Should Kodiak Sciences’ 6 Million-Share Offering Reshape How KOD Investors View Dilution Risk?

- Kodiak Sciences Inc. recently filed and commenced an underwritten public offering of 6,000,000 shares of its common stock, with underwriters granted a 30-day option to purchase up to an additional 900,000 shares, subject to market and other conditions.

- This sizeable follow-on equity raise is important for investors because it directly affects Kodiak’s funding profile while introducing the prospect of meaningful shareholder dilution.

- Next, we’ll examine how this sizable follow-on equity raise shapes Kodiak Sciences’ investment narrative and future funding flexibility.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Kodiak Sciences' Investment Narrative?

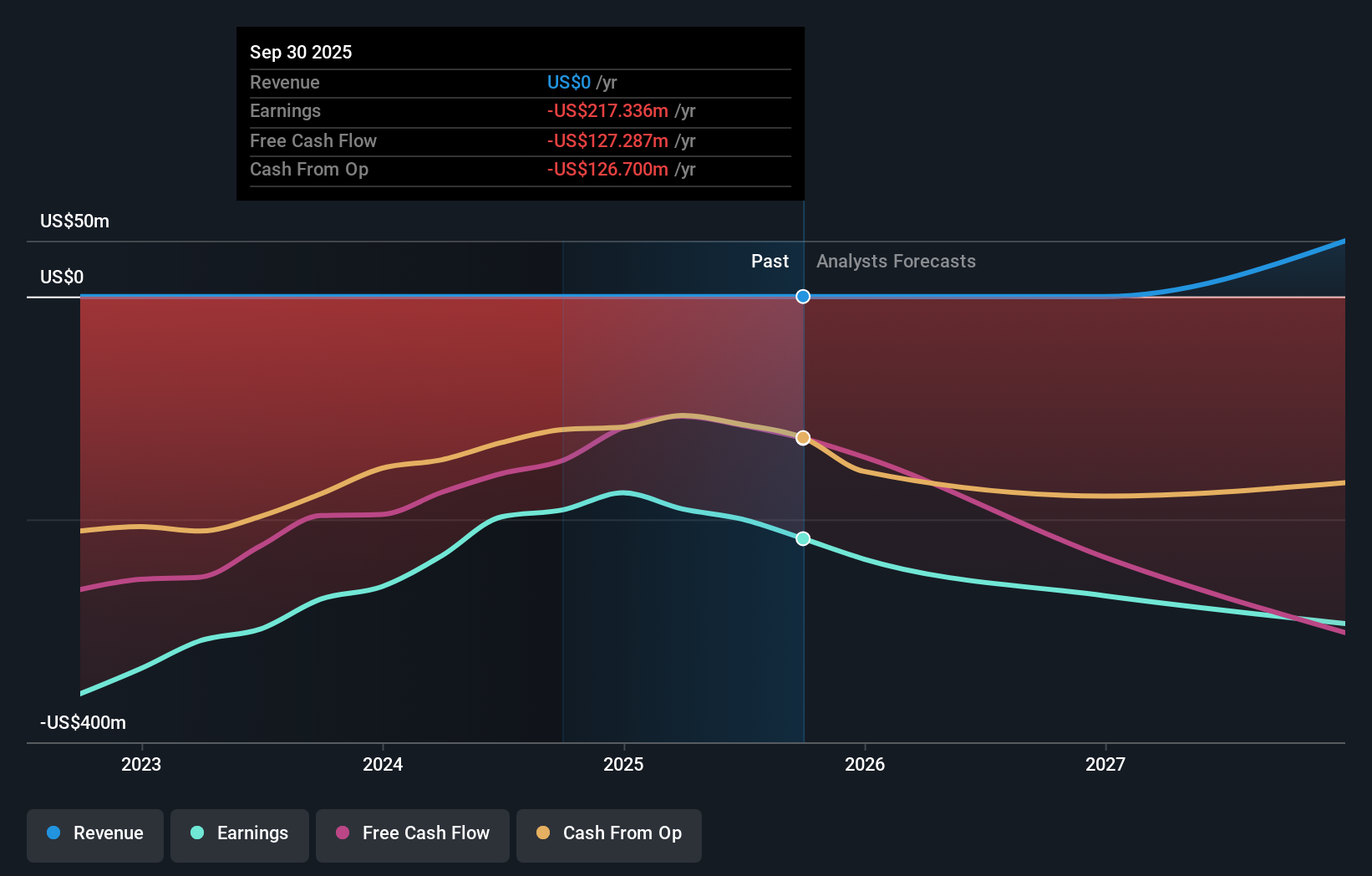

To own Kodiak Sciences today, you have to believe that its ophthalmology pipeline, particularly KSI-101 and tarcocimab, can eventually convert years of rising losses and zero revenue into sustainable commercial value. The story is still all about clinical milestones: Phase 3 progression in MESI and upcoming data in diabetic retinopathy and wet AMD remain the near term catalysts most investors are watching. The new follow on offering of up to 6.9 million shares fits into this by extending Kodiak’s cash runway, which may reduce near term financing risk but comes at the cost of meaningful dilution for existing shareholders. Given the sharp share price run this year and a consensus price target below the market price, that dilution now becomes part of the core risk/reward trade off.

However, the bigger risk is how dilution interacts with a business still burning over US$200,000,000 a year. The valuation report we've compiled suggests that Kodiak Sciences' current price could be inflated.Exploring Other Perspectives

Build Your Own Kodiak Sciences Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kodiak Sciences research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Kodiak Sciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kodiak Sciences' overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com