How Investors Are Reacting To Daikin IndustriesLtd (TSE:6367) Expanding Its European Heat Pump Joint Venture

- In December 2025, Copeland and Daikin announced they would expand their existing joint venture into Europe to supply advanced inverter swing rotary compressors, power electronics and controls tailored for residential heat pumps, with operations planned to start in 2026 across the European Economic Area, the UK, Switzerland and nearby markets.

- This move links Daikin more closely to Europe’s push to cut carbon emissions, positioning its heat pump technology at the center of the region’s residential energy transition.

- We’ll now examine how Daikin’s deeper push into European residential heat pumps could influence the company’s investment narrative and growth prospects.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

What Is Daikin IndustriesLtd's Investment Narrative?

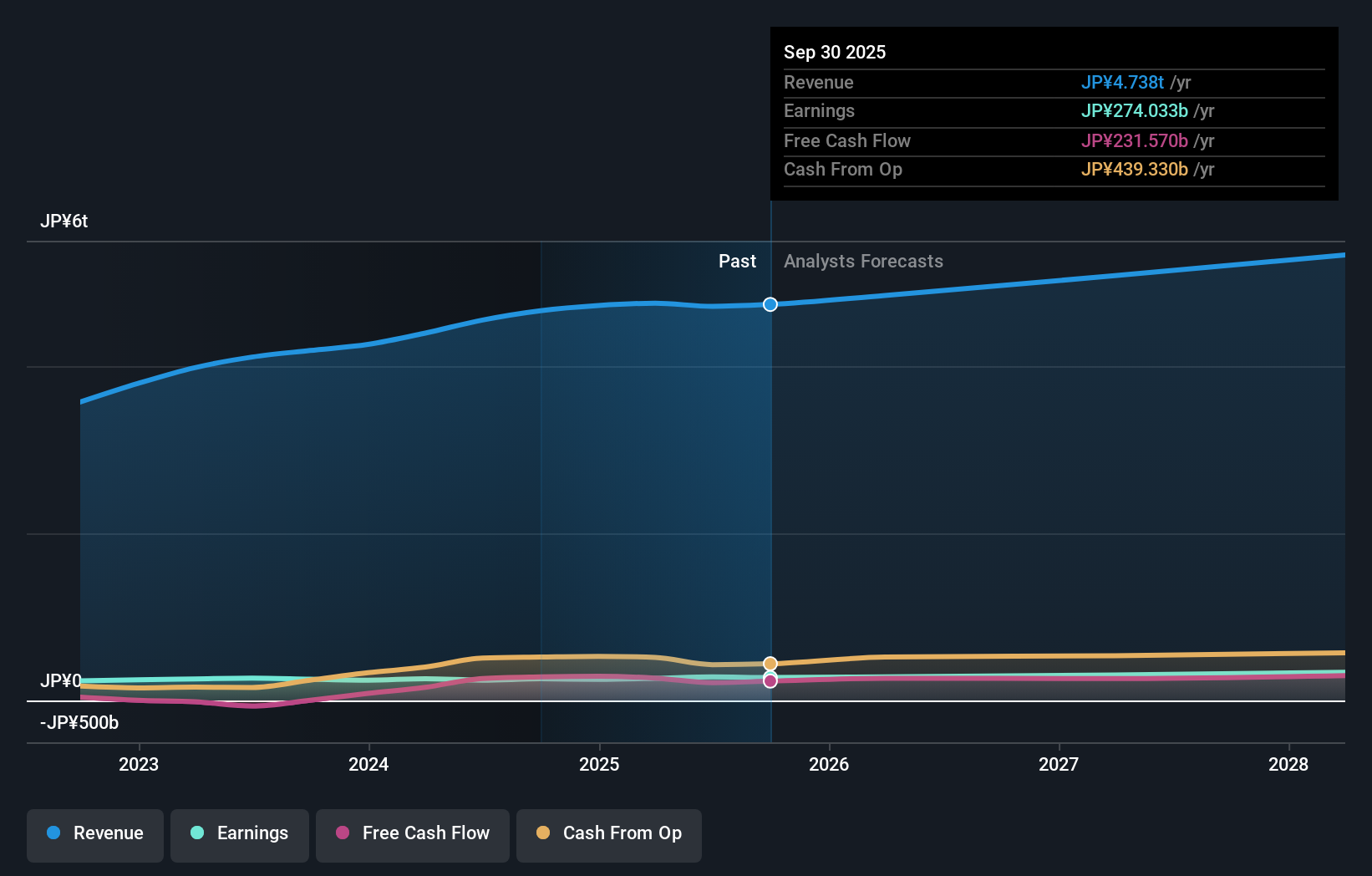

To own Daikin today, you really have to believe in its ability to convert solid but unspectacular earnings growth and high-quality HVAC technology into durable global cash flows, even as the stock has lagged both the Japanese market and its own building peers over the past few years. The expanded joint venture with Copeland in European residential heat pumps fits neatly into that story: it ties Daikin directly into policy-driven decarbonization and gives its swing rotary compressor technology a stronger route to OEM adoption across Europe. In the near term, the move is unlikely to rewrite earnings guidance on its own, but it could strengthen one of Daikin’s key growth pillars and help justify its premium P/E over time. The bigger watchpoints remain its relatively low return on equity, slower forecast growth than the market and the recent step down in the Q2 dividend, which may keep some investors cautious until they see clearer benefits from these new partnerships.

However, investors should also be aware of Daikin’s relatively low forecast return on equity. Daikin IndustriesLtd's shares have been on the rise but are still potentially undervalued by 6%. Find out what it's worth.Exploring Other Perspectives

Explore 6 other fair value estimates on Daikin IndustriesLtd - why the stock might be worth 33% less than the current price!

Build Your Own Daikin IndustriesLtd Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Daikin IndustriesLtd research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Daikin IndustriesLtd research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Daikin IndustriesLtd's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com