Ubiquiti (UI) valuation check after audit committee falls out of NYSE compliance following director’s passing

Ubiquiti (UI) just lost long time director Ronald A. Sege, leaving a vacant board seat and shrinking its audit committee to two independent members, which temporarily puts the company out of NYSE audit committee compliance.

See our latest analysis for Ubiquiti.

Even with this governance setback, Ubiquiti’s $558.39 share price still sits on the back of a powerful year to date share price return of 65.66 percent. The three and five year total shareholder returns of 111.65 percent and 108.72 percent suggest longer term momentum is firmly intact rather than fading.

If this kind of move has you thinking about what else could rerate, it might be worth exploring high growth tech and AI stocks as a way to spot other high potential names in the space.

With earnings still growing double digits and the share price hovering just below analyst targets, the key question now is simple: is Ubiquiti still trading below its true potential, or is the market already pricing in that future growth?

Price to earnings of 42.7x: Is it justified?

On a headline basis, Ubiquiti’s last close of $558.39 reflects a rich price to earnings multiple of 42.7 times that screens as expensive against peers.

The price to earnings ratio compares the company’s current share price to its earnings per share, effectively showing how many dollars investors are willing to pay for each dollar of profit.

For a profitable networking and communications business that is growing earnings at a double digit clip, a premium multiple can signal that the market is baking in strong, durable profit expansion rather than just short term momentum.

However, Ubiquiti’s 42.7 times price to earnings stands well above both the estimated fair price to earnings ratio of 35.8 times and the broader US communications industry average of 31.8 times. This suggests investors are paying a substantial premium that the market could eventually reassess toward more typical levels.

Explore the SWS fair ratio for Ubiquiti

Result: Price-to-earnings of 42.7x (OVERVALUED)

However, sustained multiple compression or a meaningful slowdown in Ubiquiti’s double digit earnings growth could quickly challenge the bullish and premium valuation narrative.

Find out about the key risks to this Ubiquiti narrative.

Another View on Value

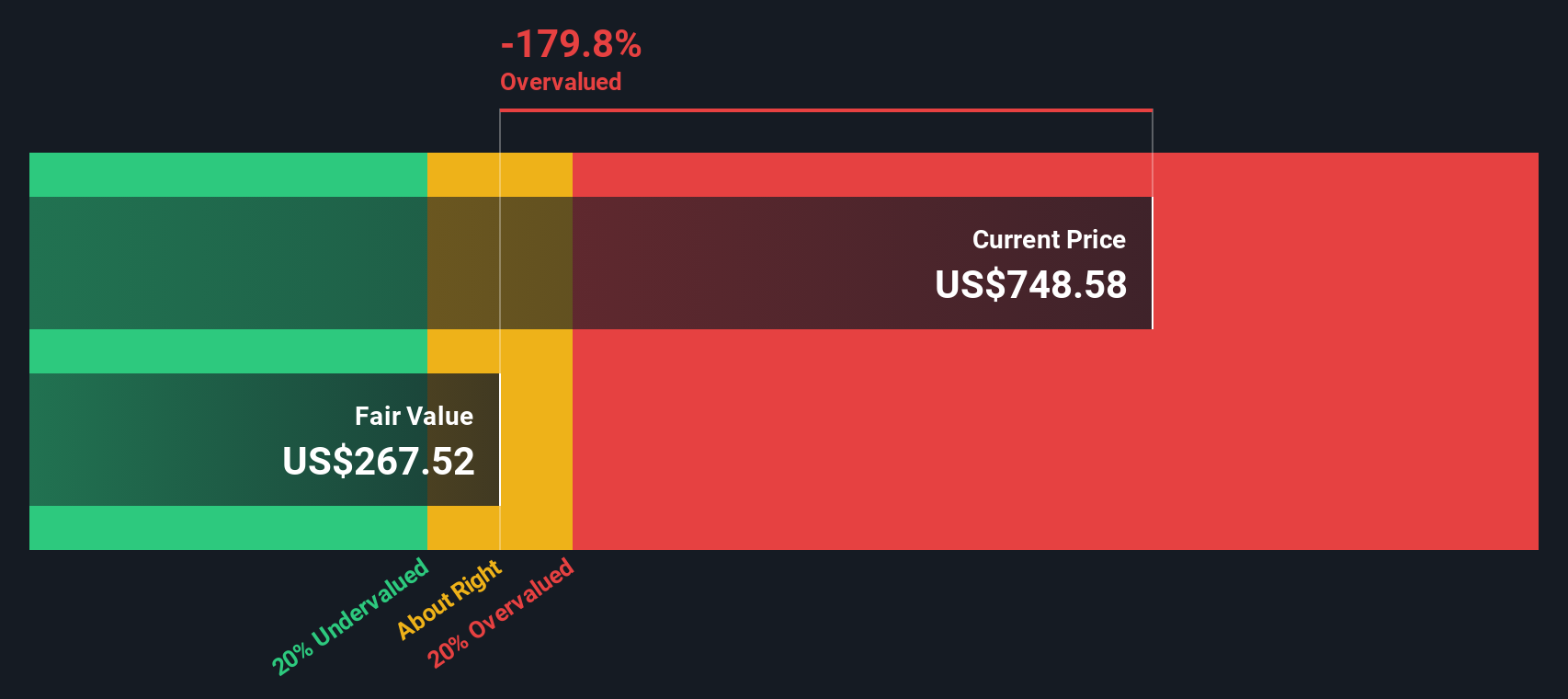

Our DCF model paints a far harsher picture than the earnings multiple. It puts Ubiquiti’s fair value around $142.42 per share, implying the stock is heavily overvalued versus its current $558.39 level. Is the market right to ignore that gap, or is this optimism overdone?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ubiquiti for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ubiquiti Narrative

If this perspective does not fully align with your own, or you prefer hands on research, you can build a tailored view in just minutes: Do it your way.

A great starting point for your Ubiquiti research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next potential winner by using the Simply Wall St screener to surface fresh, data driven opportunities that others might overlook.

- Capture mispriced potential by targeting quality businesses trading at attractive valuations through these 909 undervalued stocks based on cash flows that put long term cash flows at the center of your decision making.

- Ride powerful innovation trends by filtering for companies at the forefront of intelligent automation and data driven products using these 25 AI penny stocks tailored to growth focused investors.

- Strengthen your income foundation by zeroing in on reliable cash generators with meaningful yields via these 13 dividend stocks with yields > 3% that can support both returns and resilience in your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com