Is Signet Jewelers (SIG) Undervalued After Its Recent Share Price Pullback?

Signet Jewelers (SIG) has been drifting lower over the past month, and that pullback is starting to catch value oriented investors attention. The stock is still up solidly this year, which makes the recent weakness more interesting than alarming.

See our latest analysis for Signet Jewelers.

That recent 14 percent 1 month share price pullback, with the stock now around 86 dollars and 55 cents, looks more like a breather within an otherwise positive year to date share price return and strong 3 and 5 year total shareholder returns. This suggests momentum is cooling rather than breaking.

If Signet’s move has you reassessing where the next leg of growth might come from, this is a good moment to broaden your search and discover fast growing stocks with high insider ownership.

With earnings still growing, a sizable discount to analyst targets and a share price cooling off its highs, investors now face the key question: Is Signet quietly undervalued, or is the market already banking on its next chapter of growth?

Most Popular Narrative: 25.3% Undervalued

Compared to Signet Jewelers last close near 86 dollars and 55 cents, the most popular narrative sees materially higher long term value on offer.

Expansion of service based offerings (e.g., extended service agreements, care plans) and loyalty ecosystems is creating stable, recurring, high margin revenue streams, strengthening free cash flow and earnings predictability. Strategic improvements in merchandise assortment, reduced promotional dependency, and inventory management (including tariff mitigation strategies and supply chain optimization) improve gross margins and earnings resilience, even in dynamic tariff environments.

Curious how modest revenue growth can still justify a much higher valuation? The narrative leans on aggressive profitability shifts and capital returns. Want the full playbook?

Result: Fair Value of $115.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained softness in bridal demand or rising tariffs squeezing margins could quickly challenge assumptions about Signet’s pricing power and earnings trajectory.

Find out about the key risks to this Signet Jewelers narrative.

Another Lens On Valuation

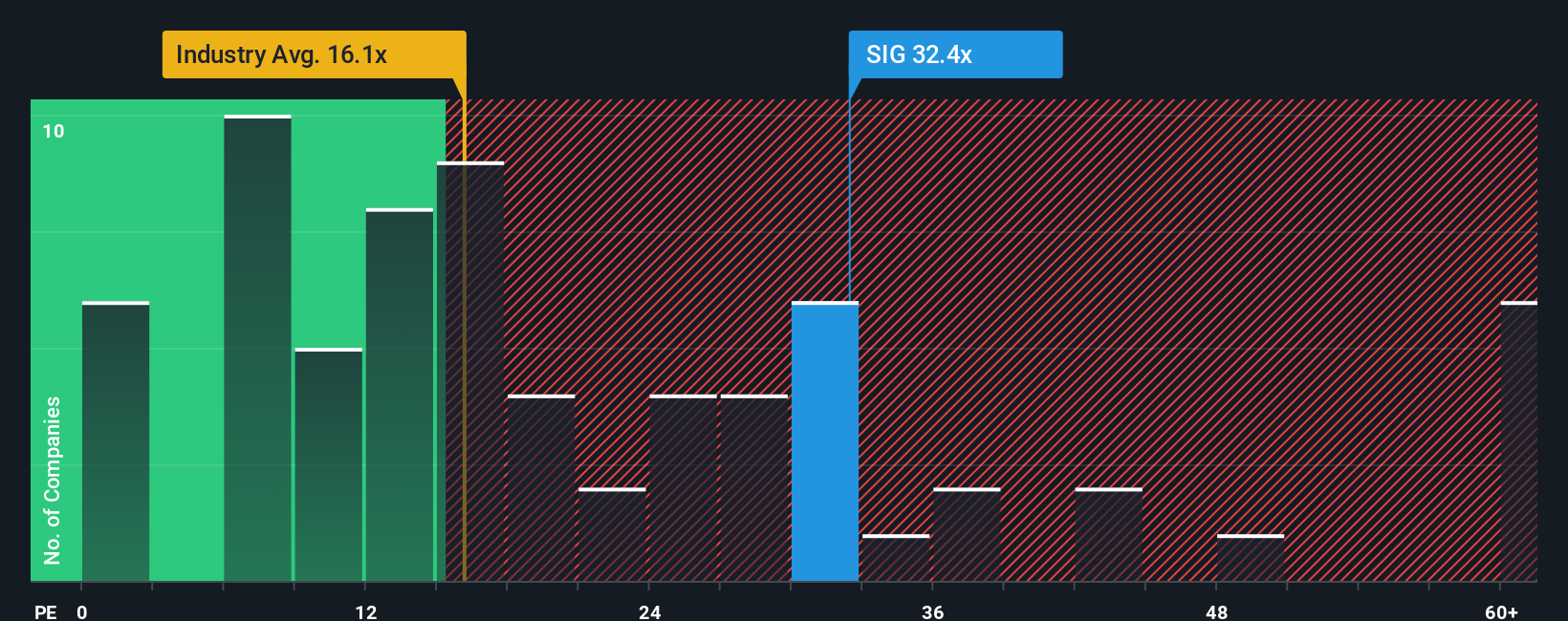

Step away from cash flows and the picture shifts. On earnings, Signet looks pricey at 24.3 times compared to 20.3 times for the US Specialty Retail industry and 15 times for peers, yet still below its 29.7 times fair ratio. This leaves investors weighing upside potential against the risk of multiple compression.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Signet Jewelers Narrative

If this perspective does not fully resonate with you, or you prefer to dig into the numbers yourself, you can build a personalized view in under three minutes, Do it your way.

A great starting point for your Signet Jewelers research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single stock. Use the Simply Wall St Screener to uncover fresh opportunities that match your strategy before the market spots them.

- Capture potential multibaggers early by scanning these 3613 penny stocks with strong financials that pair small size with surprisingly strong fundamentals.

- Ride structural shifts in automation and data by targeting these 26 AI penny stocks positioned at the heart of intelligent technology adoption.

- Consider attractive entry points by focusing on these 908 undervalued stocks based on cash flows where cash flows suggest the price has not yet caught up to intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com