Taking Stock of Acadia Realty Trust (AKR): Is the Recent Sideways Trade Hiding Undervalued Urban Retail Growth?

Recent Performance Snapshot

Acadia Realty Trust (AKR) has been drifting sideways recently, with the stock roughly flat over the past month but still down double digits year to date. This naturally raises valuation questions for income oriented investors.

See our latest analysis for Acadia Realty Trust.

Despite the recent bounce, with a 1 day share price return of 1.76 percent and a closing share price of 20.18 dollars, Acadia’s year to date share price return remains negative. Its three and five year total shareholder returns suggest the longer term story is still constructive and point to momentum that has softened rather than fully reversed.

If this kind of uneven recovery has you comparing options, it could be a good time to explore fast growing stocks with high insider ownership as potential higher momentum ideas alongside AKR.

With the shares still trading below analyst targets despite solid multi year total returns and double digit revenue growth, should investors view Acadia as a discounted play on urban retail, or has the market already priced in its next leg of growth?

Most Popular Narrative Narrative: 9.4% Undervalued

With the narrative fair value sitting modestly above Acadia Realty Trust’s 20.18 dollar last close, the spotlight turns to the growth engine underpinning that gap.

The ongoing migration of major retailers from department stores and wholesale to direct to consumer "mission critical" urban locations is fueling strong tenant demand for Acadia's street retail portfolio, driving sustained same store rent growth and higher revenue through embedded mark to market lease opportunities. The company's outsized exposure to dense, affluent urban corridors where urbanization trends and demographic shifts continue to drive premium consumer demand and limited new retail development supports strong occupancy rates, rent increases, and margin expansion.

Want to see how this high rent, low vacancy story relates to a premium valuation? The narrative focuses on growth, tighter margins, and a notable future earnings multiple. Curious how those factors combine to support today’s fair value assessment and the possibility of future upside?

Result: Fair Value of $22.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat urban retail story could be challenged if affluent consumer spending weakens or e commerce further erodes demand for high street locations.

Find out about the key risks to this Acadia Realty Trust narrative.

Another Way to Look at Value

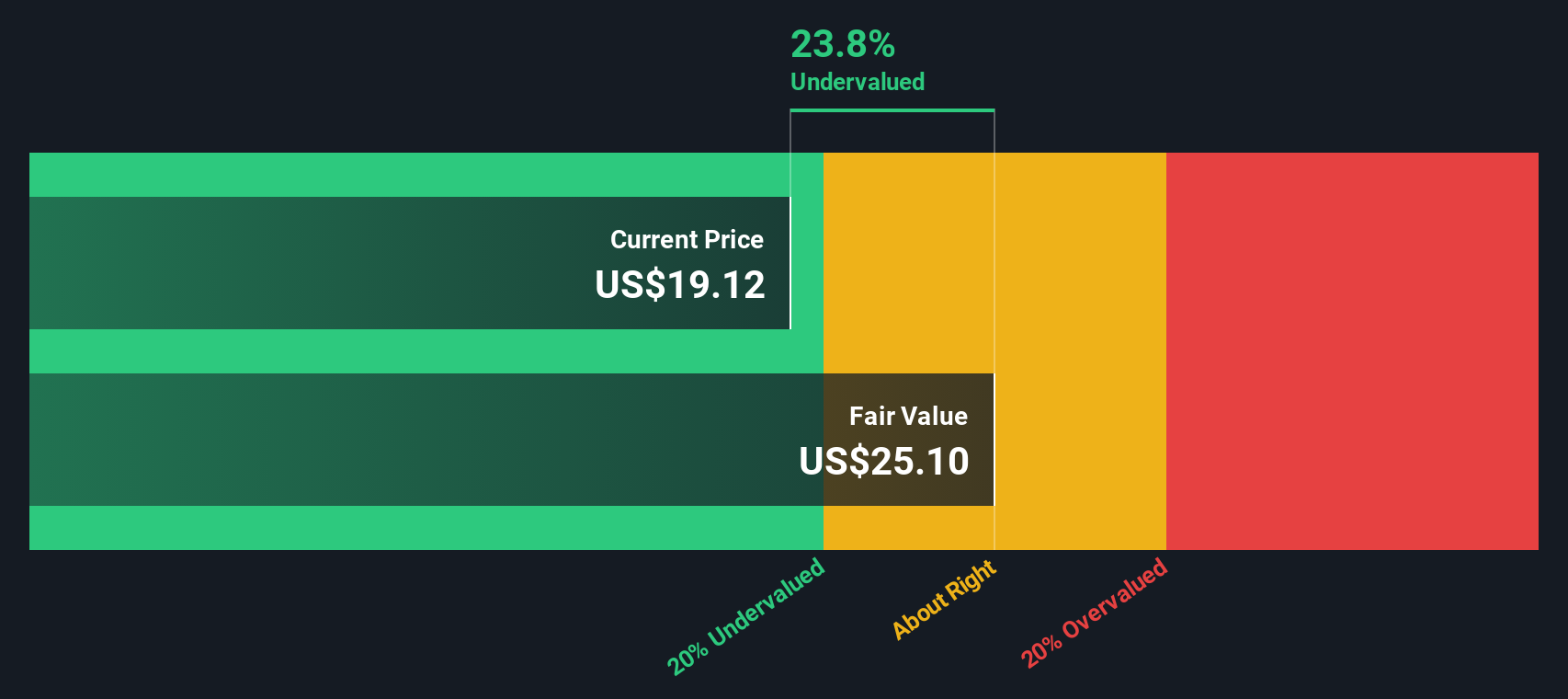

While the narrative view suggests Akadia Realty Trust is modestly undervalued, the SWS DCF model is far more optimistic. It indicates the shares trade about 30 percent below an estimated fair value of 28.99 dollars. If the cash flows are correct, is the market missing something, or are the inputs too generous?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Acadia Realty Trust Narrative

If you are not fully convinced by this take or prefer to dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your Acadia Realty Trust research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More High Conviction Ideas?

Do not stop at Acadia when some of the market’s most compelling opportunities are just a few clicks away on the Simply Wall St Screener.

- Capture potential multi baggers early by scanning these 3625 penny stocks with strong financials where small companies with serious fundamentals are already starting to separate from the noise.

- Position yourself at the forefront of intelligent automation by targeting these 26 AI penny stocks built around real products, growing revenues, and powerful data advantages.

- Lock in quality at better prices by zeroing in on these 906 undervalued stocks based on cash flows so you are not the investor who notices the bargain only after the rerating.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com