BlackBerry (TSX:BB): Assessing Valuation After Its Quiet Financial Turnaround

BlackBerry (TSX:BB) has quietly put together a meaningful turnaround in its financials, with revenue and net income both climbing over the past year, even as the share price has lagged that improvement.

See our latest analysis for BlackBerry.

Yet the share price tells a more cautious story, with a roughly flat 90 day share price return of 5.97 percent and a far stronger 1 year total shareholder return of 28.51 percent, suggesting momentum is quietly rebuilding as investors reassess BlackBerry’s turnaround potential.

If BlackBerry’s shift toward security software has your attention, this could be a good moment to scan other high growth tech names through high growth tech and AI stocks and see what else fits your strategy.

With revenue and earnings finally moving in the right direction, but the share price still stuck near analysts’ targets, investors face a key question: is BlackBerry undervalued here, or is future growth already fully priced in?

Price to earnings of 127.5x, is it justified?

On a price to earnings basis, BlackBerry looks expensive at the last close of CA$5.86, trading on 127.5x earnings compared to its peers.

The price to earnings ratio compares what investors pay today for each unit of current earnings, a key gauge for software and security focused businesses with scalable margins.

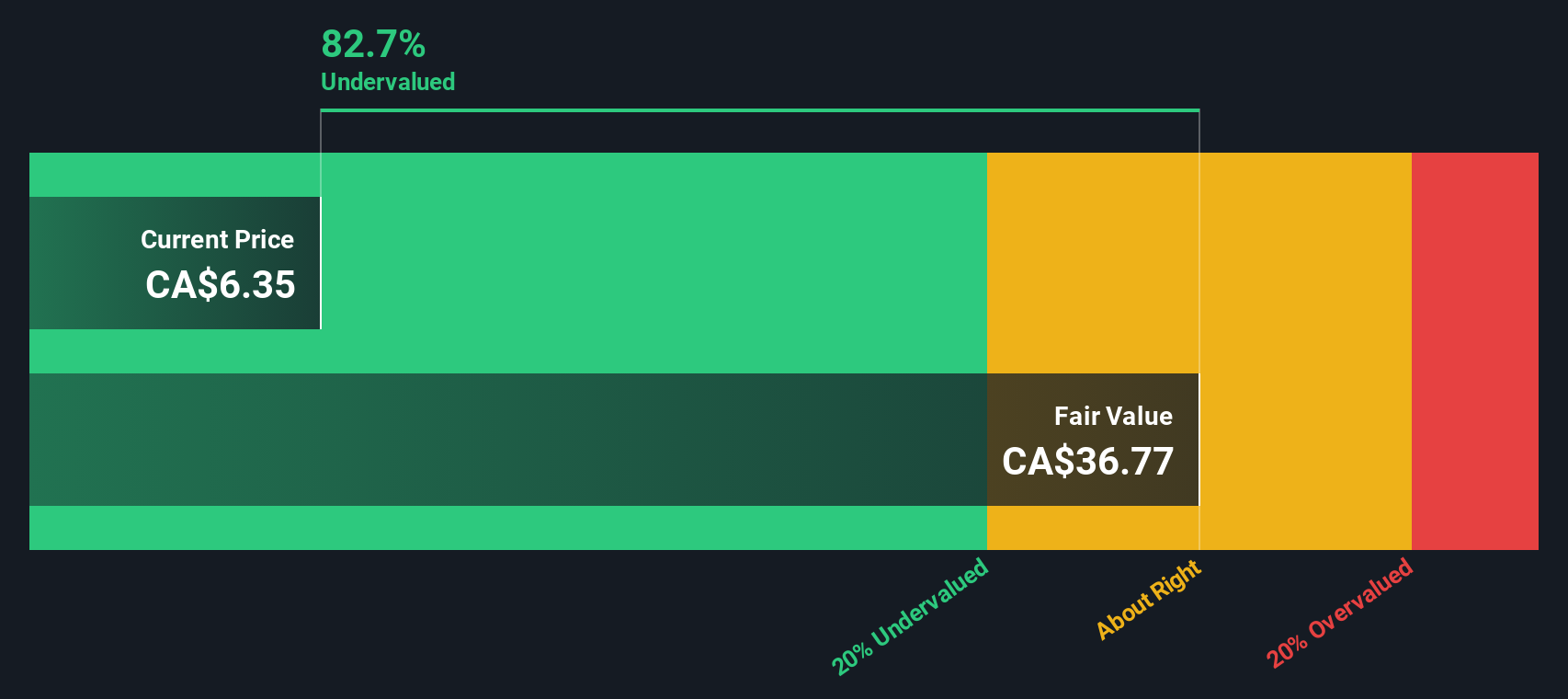

At 127.5x, the market is placing a steep premium on BlackBerry’s earnings power, well above its estimated fair price to earnings ratio of 36.5x. This implies expectations that earnings will rise sharply to catch up, even as the SWS DCF model suggests the stock trades at an 84.2 percent discount to its intrinsic value of about CA$37.17.

Relative to the wider Canadian software sector at 49.4x and peer average of 66.2x, BlackBerry’s multiple stands out as materially richer. This signals that investors are pricing in significantly stronger profit growth than the broader group.

Explore the SWS fair ratio for BlackBerry

Result: Price-to-earnings of 127.5x (OVERVALUED)

However, several risks remain, including execution challenges in its QNX and cybersecurity businesses, as well as the possibility that analyst price targets cap near term upside.

Find out about the key risks to this BlackBerry narrative.

Another View on Value

While the current price to earnings ratio of 127.5x appears rich versus peers and the fair ratio of 36.5x, our DCF model presents a different perspective, suggesting BB trades at an 84.2 percent discount to fair value around CA$37.17. Is the market missing something, or is the cash flow model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BlackBerry for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BlackBerry Narrative

If you see things differently, or want to dig into the numbers yourself, you can build a personalized view of BlackBerry in just minutes: Do it your way.

A great starting point for your BlackBerry research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself an edge by scanning fresh opportunities on Simply Wall St’s screener, where focused ideas can sharpen your next decision.

- Turn small positions into high conviction bets by checking out these 3622 penny stocks with strong financials that pair low share prices with underlying financial strength.

- Explore innovation-focused opportunities by targeting these 26 AI penny stocks positioned at the intersection of rapid growth and transformative technology.

- Identify potential mispricings by filtering for these 907 undervalued stocks based on cash flows that could offer stronger upside relative to their current market expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com