Ulta Beauty (ULTA): Revisiting Valuation After a Strong Share Price Run

Ulta Beauty (ULTA) shares have quietly outperformed over the past month, climbing about 11% even as broader retail has wobbled. That move has investors asking whether this beauty leader still offers attractive upside.

See our latest analysis for Ulta Beauty.

That recent 11.3% 1 month share price return sits on top of a strong year to date share price gain in the high 30s, with a 1 year total shareholder return of about 39%. This suggests momentum is still firmly on Ulta Beauty’s side even after the latest pullback.

If Ulta’s run has you rethinking what else could surprise to the upside, it may be worth scanning fast growing stocks with high insider ownership as a fresh source of ideas.

With shares hovering just below analyst targets and trading at a premium to some retail peers, the key question now is whether Ulta still offers mispriced growth or if the market is already baking in its next chapter.

Most Popular Narrative: 2.3% Undervalued

With Ulta Beauty last closing at $589.27 against a narrative fair value of about $603, the story hinges on disciplined growth and earnings resilience.

The analysts have a consensus price target of $574.565 for Ulta Beauty based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $680.0, and the most bearish reporting a price target of just $405.0.

Want to see what justifies a richer future earnings multiple, steady margin assumptions, and only modestly higher growth expectations, all at a higher discount rate? The full narrative unpacks the exact profit path, revenue runway, and capital return forecast underpinning this fair value target, and how they fit together.

Result: Fair Value of $603 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent wage inflation and the looming loss of Ulta’s high margin Target partnership could compress profitability and challenge the upbeat earnings trajectory.

Find out about the key risks to this Ulta Beauty narrative.

Another View: Market Ratios Flash Caution

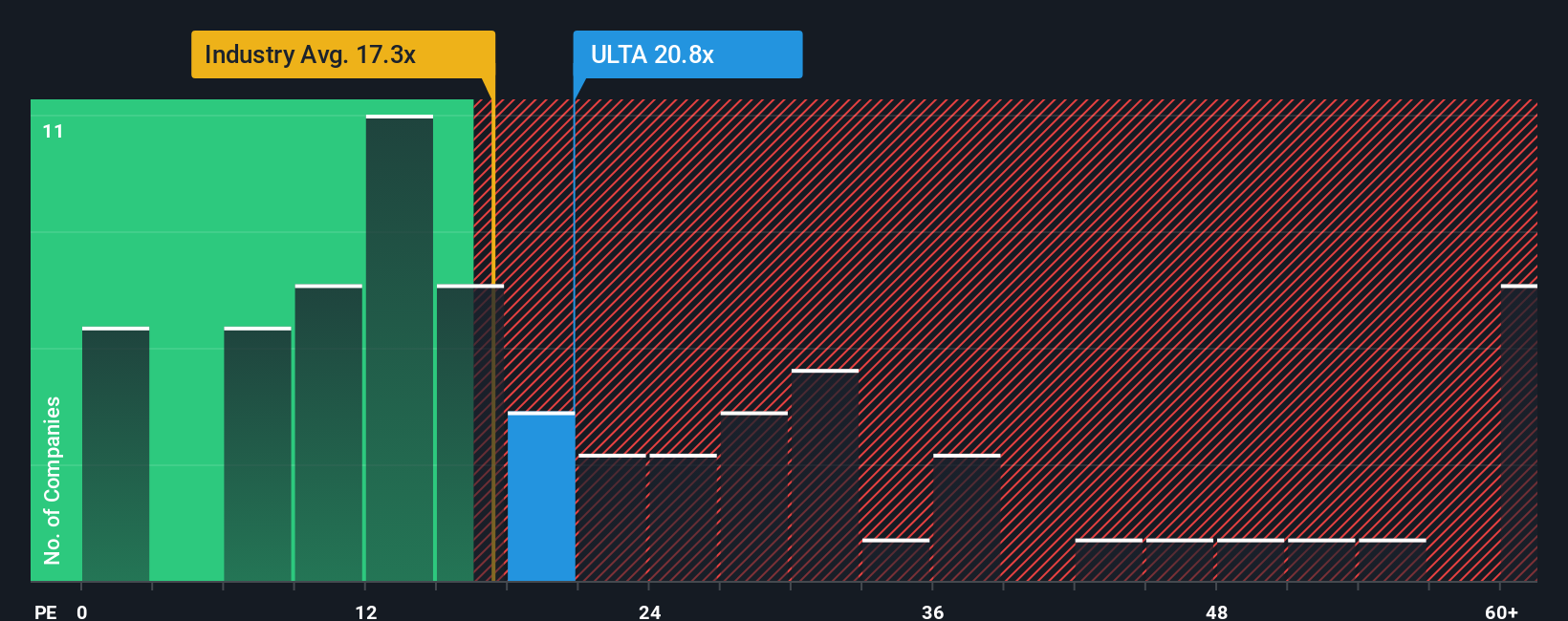

While the narrative fair value frames Ulta as about 2% undervalued, our earnings based lens tells a different story. At roughly 22 times earnings, the stock trades richer than the US specialty retail average of 20.3 times and above a fair ratio of 17.9 times. This hints at limited margin for error if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ulta Beauty for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ulta Beauty Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom view in just minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Ulta Beauty.

Ready for your next investing move?

Do not stop at one strong story when you could line up your next three winners. Use the Simply Wall St Screener to stay ahead.

- Capture cash flow opportunities by targeting these 909 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Focus on these 30 healthcare AI stocks reshaping medicine, diagnostics, and patient care.

- Explore these 80 cryptocurrency and blockchain stocks at the front line of blockchain innovation and digital finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com