Loomis (OM:LOOMIS) Valuation After SEK 320 Million Goodwill Impairment in Q4 2025

Loomis (OM:LOOMIS) just booked a SEK 320 million non cash goodwill impairment for the fourth quarter of 2025, a move that reshapes how the market reads its balance sheet and long term earnings power.

See our latest analysis for Loomis.

The impairment lands after a choppy few months, with a 30 day share price return of 4.07 percent but a weaker 90 day share price return of minus 9.74 percent. However, the five year total shareholder return of 103.56 percent shows long term momentum remains intact.

If this accounting hit has you reassessing risk, it could also be a good moment to explore fast growing stocks with high insider ownership as potential complementary ideas for your watchlist.

With the shares still trading at a roughly 20 percent discount to analyst targets despite solid earnings growth, is Loomis quietly slipping into undervalued territory, or is the market already factoring in all the future upside?

Most Popular Narrative Narrative: 16.5% Undervalued

With Loomis last closing at SEK 378 against a narrative fair value of roughly SEK 453, the valuation hinges on how far its business mix can evolve.

Expansion into adjacent, high security logistics services (e.g., Loomis Pharma and cross border transport for valuables) leverages Loomis' existing expertise and network, opening new, less commoditized markets with higher margins and recurring revenue profiles supporting future top line and net margin growth.

Want to see how modest growth, rising margins, and shrinking share count combine into that upside case? The full narrative unpacks the math driving this valuation call.

Result: Fair Value of $452.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, steady upside assumes diversification executes smoothly and that early stage ventures like Loomis Pay scale fast enough to offset structural cash and ATM volume declines.

Find out about the key risks to this Loomis narrative.

Another Angle on Value

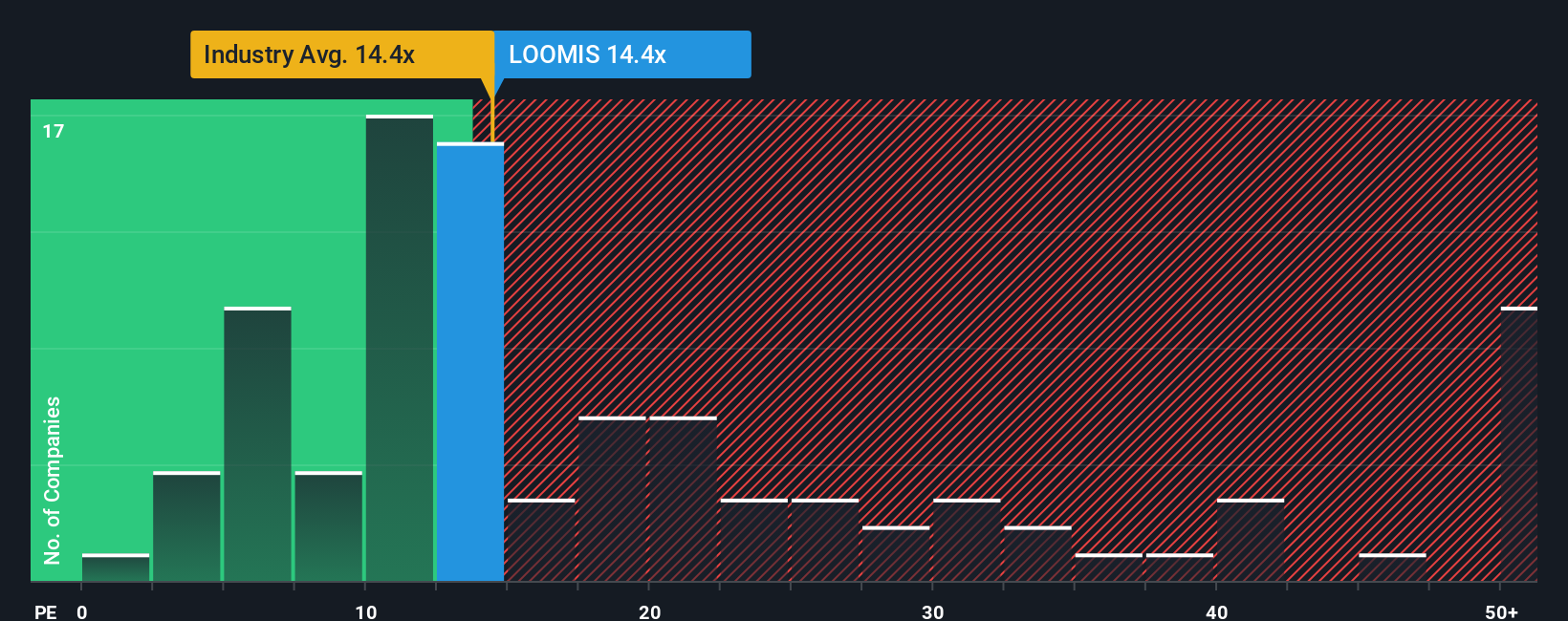

On earnings, Loomis trades at about 14.2 times, roughly in line with the European commercial services average of 14.2 times but well below its 22.1 times fair ratio. If the market drifts toward that fair ratio, does today’s price reflect caution or a missed opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Loomis Narrative

If you see Loomis differently or want to dig into the numbers yourself, you can build a custom valuation story in minutes: Do it your way.

A great starting point for your Loomis research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Use the momentum from your Loomis research and quickly spot your next opportunity with focused stock ideas that could sharpen and strengthen your overall portfolio strategy.

- Capture potential mispricings by targeting companies trading below their cash flow value through these 909 undervalued stocks based on cash flows tailored to investors hunting for upside with a margin of safety.

- Position your portfolio for structural growth trends by tapping into these 25 AI penny stocks that are harnessing artificial intelligence to reshape entire industries.

- Lock in reliable income streams with these 13 dividend stocks with yields > 3% designed for investors who want yields above 3 percent without sacrificing fundamental quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com