Assessing SENKO Group Holdings (TSE:9069)’s Valuation After Its Rapid Share Buyback Initiative

SENKO Group Holdings (TSE:9069) just wrapped up a fast tracked share buyback, scooping up roughly 2.6% of its shares in two days, a clear signal about management’s view on capital efficiency.

See our latest analysis for SENKO Group Holdings.

The swift completion of the buyback comes after a solid run, with a year to date share price return of 29.11 percent and a three year total shareholder return of 120.65 percent. This suggests momentum is still broadly positive despite some recent quarterly volatility.

If this kind of capital allocation story has your attention, it could be a good moment to broaden your watchlist and discover fast growing stocks with high insider ownership

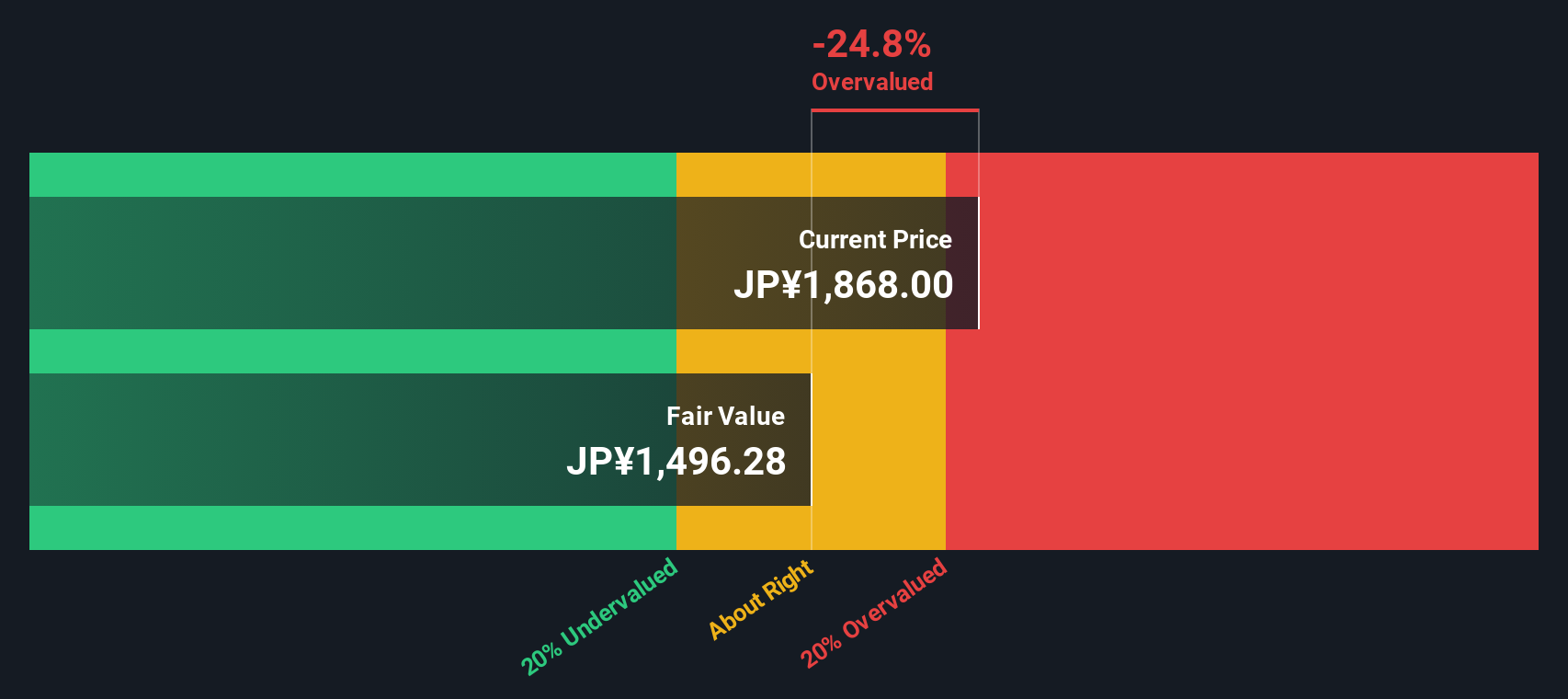

The question now is whether this rapid capital return still leaves SENKO trading below its fundamentals, or if the recent rally means the market is already baking in the next leg of earnings growth.

Price to earnings of 19.6x: Is it justified?

SENKO Group Holdings currently trades on a price to earnings ratio of 19.6 times, putting a premium valuation on the last close of ¥1,934.

The price to earnings multiple compares the share price to annual earnings per share, giving a snapshot of how much investors are willing to pay for each unit of profit in a given business.

For SENKO, a 19.6 times multiple suggests the market is pricing in continued earnings growth and relatively resilient profits. However, it stands noticeably above the company’s estimated fair price to earnings ratio of 16.2 times, a level our fair value work implies the market could ultimately gravitate toward.

That premium also looks stretched against benchmarks, with SENKO valued higher than the JP Logistics industry average multiple of 14.1 times and above the peer group average of 18.1 times. This underlines how much optimism is already embedded in the shares compared with rivals exposed to similar sector dynamics.

Explore the SWS fair ratio for SENKO Group Holdings

Result: Price to earnings of 19.6x (OVERVALUED)

However, slower logistics demand or a setback in its diversified services could still compress margins and challenge the premium multiple investors are paying.

Find out about the key risks to this SENKO Group Holdings narrative.

Another View on Value

Our DCF model paints a starker picture, with SENKO trading around ¥1,934 versus an estimated fair value near ¥1,337, implying it is materially overvalued on a cash flow basis. If earnings growth stumbles, will the share price adjust down toward that DCF line?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SENKO Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SENKO Group Holdings Narrative

If you see the numbers differently, or want to dig into the details yourself, you can build a personalised narrative in just minutes with Do it your way.

A great starting point for your SENKO Group Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, you may wish to lock in a few fresh opportunities by scanning targeted stock lists that match your return goals and risk tolerance on Simply Wall Street.

- Target reliable income by reviewing these 13 dividend stocks with yields > 3% that may support your portfolio’s cash flow and help reduce reliance on market swings.

- Explore potential growth leaders through these 25 AI penny stocks, where innovation and changing revenue trends can influence your long term returns.

- Consider positioning yourself ahead of the crowd with these 80 cryptocurrency and blockchain stocks, focusing on companies using blockchain in payments, infrastructure, and digital asset ecosystems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com