Hyatt (H): Assessing Valuation After First Park Hyatt Resort Launch in Mexico

Hyatt Hotels (H) just opened Park Hyatt Cabo del Sol, its first Park Hyatt in Mexico, giving the stock a fresh talking point around luxury growth and high spending leisure travel.

See our latest analysis for Hyatt Hotels.

The launch of Park Hyatt Cabo del Sol builds on a year where Hyatt’s 90 day share price return of 15.36 percent signals building momentum, even though the 1 year total shareholder return of 3.64 percent is more muted compared with a much stronger 3 year total shareholder return of 74.83 percent and 5 year total shareholder return of 130.92 percent.

If this kind of upscale travel story has your attention, it may be worth exploring other hospitality names using fast growing stocks with high insider ownership as a fresh hunting ground for ideas.

With the shares now trading just a few percent below both intrinsic value estimates and Wall Street targets after a powerful three year run, is Hyatt quietly setting up a fresh entry point, or is the market already factoring in the next leg of growth?

Most Popular Narrative: 2.9% Undervalued

With Hyatt closing at $162.69 against a narrative fair value near $167.57, the story hinges on how aggressively growth and margins can scale.

The strong development pipeline, with approximately 138,000 rooms and several new signings in diverse locations like India, Italy, and the U.S., is likely to drive revenue growth as these new properties come online. The addition of over 2 million new World of Hyatt loyalty members, increasing the member base to approximately 56 million, indicates higher expected direct bookings, which can positively impact both revenue and net margins.

Curious how rapid room growth, shifting margins, and a richer earnings multiple all connect to that fair value tag? Want to see the full playbook?

Result: Fair Value of $167.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting booking behavior and potential delays from higher construction costs could pressure RevPAR and push out the growth narrative that is currently priced in.

Find out about the key risks to this Hyatt Hotels narrative.

Another View: Rich Multiples, Higher Bar

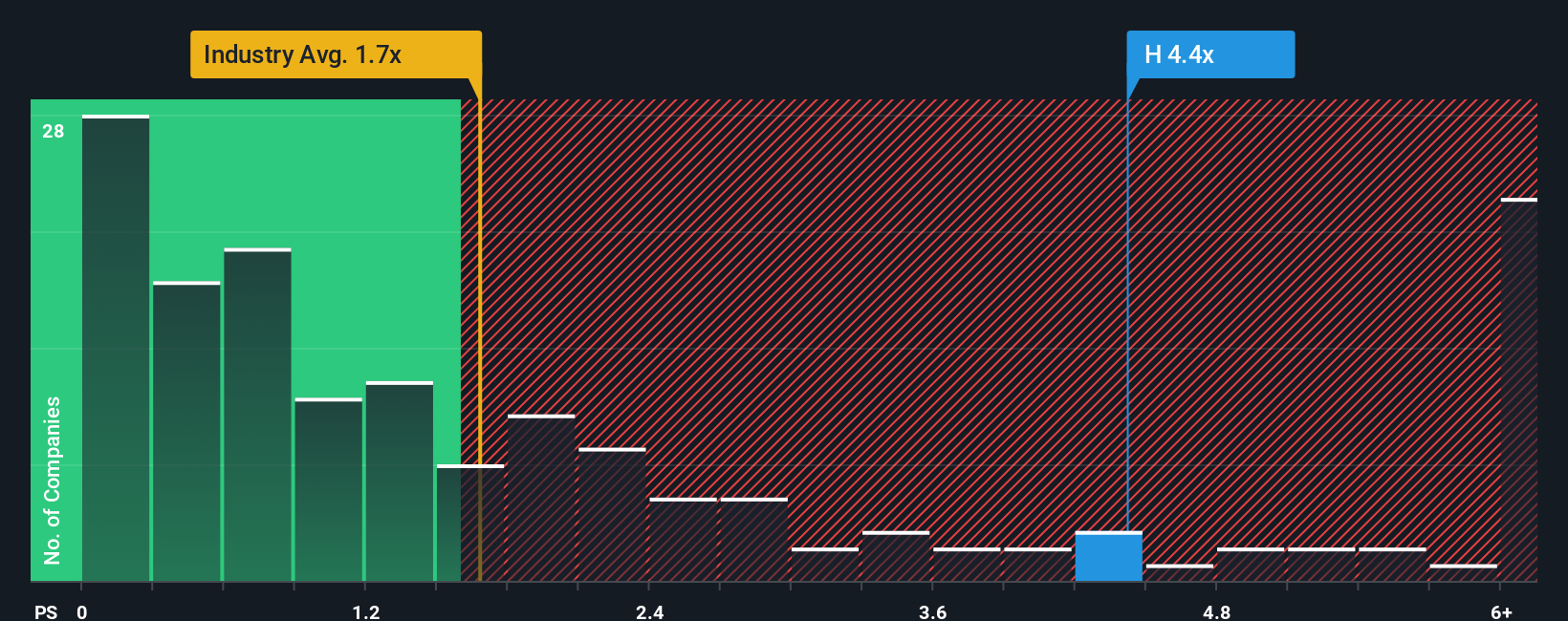

While the narrative points to a modest 2.9 percent undervaluation, Hyatt trades on a 4.6 times sales multiple, well above peers at 2.9 times and the US hospitality average of 1.7 times, and even above a 3.4 times fair ratio the market could drift toward. That premium leaves less room for error if growth cools or margins disappoint. The key question is whether the current price compensates you enough for that execution risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hyatt Hotels Narrative

If you see the story differently, or just prefer to dive into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Hyatt Hotels research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, consider checking fresh stock ideas on the Simply Wall Street Screener, where data and narratives work together for you.

- Capture potential income opportunities by reviewing these 13 dividend stocks with yields > 3% that could strengthen the yield profile of your portfolio.

- Position yourself ahead of digital disruption with these 80 cryptocurrency and blockchain stocks that are building real businesses around blockchain and new payment rails.

- Upgrade the quality of your watchlist by scanning these 909 undervalued stocks based on cash flows that may offer mispriced long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com