Air Water (TSE:4088) Valuation Check as Leadership Transitions to New Sole Representative Director and CEO

Air Water (TSE:4088) just announced a leadership reshuffle, with longtime Chairman and Representative Director Kikuo Toyoda stepping down to become Senior Advisor as of December 3, 2025, while Ryosuke Matsubayashi assumes sole representative authority.

See our latest analysis for Air Water.

The leadership reshuffle lands after a mixed stretch for investors, with a 1 day share price return of 1.50 percent but a weaker 90 day share price return of negative 17.18 percent, even as the 3 year total shareholder return of 57.78 percent points to solid longer term value creation.

If this leadership shake up has you rethinking your exposure to Japanese industrials, it could be a good moment to explore fast growing stocks with high insider ownership for other compelling ideas.

With the stock still down over the past quarter yet trading at a sizeable discount to analyst targets, is Air Water quietly undervalued after its leadership reshuffle, or are markets already factoring in the next leg of growth?

Price-to-Earnings of 10x: Is it justified?

Air Water's shares last closed at ¥2200, translating into a price to earnings ratio of around 10 times, which screens as attractively valued against several benchmarks.

The price to earnings ratio compares what investors pay for each unit of current earnings. It is a widely used yardstick for diversified industrial and chemicals companies like Air Water.

In this case, the stock trades below both the broader Japanese market multiple of 14.2 times and the JP Chemicals industry average of 12.6 times. It also sits under an estimated fair price to earnings ratio of 15.3 times that our fair ratio work suggests the market could reasonably migrate toward if sentiment improves.

That discount is even starker versus a peer average multiple of 26.2 times, implying the market is pricing Air Water's earnings stream more conservatively than many comparable names.

Explore the SWS fair ratio for Air Water

Result: Price-to-Earnings of 10x (UNDERVALUED)

However, markets could stay cautious if industrial demand softens or regulatory shifts weigh on core gas, chemicals, and healthcare profitability.

Find out about the key risks to this Air Water narrative.

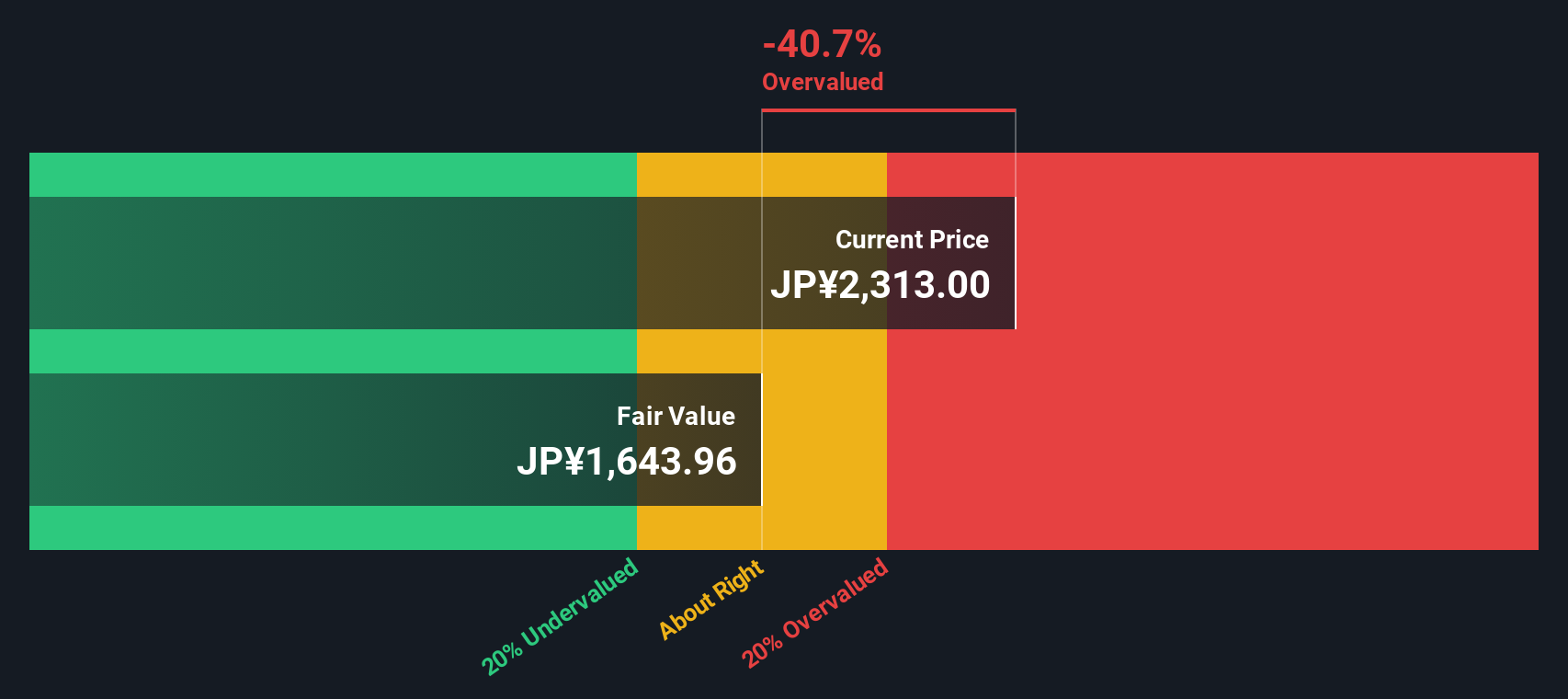

Another View, DCF Paints a Tougher Picture

While a 10 times earnings multiple makes Air Water look inexpensive, our DCF model points the other way, with fair value closer to ¥1657.1. This means the current ¥2200 price screens as overvalued on cash flow terms. Is the market overestimating durability of those earnings?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Air Water for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Air Water Narrative

If you see the numbers differently or want to stress test your own assumptions, build a personalised view in just a few minutes: Do it your way

A great starting point for your Air Water research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at a single opportunity. Use the Simply Wall Street Screener to uncover focused ideas that could sharpen your portfolio and keep you ahead.

- Capture potential high growth by scanning these 3613 penny stocks with strong financials that already show improving fundamentals and room to scale.

- Position yourself for structural change in medicine by targeting these 30 healthcare AI stocks at the intersection of data, diagnostics, and treatment.

- Lock in reliable cash returns by filtering for these 13 dividend stocks with yields > 3% that offer income strength alongside sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com