Is Essential Properties Realty Trust Still Attractive After Strong Multi Year Share Price Gains?

- If you are wondering whether Essential Properties Realty Trust is quietly turning into a value opportunity, or if the easy gains are already gone, you are in the right place to unpack what the market is really pricing in.

- The stock has drifted slightly lower over the last week and month, but zoom out and you will see it is still up about 51% over three years and 81% over five. This indicates that the long term story has been far more positive than the recent dips suggest.

- Recent headlines have focused on Essential Properties expanding its net lease portfolio, selectively acquiring single tenant properties while maintaining long lease terms and tenant diversification. That combination of steady expansion and disciplined deal making helps explain why the longer term returns look strong even if short term sentiment has softened.

- On our framework of 6 valuation checks, Essential Properties scores a 4 out of 6 on undervaluation, as shown in our valuation summary. Next we will walk through what traditional valuation methods say about the stock, before finishing with a more complete way to think about its true worth.

Approach 1: Essential Properties Realty Trust Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting its future adjusted funds from operations and discounting those cash flows back to today in dollar terms. For Essential Properties Realty Trust, the latest twelve month free cash flow is about $307.9 million, providing the starting point for this analysis.

Some analysts expect cash flows to grow steadily, with Simply Wall St extending those forecasts beyond the usual five year window. On this basis, annual free cash flow is projected to rise to around $914.8 million by 2035, reflecting an increase in the company’s earning power over time. These future cash flows are discounted using a 2 Stage Free Cash Flow to Equity model tailored to REIT adjusted funds from operations.

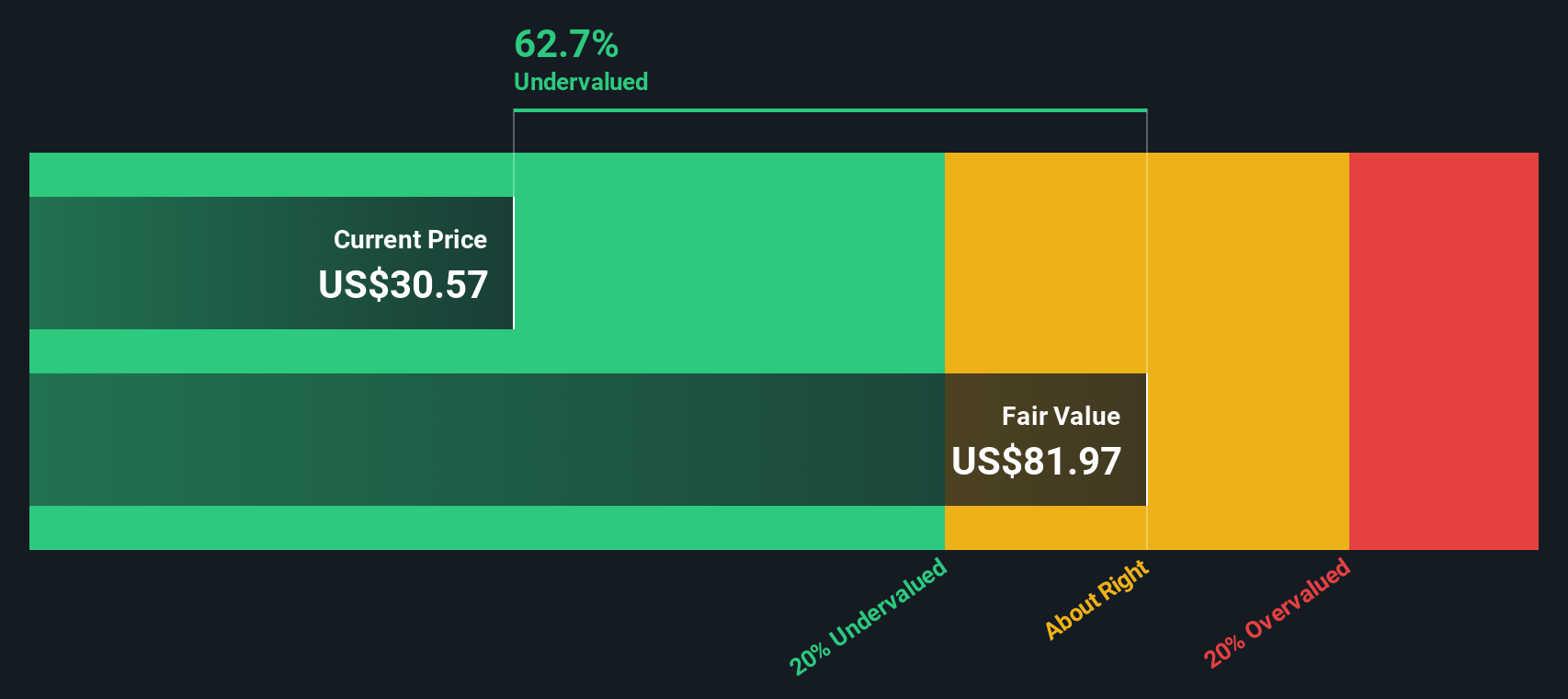

Bringing all those discounted cash flows together produces an estimated intrinsic value of about $82.03 per share. Compared with the current share price, the model implies the stock is trading at a 62.9% discount, which indicates a wide margin of safety for long term investors within the assumptions of this analysis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Essential Properties Realty Trust is undervalued by 62.9%. Track this in your watchlist or portfolio, or discover 909 more undervalued stocks based on cash flows.

