First Majestic Silver (TSX:AG) Valuation After Santa Elena Expansion Plans and Exploration Upside

First Majestic Silver (TSX:AG) is back in focus after fresh drilling at its Santa Elena mine outlined larger gold and silver zones, prompting new mine planning work and a planned processing expansion through 2026.

See our latest analysis for First Majestic Silver.

Those exploration wins and the recent $300 million convertible notes issue have landed in a market that was already warming to the story. A 30 day share price return of 31.02 percent and a year to date share price return of 157.16 percent point to strong positive momentum, while the 1 year total shareholder return of 163.72 percent and 3 year total shareholder return of 88.5 percent underline how sentiment has steadily swung in First Majestic’s favor as investors price in higher growth and, arguably, a healthier balance between risk and reward.

If Santa Elena’s expansion has you rethinking where the next leg of growth could come from, it is worth exploring fast growing stocks with high insider ownership as a way to uncover more ambitious, owner aligned ideas beyond precious metals.

With Santa Elena’s potential ramping up, a fresh $300 million in low cost capital, and the shares still trading well below some intrinsic value estimates, is this a genuine buying opportunity or has the market already priced in future growth?

Most Popular Narrative: 5.2% Overvalued

With First Majestic Silver closing at CA$22.09, the most widely followed narrative sees fair value a touch lower at CA$21.00, framing a modest premium that invites closer scrutiny of its long term assumptions.

Substantial ongoing investment in exploration (e.g., 255,000 meters drilled, addition of drilling rigs, and development of large new ore bodies like Navidad and Santo Niño) is expected to extend reserve life, increase production capacity, and drive long term revenue and cash flow growth.

Curious how disciplined drilling, rising margins, and a rich future earnings multiple all combine into that fair value calculation? The narrative leans on ambitious production scaling, fatter profitability, and a valuation usually reserved for faster growing sectors. Want to see exactly which growth and margin assumptions have to click into place for this price to hold up? Read on and unpack the full story behind the numbers.

Result: Fair Value of $21.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost inflation and Mexico specific political or regulatory shocks could quickly erode margins and undermine the upbeat growth narrative that investors are buying into.

Find out about the key risks to this First Majestic Silver narrative.

Another View: Market Ratios Tell a Different Story

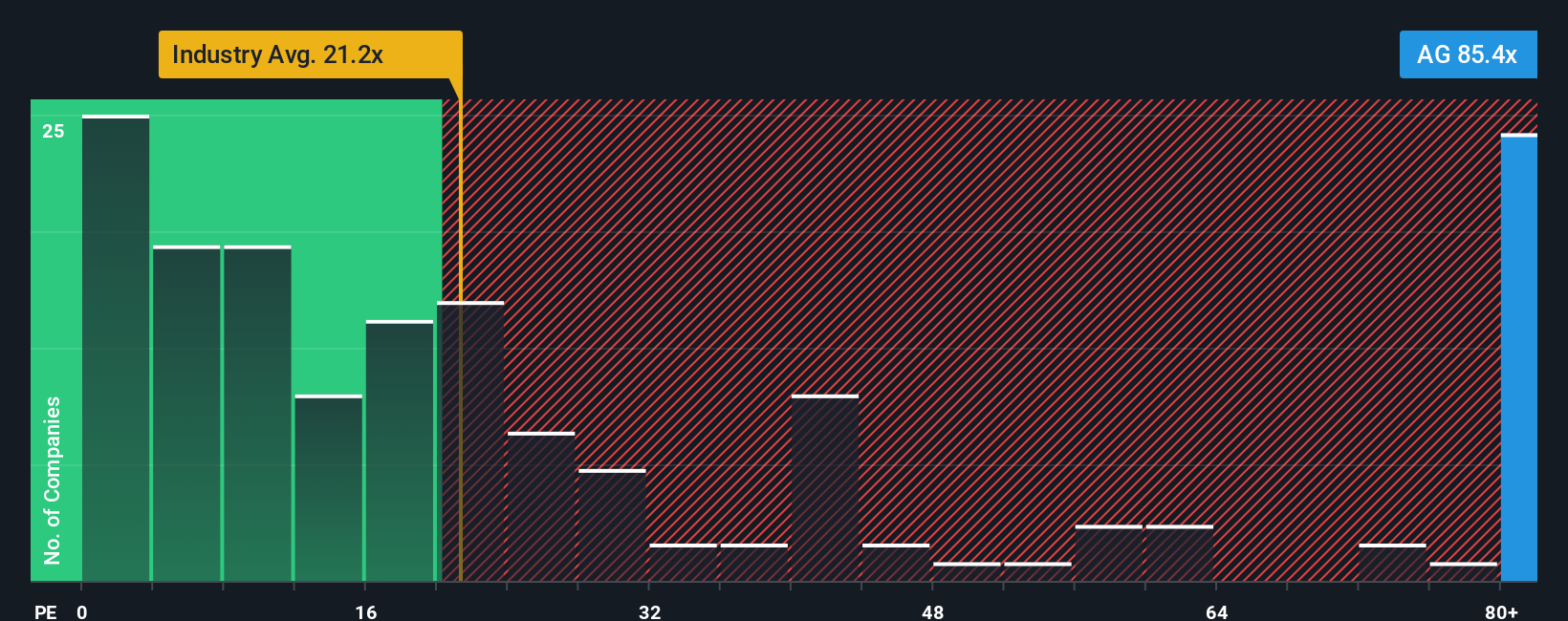

While the consensus narrative sees First Majestic as modestly overvalued, our look at its price to earnings ratio paints a starker picture. At 115.3 times earnings versus about 21.4 times for the Canadian metals and mining industry and 46.7 times for peers, the stock trades at a far richer valuation than similar names. If sentiment cools or growth underdelivers, that premium could quickly unwind and test recent gains.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Majestic Silver for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Majestic Silver Narrative

If you see the story differently, or want to dig into the numbers yourself, you can build a complete view in minutes with Do it your way.

A great starting point for your First Majestic Silver research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Do not stop at a single opportunity; use the Simply Wall Street Screener to quickly surface fresh, data driven ideas that keep your portfolio working harder.

- Capture potential mispricings early by targeting companies trading below their estimated cash flow value with these 907 undervalued stocks based on cash flows.

- Ride powerful secular trends by focusing on innovators reshaping automation and intelligence through these 26 AI penny stocks.

- Boost your income strategy by pinpointing established businesses offering attractive payouts via these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com