Insider Activity Highlights 3 Undervalued Small Caps In European Markets

As European markets navigate a mixed landscape, with the pan-European STOXX Europe 600 Index ending slightly lower and varied performances across major indices like Germany's DAX and France's CAC 40, investors are closely watching economic indicators for cues on future growth. Amidst this backdrop, understanding insider activity can offer valuable insights into potentially undervalued small-cap stocks that may be poised to capitalize on these market conditions.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Norcros | 13.5x | 0.7x | 41.75% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 40.35% | ★★★★★☆ |

| Tokmanni Group Oyj | 12.2x | 0.3x | 42.08% | ★★★★★☆ |

| Eastnine | 11.6x | 7.4x | 49.62% | ★★★★★☆ |

| Senior | 25.0x | 0.8x | 26.18% | ★★★★★☆ |

| A.G. BARR | 14.4x | 1.6x | 48.14% | ★★★★☆☆ |

| Eurocell | 16.6x | 0.3x | 39.24% | ★★★★☆☆ |

| Tristel | 28.8x | 4.1x | 22.28% | ★★★☆☆☆ |

| Kendrion | 29.3x | 0.7x | 41.71% | ★★★☆☆☆ |

| CVS Group | 46.0x | 1.3x | 26.40% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

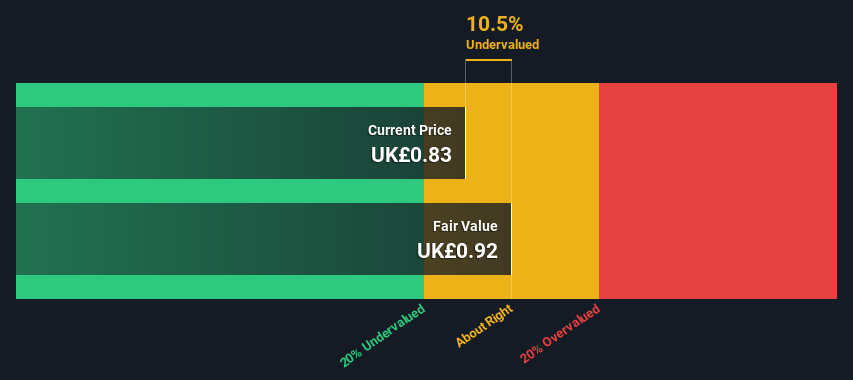

dotdigital Group (AIM:DOTD)

Simply Wall St Value Rating: ★★★★★★

Overview: Dotdigital Group is a company specializing in data-driven omni-channel marketing automation, with operations focused on providing tools and services for businesses to enhance their digital marketing strategies, and it has a market cap of approximately £0.29 billion.

Operations: The company's primary revenue stream is derived from its data-driven omni-channel marketing automation services, with the latest reported revenue at £83.92 million. The gross profit margin has shown a notable trend, peaking at 92.46% in late 2019 before experiencing a decline to 79.30% by mid-2025. Operating expenses are significant, primarily driven by general and administrative costs which reached £50.47 million in the most recent period, impacting net income margins that have decreased over time to 13.36%.

PE: 17.8x

dotdigital Group, a digital marketing platform company, is drawing attention for its potential value. With sales reaching £83.92 million for the year ending June 2025 and net income of £11.21 million, they show steady financial health. The recent approval of a 10% increase in dividends to 1.21 pence per share reflects confidence in future earnings growth. A planned share repurchase program worth up to £3 million aims to manage dilution from employee incentives, indicating strategic capital management amidst their ongoing M&A pursuits without carrying debt burdens.

