Does Steve Madden’s Strong 2025 Runway Justify Today’s Price Tag?

- If you are wondering whether Steven Madden is still worth buying after its recent run, or if its best days are behind it, this is a good place to unpack what the current share price really implies.

- The stock has climbed 1.3% over the last week and a strong 16.4% over the last month, adding to a 51.0% gain over three years and 42.9% over five years. This naturally raises the question of whether the current $44.15 price fairly reflects that momentum.

- Recent market attention has focused on how Steven Madden is navigating shifting consumer demand in footwear and accessories, with investors watching closely as the brand leans into design, direct to consumer channels, and international expansion. These themes have helped shape sentiment around the stock and partly explain why the share price has been grinding higher instead of sitting still.

- Despite that backdrop, Steven Madden currently scores just 2/6 on our valuation checks, suggesting the market might be pricing in a fair amount of optimism already. Next we will walk through what different valuation approaches say about the stock, and then finish with a broader way to think about its true value beyond the numbers alone.

Steven Madden scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Steven Madden Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth today by projecting its future cash flows and discounting them back to the present using an appropriate rate of return.

For Steven Madden, the model starts with last twelve month Free Cash Flow of about $144.5 Million and then projects how that cash flow might grow. Analysts provide detailed estimates for the next few years, and Simply Wall St extends these out further, with Free Cash Flow expected to reach around $698.2 Million by 2035 as growth gradually moderates over time.

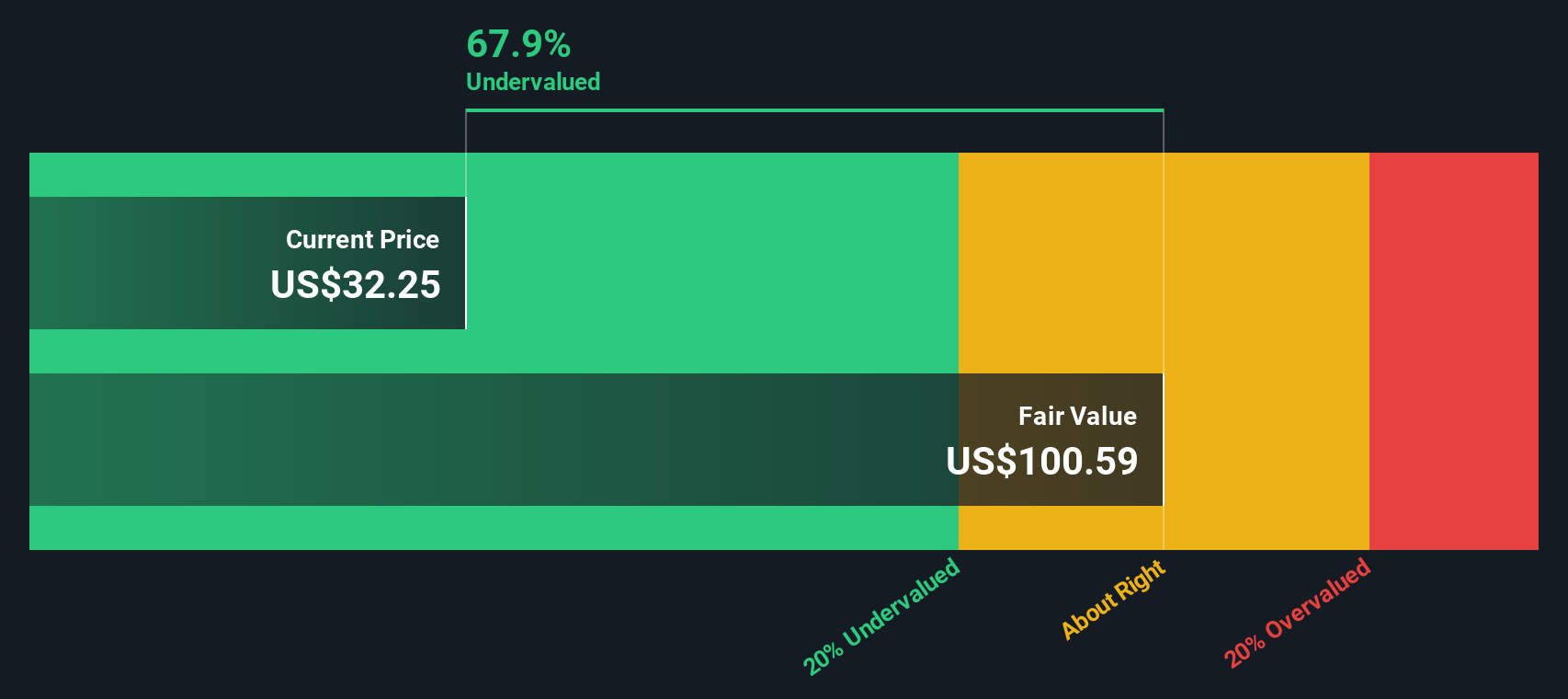

Adding up all these projected cash flows and discounting them back to today gives an estimated intrinsic value of roughly $111.86 per share. Compared with the current share price of $44.15, the DCF suggests the stock is trading at about a 60.5% discount to its calculated fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Steven Madden is undervalued by 60.5%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

Approach 2: Steven Madden Price vs Earnings

For profitable companies like Steven Madden, the Price to Earnings ratio is a useful way to gauge how much investors are willing to pay for each dollar of current earnings. A higher PE can be justified when a business is expected to grow faster or is seen as lower risk, while slower growing or riskier companies typically warrant a lower, more conservative multiple.

Steven Madden currently trades on a PE of about 57.0x, which sits well above both the Luxury industry average of roughly 22.6x and the broader peer group at around 20.3x. Simply Wall St also calculates a proprietary Fair Ratio for the stock of about 46.9x, which estimates what a reasonable PE should be once factors such as earnings growth, profit margins, market cap, industry characteristics and company specific risks are taken into account. This tailored Fair Ratio is more informative than simple peer or industry comparisons because it adjusts for Steven Madden’s particular strengths and risk profile rather than assuming all companies deserve the same multiple.

Since the current 57.0x PE stands noticeably above the 46.9x Fair Ratio, the multiple based view suggests the shares are trading on the expensive side.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Steven Madden Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you connect your view of Steven Madden’s business, like how fast digital and international sales grow or how quickly margins recover, to a concrete financial forecast, a calculated fair value, and a clear buy or sell decision by comparing that fair value to today’s price. The system dynamically updates as new news or earnings arrive, so that one investor might build a bullish Steven Madden Narrative assuming margins climb toward 11 to 12 percent and fair value sits above $43.75. Another might construct a more cautious Narrative that bakes in slower growth, persistent tariff pressure, and a fair value closer to the low analyst targets around $24, and both can immediately see whether their story says the current price is attractive or stretched.

Do you think there's more to the story for Steven Madden? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com