Japan Logistics Fund (TSE:8967) Valuation After Strategic Logistics Portfolio Overhaul and New Bank Financing

Japan Logistics Fund (TSE:8967) just kicked off a strategic overhaul of its portfolio, shifting capital from the Kadoma Logistics Center into a 45% stake in Ishikari, backed by fresh bank financing.

See our latest analysis for Japan Logistics Fund.

Those moves seem to be resonating, with the latest share price at ¥103,100 and a solid year to date share price return of 16.45 percent, alongside a strong 1 year total shareholder return of 24.43 percent that suggests momentum is quietly building.

If this kind of repositioning has you thinking more broadly about opportunities, it could be a good moment to explore fast growing stocks with high insider ownership.

With analysts still seeing upside to the current price but recent earnings under mild pressure, the real question is whether Japan Logistics Fund is trading below its true value or if the market is already pricing in its future growth.

Price-to-Earnings of 24.6x: Is it justified?

On a Price to Earnings ratio of 24.6x against a last close of ¥103,100, Japan Logistics Fund screens as mildly expensive relative to several benchmarks.

The Price to Earnings multiple compares what investors pay today for each unit of current earnings, a key lens for income focused REIT names where distributions are anchored in profit generation.

For Japan Logistics Fund, the 24.6x multiple sits below the broader Industrial REITs industry average of 27.3x, yet above both the Asian Industrial REITs subset at 18.3x and our estimated fair Price to Earnings ratio of 24.1x. That mix suggests the market is paying a premium to regional peers and a slight premium to where our regression based fair ratio implies the multiple could eventually settle.

Against its peer average of 32.6x, however, Japan Logistics Fund looks outright cheaper, highlighting how its valuation could compress towards the tighter 24.1x fair level or re rate closer to higher valued comparables depending on how its earnings trajectory, currently expected to decline modestly, actually unfolds.

Explore the SWS fair ratio for Japan Logistics Fund

Result: Price-to-Earnings of 24.6x (ABOUT RIGHT)

However, recent revenue softness and modest earnings declines could signal that Japan Logistics Fund struggles to fully justify its current valuation and growth expectations.

Find out about the key risks to this Japan Logistics Fund narrative.

Another Angle on Value

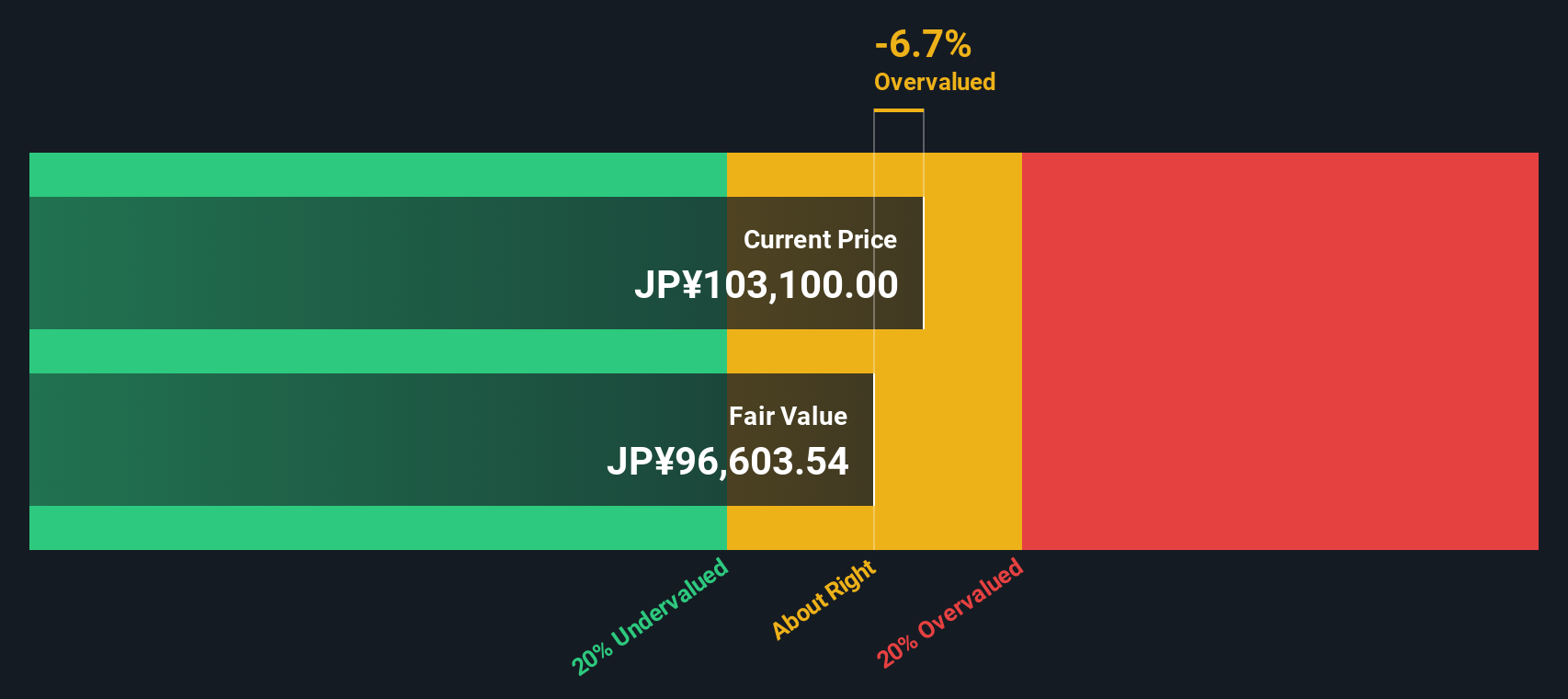

Our DCF model presents a tougher picture than the earnings multiple, with Japan Logistics Fund trading around 7 percent above an estimated fair value of roughly ¥96,300. If cash flows do not improve, that premium could leave little room for error if sentiment turns.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Japan Logistics Fund for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Japan Logistics Fund Narrative

If you see things differently or want to dig into the numbers yourself, you can build a tailored view in just a few minutes: Do it your way.

A great starting point for your Japan Logistics Fund research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you stop here, lock in an edge by scanning new ideas on the Simply Wall Street Screener so you do not miss your next winner.

- Capture potential mispricings by targeting companies that look fundamentally cheap relative to their cash flows using these 908 undervalued stocks based on cash flows.

- Ride powerful secular trends by focusing on innovators harnessing machine learning and automation through these 25 AI penny stocks.

- Strengthen your income stream with businesses offering robust yields and steady payouts via these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com