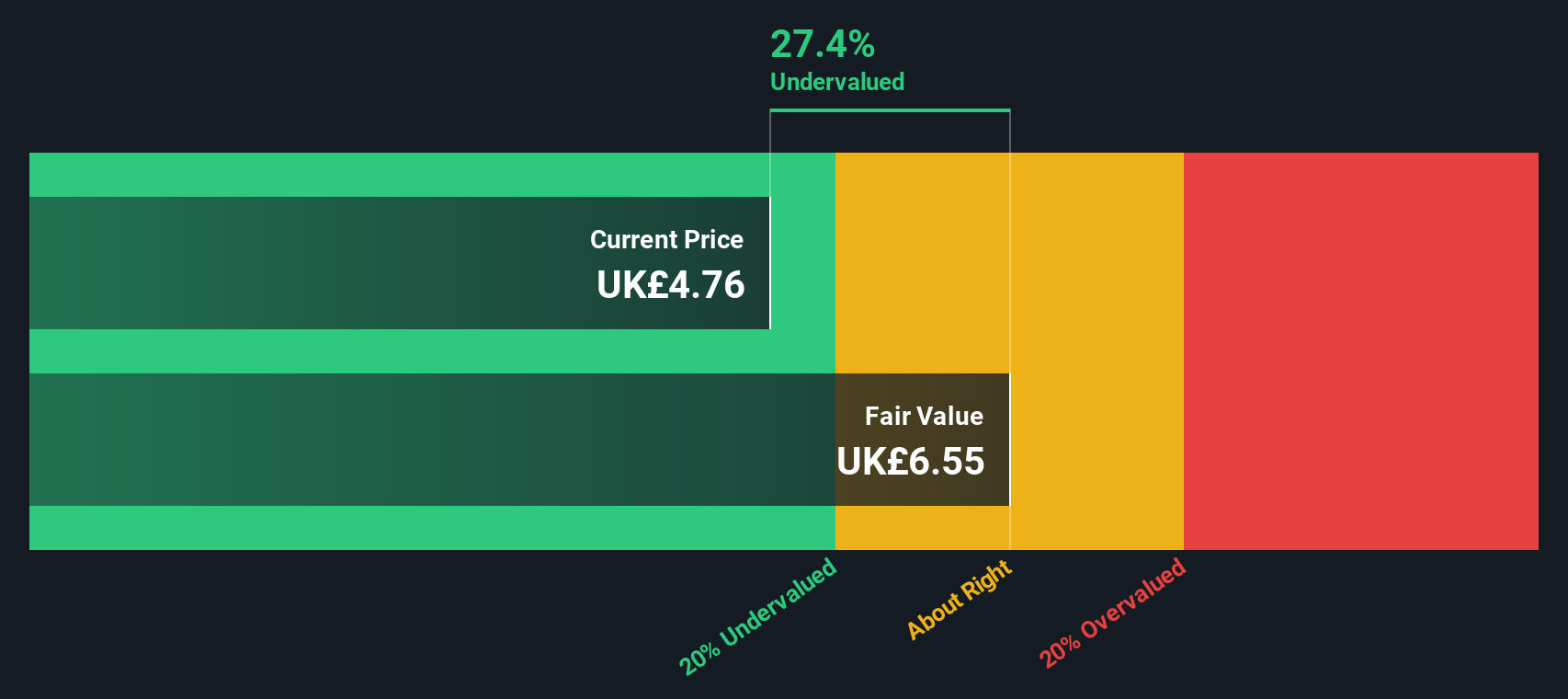

Chemring Group (LSE:CHG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Chemring Group is a defense technology company specializing in sensors, information, countermeasures, and energetics with a market cap of approximately £1.06 billion.

Operations: The company generates revenue primarily from two segments: Sensors & Information and Countermeasures & Energetics. The gross profit margin has shown significant fluctuations, peaking at 100% in several periods due to unreported COGS, while recent figures are around 67.95%. Operating expenses have consistently been a major cost component, with General & Administrative Expenses being the largest contributor within this category. Net income margins have improved over time, reaching approximately 10.71% in the latest reported period.

PE: 24.6x

Chemring Group, a European small cap, recently reported an increase in sales to £497.5 million and net income rising to £48.2 million for the year ending October 2025. Earnings per share improved, reflecting stronger financial performance. The board proposed a higher final dividend of 5.3p per share, indicating confidence in future prospects. Although reliant on external borrowing for funding, Chemring's earnings are projected to grow annually by 13%. Recent insider confidence is evident with notable share purchases throughout the year.

- Delve into the full analysis valuation report here for a deeper understanding of Chemring Group.

Gain insights into Chemring Group's past trends and performance with our Past report.

