Assessing Allegion (ALLE) Valuation After Strong Q3 Beat and Upgraded Full-Year Guidance

Allegion (ALLE) is back on investors radar after a stronger than expected third quarter, where earnings beat expectations, Americas demand held up, and recent acquisitions helped lift international sales despite some margin pressure.

See our latest analysis for Allegion.

At around $159.67 per share, Allegion has given investors a solid 24.17 percent year to date share price return. Its 18.48 percent one year total shareholder return and nearly 60 percent three year total shareholder return suggest momentum is still broadly constructive as the market prices in steady growth and manageable risks after the earnings beat and routine dividend affirmation.

If Allegion's mix of steady cash flows and security focused growth has caught your attention, this could be a good moment to broaden your watchlist with fast growing stocks with high insider ownership.

With Allegion trading near record highs and analysts still seeing upside to their price targets, the real question is whether investors are getting in ahead of further gains or paying up for growth that is already priced in.

Most Popular Narrative: 12.8% Undervalued

With Allegion last closing at $159.67 against a narrative fair value near $183, the current pricing implies investors are still discounting its long term plan.

Strategic investments in electronic/software acquisitions (ELATEC, Gatewise, Waitwhile) are expected to drive new recurring revenue streams and margin accretion starting in 2026, enhancing both top line growth and net margin profile as SaaS and high margin hardware gain share of the portfolio.

Curious how a security hardware business earns a growth style valuation? The answer blends faster software driven cash flows with richer margins and disciplined share reduction. Want to see which specific profit and revenue targets have to hit for that story to work?

Result: Fair Value of $183.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent international weakness or a downturn in nonresidential construction could quickly test confidence in Allegion's growth, margin, and valuation assumptions.

Find out about the key risks to this Allegion narrative.

Another Lens on Valuation

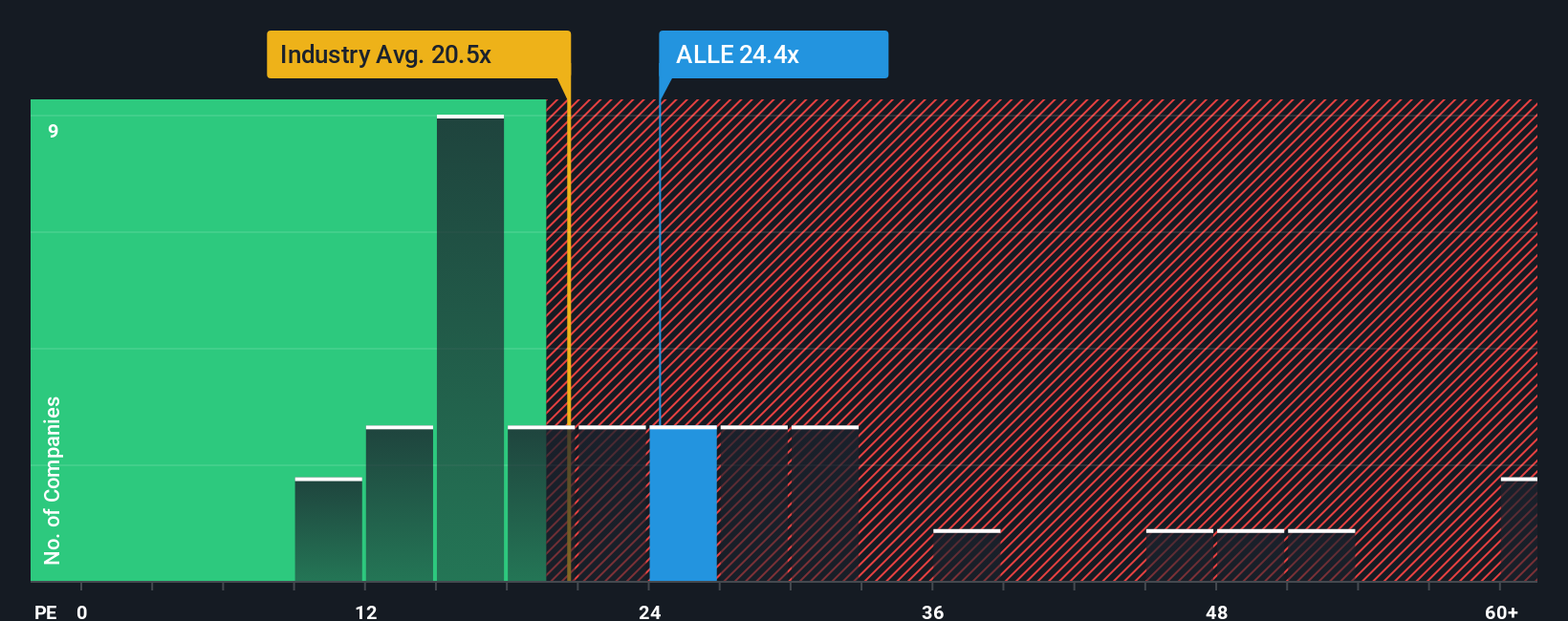

While the narrative fair value suggests Allegion is undervalued, its 21.5x earnings multiple paints a cooler picture. That is richer than both the US Building industry at 19.8x and peers at 20x, yet close to a 22.7x fair ratio, which hints more at valuation risk than clear upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Allegion Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom view in minutes: Do it your way.

A great starting point for your Allegion research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one compelling opportunity. Use the Simply Wall Street Screener to uncover focused stock ideas that match your strategy before the next move is priced in.

- Capture income potential by reviewing these 13 dividend stocks with yields > 3% that aim to keep paying you while markets stay unpredictable.

- Position ahead of the next wave of innovation by scanning these 25 AI penny stocks at the heart of automation and intelligent software.

- Strengthen your value hunting edge with these 909 undervalued stocks based on cash flows that may be trading below what their cash flows suggest they are worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com