Tel-Aviv Stock Exchange (TASE:TASE): Assessing a Rich Valuation After a Strong Multi-Year Share Price Run

Tel-Aviv Stock Exchange (TASE:TASE) has been quietly outpacing many local names, with shares up 4% over the past month and about 18% in the past 3 months, rewarding patient holders.

See our latest analysis for Tel-Aviv Stock Exchange.

Despite a softer 1 day share price return, Tel-Aviv Stock Exchange’s 116% year to date share price return and near 600% 5 year total shareholder return suggest momentum has been building as investors reassess its growth and fee earning potential.

If Tel-Aviv Stock Exchange’s run has you rethinking what else might be worth a closer look, you can scan the market for discovery worthy fast growing stocks with high insider ownership.

With shares already surging and fundamentals improving, the key question now is whether Tel-Aviv Stock Exchange still trades below its true worth, or if the market has already priced in the next leg of growth.

Price to Earnings of 55.3x, Is it justified?

Tel-Aviv Stock Exchange closed at ₪92.36, reflecting a rich valuation on a 55.3x price to earnings ratio that stands well above peers and industry benchmarks.

The price to earnings multiple compares the share price with the company’s earnings per share, effectively showing how many years of current earnings investors are willing to pay for. For an exchange operator like TASE, this metric is closely watched because earnings are tied to trading volumes, listing activity, and fee based services that can be structurally high margin.

At 55.3x earnings, investors appear to be paying a premium for Tel-Aviv Stock Exchange’s strong profitability profile, including high quality earnings, a 25.8% return on equity, and earnings growth that has materially outpaced the wider capital markets industry. However, this multiple is difficult to benchmark against a model driven fair ratio at this stage, as there is currently insufficient data to calculate Tel-Aviv Stock Exchange’s price to earnings fair ratio.

Compared to the Asian Capital Markets industry average of 19.6x and a peer average of 19.3x, Tel-Aviv Stock Exchange’s 55.3x price to earnings ratio is strikingly higher, implying the market is pricing in substantially stronger or more durable earnings than the typical exchange or capital markets peer.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to Earnings of 55.3x (OVERVALUED)

However, the Tel-Aviv Stock Exchange’s premium could be vulnerable to weaker trading volumes or regulatory shifts that compress fee income and profitability expectations.

Find out about the key risks to this Tel-Aviv Stock Exchange narrative.

Another View on Value

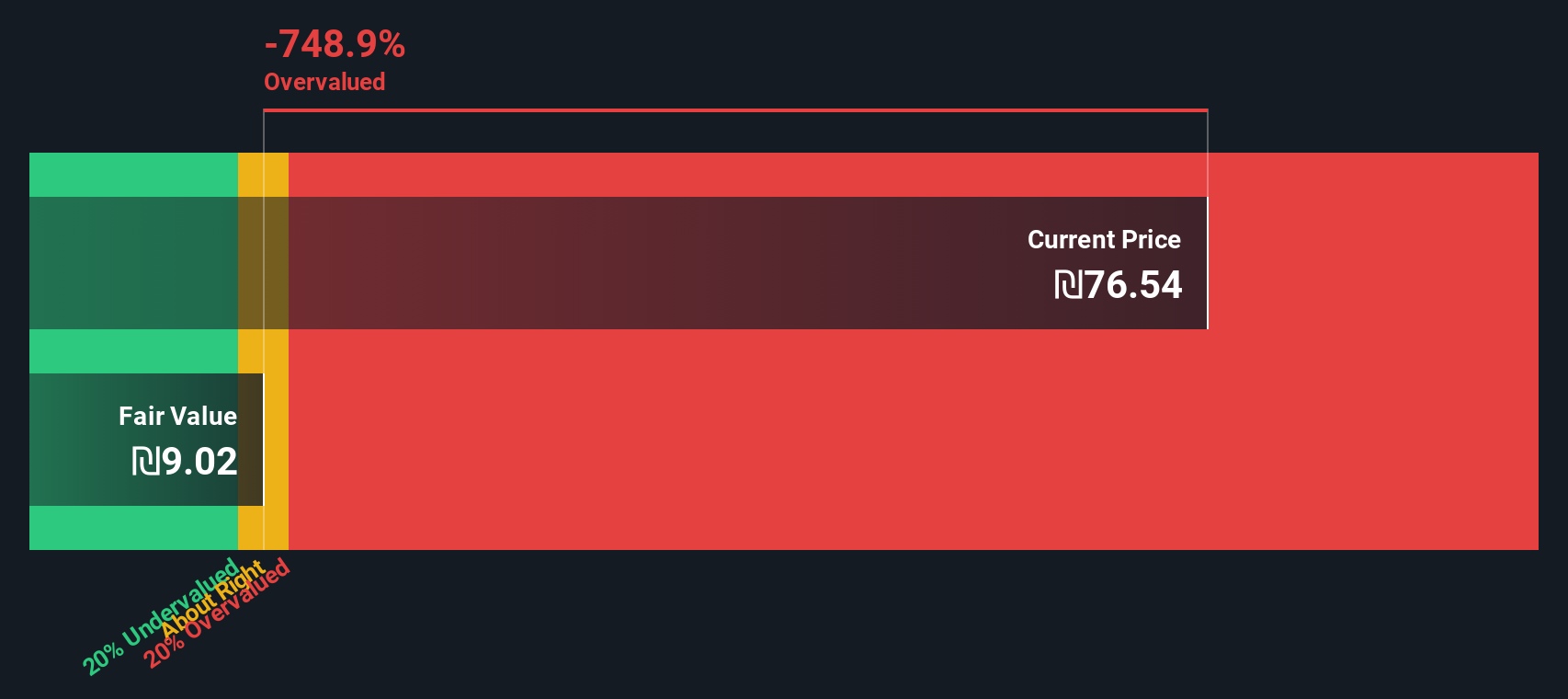

Our DCF model paints a far less generous picture than the earnings multiple. It suggests Tel-Aviv Stock Exchange is trading well above its fair value, implying that even strong growth may not fully justify today’s price. Could sentiment be running ahead of fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tel-Aviv Stock Exchange for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tel-Aviv Stock Exchange Narrative

If you see the story differently, or want to dig into the numbers yourself, you can build a complete narrative in minutes, Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Tel-Aviv Stock Exchange.

Ready for your next investing move?

Do not stop at one opportunity, use the Simply Wall Street Screener now to lock onto fresh, data driven ideas before other investors catch on.

- Explore potential market mispricing by targeting quality businesses trading below intrinsic value with these 906 undervalued stocks based on cash flows.

- Find companies involved in intelligent automation by focusing on innovators powering machine learning developments through these 26 AI penny stocks.

- Research income-focused opportunities by identifying companies with established dividend payments and attractive yields using these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com