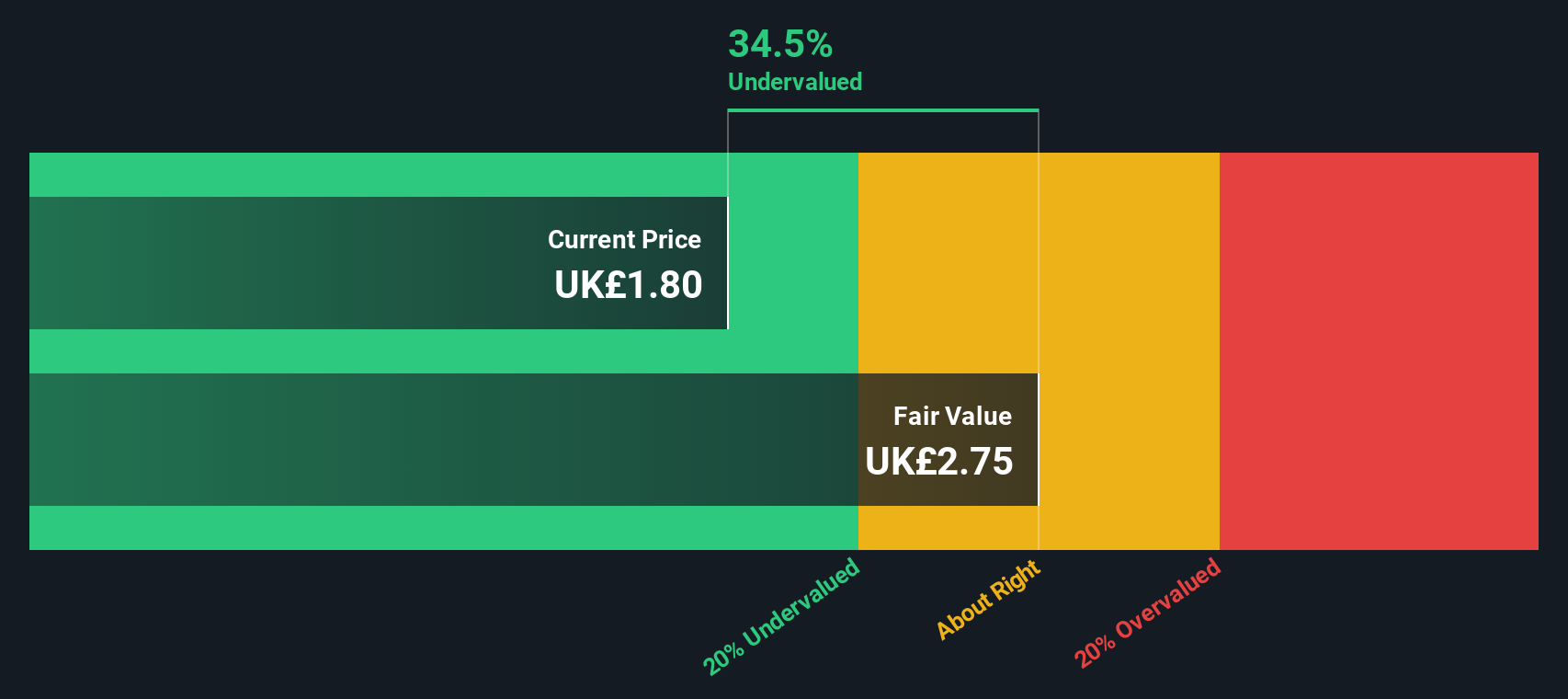

Senior (LSE:SNR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Senior is a company that operates in the aerospace and flexonics sectors, with a market capitalization of approximately £0.76 billion.

Operations: The company generates revenue primarily from its Aerospace and Flexonics segments, with recent quarterly figures showing £670.7 million and £316.9 million respectively. Gross profit margin has shown variability, reaching 21.32% in the most recent period ending June 2024. Operating expenses have been significant, consistently impacting net income margins over several periods.

PE: 25.0x

Senior's recent activities highlight its potential as an undervalued stock in Europe. The company secured a multi-year contract with Airbus, showcasing its prowess in aerospace components and boosting future revenue streams. Additionally, Senior's involvement in the HAPSS consortium underscores its commitment to sustainable aviation technologies. Insider confidence is evident with Independent Chairman Ian King acquiring 75,000 shares for £130,402 between October and November 2025. Revenue increased by 5.9% year-on-year through October 2025, driven by strong aerospace sales growth of 9.4%.

- Dive into the specifics of Senior here with our thorough valuation report.

Evaluate Senior's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Access the full spectrum of 75 Undervalued European Small Caps With Insider Buying by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com