Ares Management (ARES): Reviewing Valuation After S&P 500 Inclusion and Rising Investor Attention

Ares Management (ARES) just joined the S&P 500 and several related indices, a shift that typically forces fresh buying from index funds and puts the stock on more institutional radar screens.

See our latest analysis for Ares Management.

That index promotion has arrived alongside a powerful 30 day share price return of 18.6 percent. However, the year to date share price return is slightly negative, and the five year total shareholder return of just over 300 percent shows the longer term momentum story is still very much intact.

If Ares has caught your eye, it might be a good moment to see what else is gaining attention and discover fast growing stocks with high insider ownership.

Yet with Ares now trading near record levels and only a modest discount to consensus targets, investors face a key question: is the recent surge underestimating future growth, or has the market already priced it all in?

Most Popular Narrative: 5.4% Undervalued

Compared with Ares Management’s last close at $173.61, the most followed narrative points to a fair value of $183.60, implying modest upside and robust underlying growth assumptions.

The significant ramp in perpetual capital (now nearly 50% of fee paying AUM), combined with consistent investment performance and low client redemptions, is expected to drive higher recurring fee revenues, greater profitability, and improved earnings visibility.

Curious what kind of earnings leap those recurring fees are meant to fund? The narrative leans on bold growth, expanding margins, and a surprisingly rich future multiple. Want to see the numbers behind that confidence?

Result: Fair Value of $183.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, mounting competition in private credit and heavier regulatory scrutiny could squeeze fees, pressure margins, and undermine the growth implied in this upbeat narrative.

Find out about the key risks to this Ares Management narrative.

Another View: Market Ratios Tell a Different Story

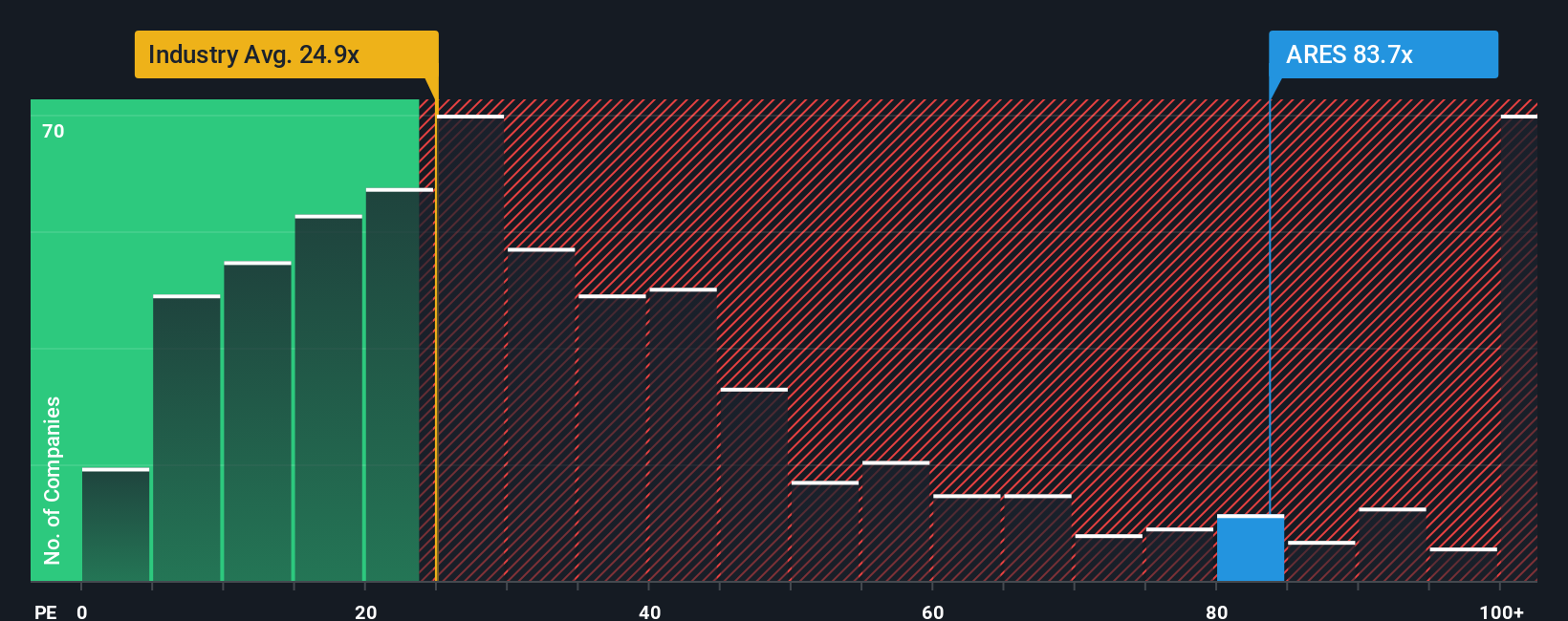

While the popular narrative sees Ares Management as modestly undervalued, the market’s own numbers push back. On a price to earnings basis, Ares trades at 74.3 times, far richer than both the US Capital Markets industry on 25.2 times and peers at 14.4 times, and well above a 23.1 times fair ratio our analysis suggests the market could eventually gravitate toward. If sentiment cools, could simple mean reversion in this ratio erase much of that perceived upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ares Management Narrative

If your view differs from these takes, or you would rather dig into the numbers yourself, you can build a custom narrative in minutes: Do it your way.

A great starting point for your Ares Management research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop with Ares when you can quickly scan other high potential ideas on Simply Wall Street’s Screener and position yourself ahead of the crowd.

- Capture income potential by targeting steady payers using these 13 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow in any market.

- Seize growth in cutting edge innovation through these 25 AI penny stocks that are building real businesses around artificial intelligence, not just hype.

- Strengthen your long term returns by focusing on quality names in these 909 undervalued stocks based on cash flows before the wider market wakes up to their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com