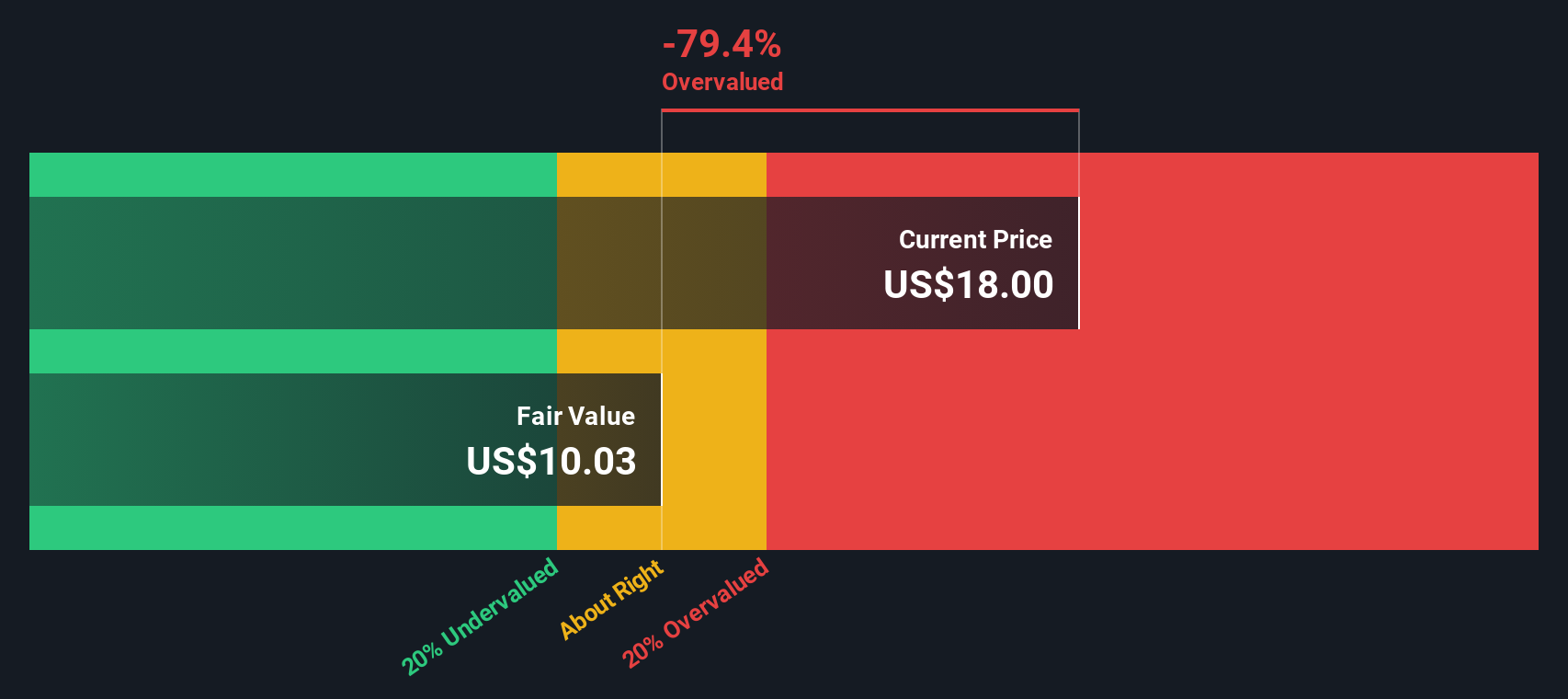

While the narrative model sees Viavi as about 2 percent undervalued, the SWS DCF model is more cautious and suggests shares trade well above an intrinsic value near 10 dollars. If cash flows do not scale as quickly as hoped, is the market leaning too hard into the AI story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Viavi Solutions Narrative

If you see the story differently or want to dive into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Viavi Solutions research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, put Simply Wall St to work and quickly surface fresh opportunities that match your strategy, so you are not leaving obvious winners on the table.

- Capture high potential value plays by scanning these 911 undervalued stocks based on cash flows that may be mispriced relative to their future cash flows.

- Position yourself at the heart of the AI build out by checking these 26 AI penny stocks pushing boundaries in automation, data, and intelligent infrastructure.

- Secure your portfolio income stream by reviewing these 14 dividend stocks with yields > 3% offering attractive yields with the potential for reliable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com