Camping World (CWH): Reassessing Valuation After a Steep Three-Month Share Price Slide

Camping World Holdings (CWH) has had a rough stretch lately, with the stock sliding over the past 3 months and year, and that kind of persistent weakness usually forces investors to revisit the long term story.

See our latest analysis for Camping World Holdings.

The latest slide, including a steep 90 day share price return of minus 42.53 percent and a 1 year total shareholder return of minus 52.49 percent, signals fading momentum as investors reassess both cyclical risks and the valuation backdrop.

If this sort of volatility has you comparing options, now is a good moment to broaden your watchlist and discover fast growing stocks with high insider ownership.

With Camping World’s shares deeply in the red yet still tied to a growing RV ecosystem, investors face a key question: is this slump masking undervaluation, or is the market already pricing in any future recovery?

Most Popular Narrative Narrative: 43.1% Undervalued

Compared with Camping World Holdings’ last close at $10, the most widely followed narrative points to a materially higher fair value anchored around future earnings power.

Increased store productivity through consolidation and SG&A cost reductions is unlocking significant operating leverage even while industry shipment trends remain pressured, positioning the company to expand net margins and earnings as volume recovers or stabilizes. The long term demographic shift favoring active, outdoor oriented retirees combined with continued preference for domestic travel should underpin stable demand for RV ownership and usage.

Want to see how modest revenue growth, sharply improving margins, and a reset earnings multiple combine to justify a higher fair value? The full narrative lays out an unusually detailed roadmap from current losses to meaningful profitability, along with the earnings base it believes the market is overlooking.

Result: Fair Value of $17.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubbornly weak RV demand, or further pressure on entry level buyers, could force deeper discounting and undermine the margin rebound that this optimistic narrative assumes.

Find out about the key risks to this Camping World Holdings narrative.

Another View: Cash Flows Paint A Harsher Picture

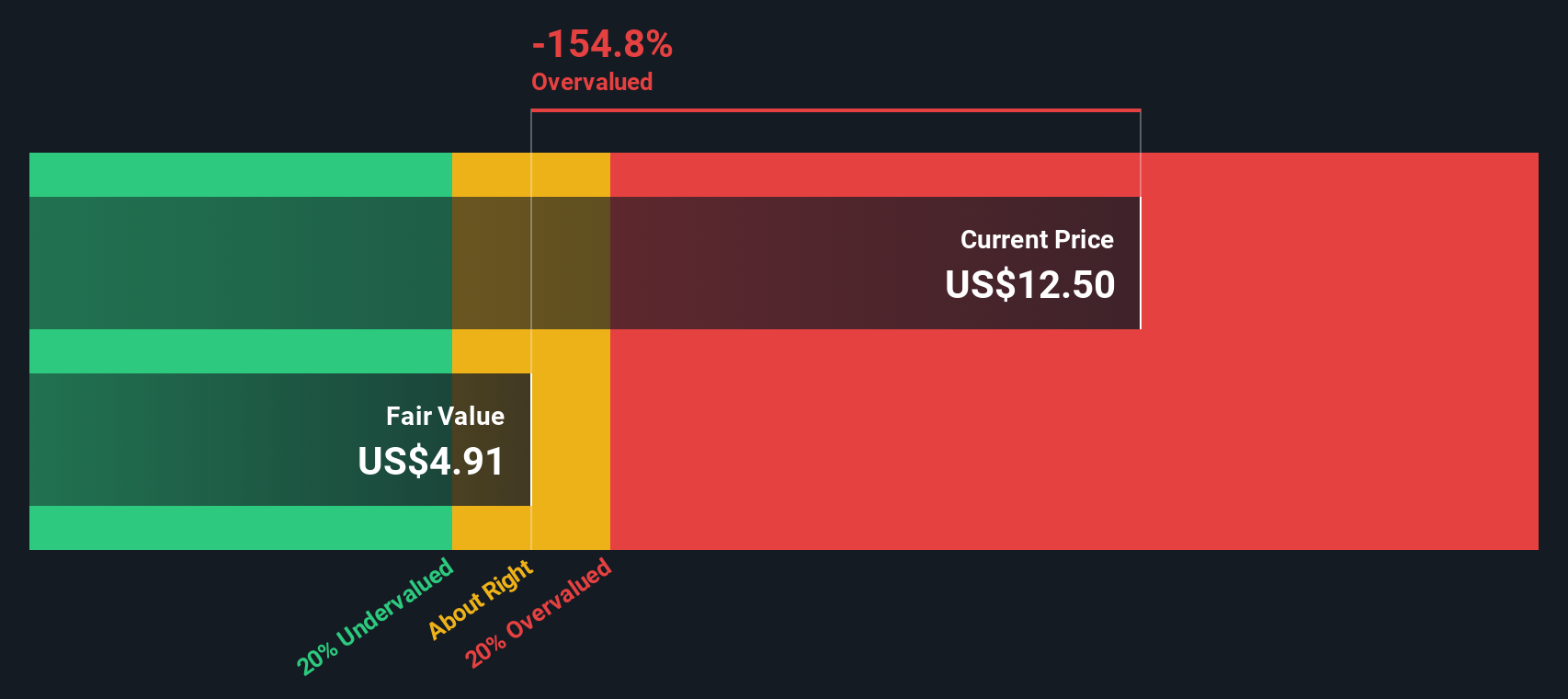

While the narrative and analyst targets imply upside, our DCF model is far less generous. It points to a fair value of about $3.85 a share, well below the current $10 price. If the cash flow math is right, today’s slump could just be the middle of the story, not the end.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Camping World Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 912 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Camping World Holdings Narrative

If this angle does not quite fit your view, or you would rather dig into the numbers yourself, you can quickly build a tailored narrative in just a few minutes: Do it your way.

A great starting point for your Camping World Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next potential opportunity by using the Simply Wall St Screener to uncover fresh, data driven stocks that fit your strategy.

- Capitalize on mispriced opportunities by targeting companies trading below their intrinsic value using these 912 undervalued stocks based on cash flows.

- Ride structural growth in cutting edge innovation by focusing on these 25 AI penny stocks shaping the future of intelligent technology.

- Strengthen your income stream by filtering for reliable payers with these 13 dividend stocks with yields > 3% delivering yields that stand out from the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com