Genius Sports (GENI) Valuation Revisited After FanDuel Content Partnership and New 2028 Revenue Target

Genius Sports (GENI) just laid out an ambitious 2028 revenue goal of $1.2 billion, while simultaneously deepening its U.S. footprint through a new Intelligent Content Platform partnership with FanDuel Sports Network.

See our latest analysis for Genius Sports.

The stock has been choppy lately, with a 10.47% 1 month share price return but a 13.12% 3 month share price decline. However, a 200.28% 3 year total shareholder return signals that longer term momentum is still very much alive.

If Genius Sports’ roadmap has you rethinking your exposure to sports and media tech, this could be a good moment to uncover high growth tech and AI stocks that are shaping the next wave of digital innovation.

With the stock still trading at a hefty discount to analyst targets but already boasting a 200 percent three year run, the key question now is whether Genius Sports is still a value play or if markets are already pricing in its next leg of growth.

Most Popular Narrative Narrative: 30.4% Undervalued

With Genius Sports last closing at $10.66 against a narrative fair value of $15.32, the story points to meaningful upside if its growth path holds.

• In order for you to agree with the analyst's consensus, you would need to believe that by 2028, revenues will be $930.2 million, earnings will be $120.7 million, and it would be trading on a PE ratio of 46.2x, assuming you use a discount rate of 8.9%.

Curious what kind of revenue ramp, margin lift, and share count growth could support such a rich future earnings multiple? The narrative lays it all out, step by step.

Result: Fair Value of $15.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering regulatory uncertainty and fiercer competition for exclusive sports data rights could derail revenue growth assumptions and compress the rich valuation narrative.

Find out about the key risks to this Genius Sports narrative.

Another Lens on Valuation

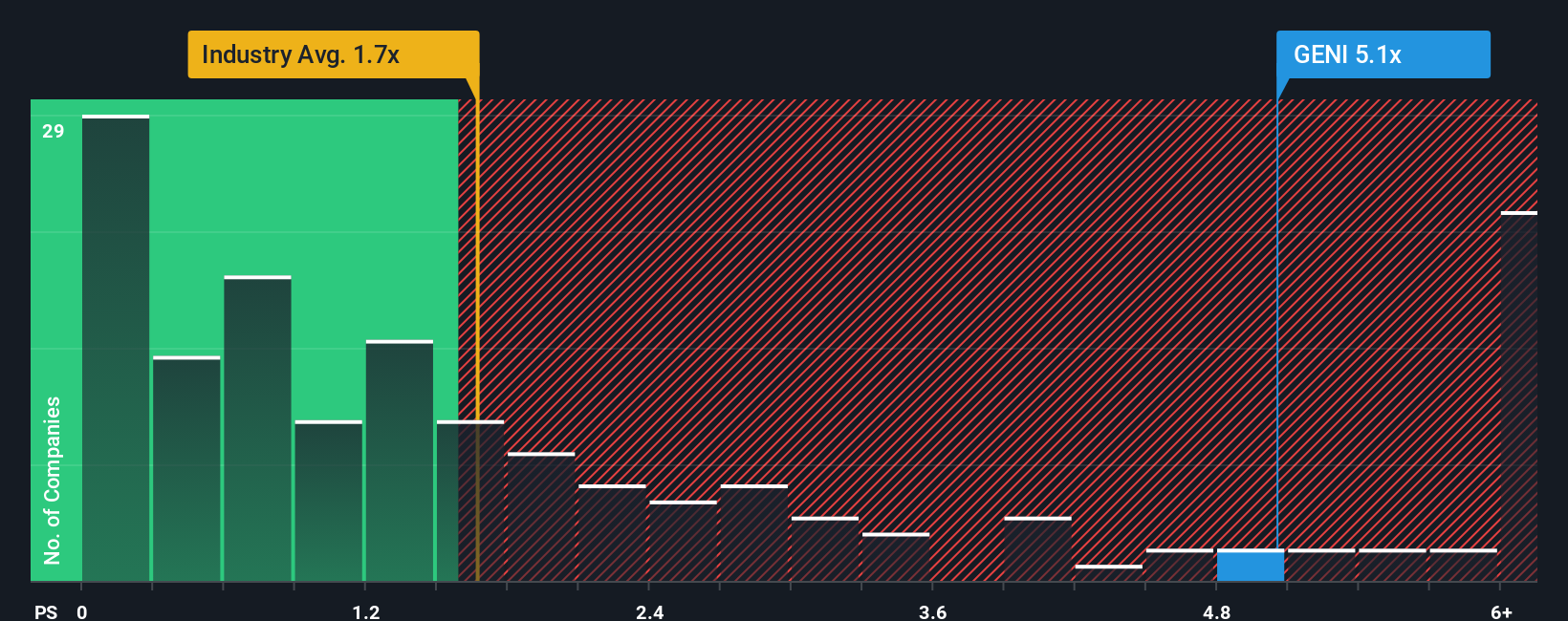

While the narrative framing suggests Genius Sports is meaningfully undervalued, its 4.2x price to sales ratio looks punchy against both peers and a 1.5x fair ratio, signaling the market already bakes in a lot of growth and leaves less room for execution missteps.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Genius Sports Narrative

If you see the story differently or simply want to stress test the assumptions yourself, you can build a fresh narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Genius Sports.

Looking for more investment ideas?

Before markets move again, give yourself an edge by scanning fresh opportunities on Simply Wall St’s powerful screener and lining up your next high conviction ideas.

- Capitalize on overlooked value by targeting companies trading at compelling discounts using these 911 undervalued stocks based on cash flows that could set up your next big winner.

- Position ahead of the next AI surge by filtering for innovative businesses shaping automation, data intelligence, and digital infrastructure through these 26 AI penny stocks.

- Lock in potential income streams by zeroing in on reliable payers with attractive yields when you run these 14 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com