Blue Owl Capital (OWL): Reassessing Valuation After Lawsuit Filings and BDC Merger Liquidity Concerns

Blue Owl Capital (OWL) is back in the spotlight after a wave of securities class action filings tied to its business development company merger, liquidity disclosures, and a string of disappointing third quarter numbers.

See our latest analysis for Blue Owl Capital.

Those legal headlines are landing against a tough backdrop, with Blue Owl’s share price at $15.83 after a 1 month share price return of 8.28% but a much weaker year to date share price return of negative 32.9%. Even so, its 3 year total shareholder return of 70.67% shows the longer term compounding story is still intact and suggests current momentum is fragile rather than decisively broken.

If this mix of pressure and long term growth has you rethinking your watchlist, it could be a good moment to explore fast growing stocks with high insider ownership.

With the stock trading at a steep discount to analyst targets despite double digit revenue and earnings growth, is Blue Owl now a bruised compounder on sale, or is the market already bracing for even tougher years ahead?

Most Popular Narrative Narrative: 24% Undervalued

With the most popular narrative putting fair value near $20.82 versus Blue Owl’s $15.83 last close, the spread highlights how differently models and markets are thinking.

Exceptional long term opportunities in digital infrastructure, fueled by generational investment in data centers/AI related assets where Blue Owl has industry leadership, are catalyzing large scale fundraising and deployment, supporting robust growth in management fees and recurring revenues over the next several years.

Want to see how ambitious growth, rising margins, and a reset earnings multiple combine to justify that gap? The full narrative reveals the exact roadmap.

Result: Fair Value of $20.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid, acquisition-led expansion, and any sustained slowdown in fundraising or capital inflows, could quickly pressure margins and undermine today’s optimistic growth assumptions.

Find out about the key risks to this Blue Owl Capital narrative.

Another Lens On Value

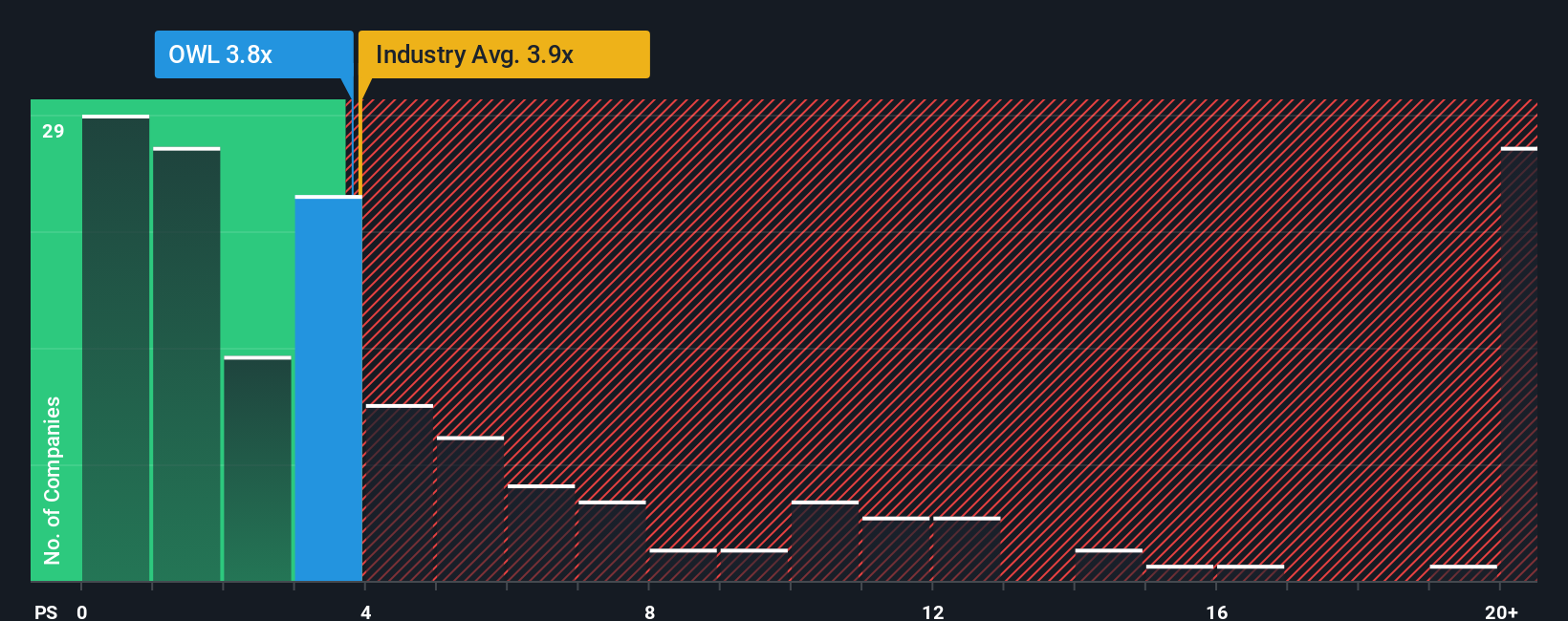

On sales based metrics, Blue Owl is no obvious bargain. Its price to sales ratio sits at 3.8 times, roughly in line with both peers and the 3.8 times fair ratio, suggesting limited multiple upside. If growth wobbles, does that leave more downside risk than upside surprise?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Blue Owl Capital Narrative

If you see the story differently and want to dive into the numbers yourself, you can craft a personalized view in just a few minutes: Do it your way.

A great starting point for your Blue Owl Capital research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before markets move without you, put Simply Wall Street’s screener to work and line up your next opportunities with focused, data driven shortlists built for action.

- Explore early stage momentum by targeting quality growth potential in these 3625 penny stocks with strong financials before the crowd fully catches on.

- Position your portfolio in transformational technology by zeroing in on these 25 AI penny stocks that may help shape the future of automation and intelligence.

- Look for potentially mispriced opportunities by focusing on these 909 undervalued stocks based on cash flows where strong cash flows and discounted valuations may be present.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com