Approach 2: Essential Properties Realty Trust Price vs Earnings

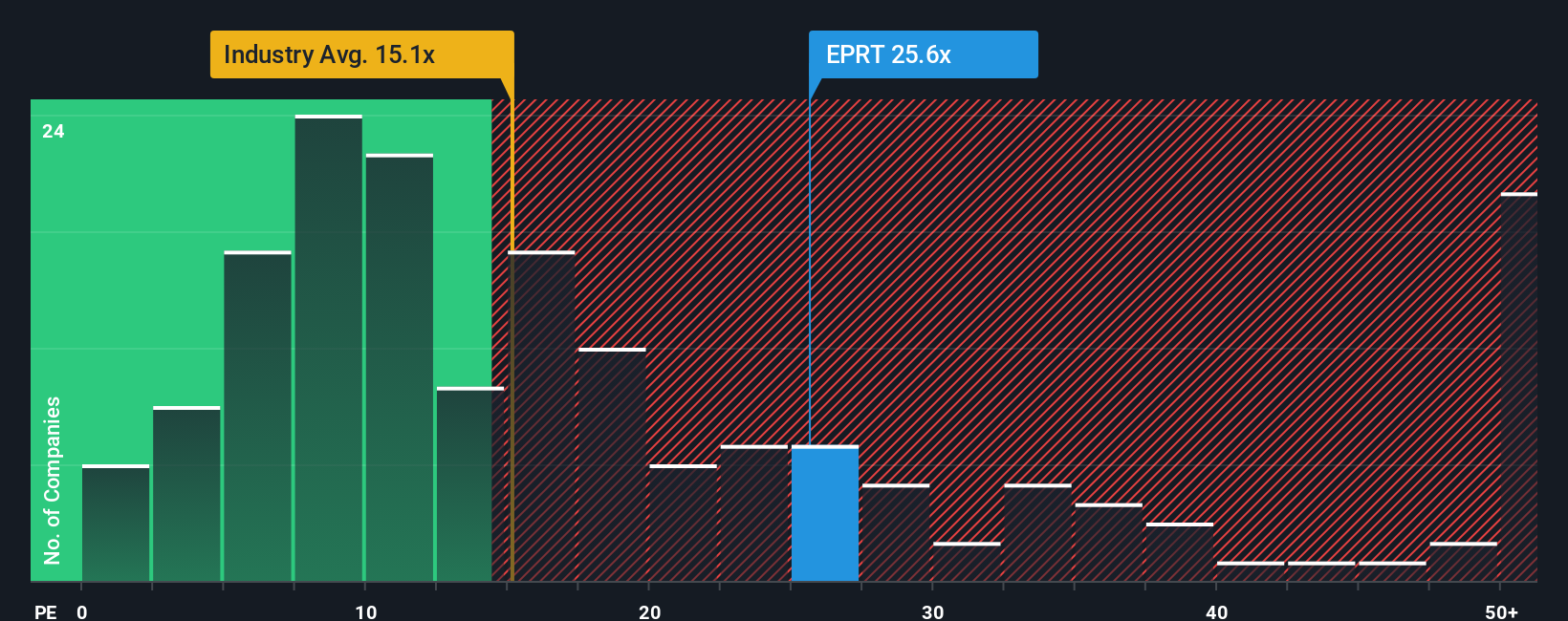

For a consistently profitable REIT like Essential Properties, the price to earnings, PE, ratio is a useful way to gauge what investors are willing to pay for each dollar of current earnings. In general, faster growing and lower risk businesses are associated with higher PE ratios, while slower growth or higher uncertainty are associated with lower multiples.

Essential Properties currently trades on a PE of about 25.2x, which is above the broader REITs industry average of roughly 15.9x, but below the peer group average near 33.1x. To move beyond simple comparisons, Simply Wall St also calculates a proprietary Fair Ratio, the PE you might expect based on the company’s earnings growth, profit margins, risk profile, industry and market cap. For Essential Properties, this Fair Ratio is around 33.8x.

Because the Fair Ratio incorporates company specific factors rather than just comparing to generic peers, it provides a more tailored view of what a reasonable multiple could be. With the actual PE of 25.2x sitting below the 33.8x Fair Ratio, this lens suggests the market is currently valuing Essential Properties at a lower multiple than that implied by the Fair Ratio.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1456 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Essential Properties Realty Trust Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page. There you connect your view of a company’s story with your assumptions for its future revenue, earnings, margins and fair value. You can then compare that fair value to today’s price to decide whether to buy, hold or sell. Your Narrative will automatically refresh as new news or earnings arrive. One investor might build a bullish Essential Properties Realty Trust Narrative around resilient, service based tenants, 16% plus annual revenue growth and a fair value closer to the most optimistic 40 dollar target. Another investor might take a more cautious view focused on tenant concentration, financing risks and a fair value closer to the low 33 dollar target. Both investors can use the same tool to turn their story into numbers and a clear decision.

Do you think there's more to the story for Essential Properties Realty Trust? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com