IDC: The global wristwatch market grew 10% year-on-year in the first three quarters of 2025

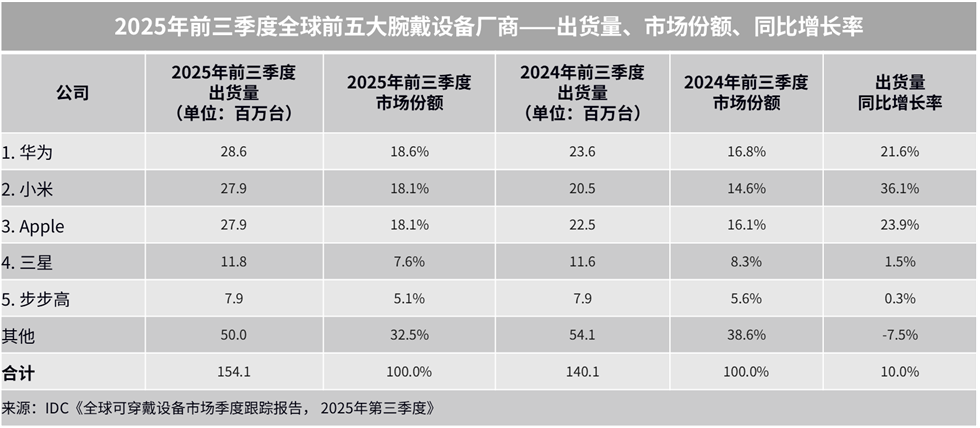

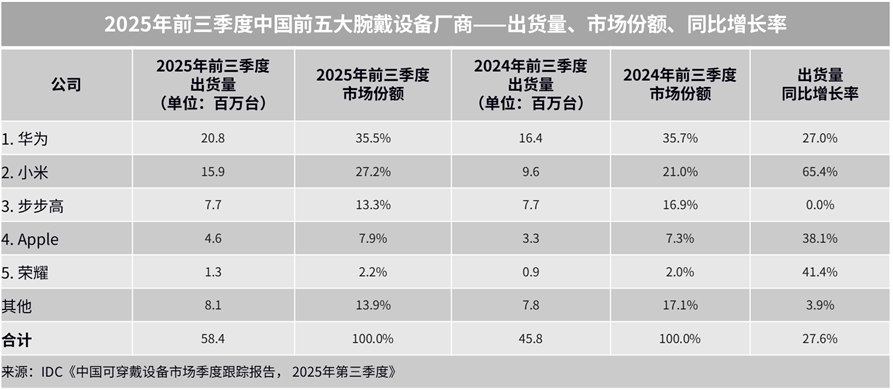

The Zhitong Finance App learned that according to the “Global Wearable Device Market Quarterly Tracking Report” recently released by the International Data Corporation (IDC), the global wrist device market shipped 150 million units in the first three quarters of 2025, an increase of 10.0% over the previous year. Among them, the cumulative shipment volume in the Chinese market was 58.43 million units, an increase of 27.6% over the previous year. Leading manufacturers intensively iterated on new products in the first three quarters, not only effectively driving the growth of the smartwatch market globally, but also in developed regions such as Europe and the US, creating a synergy between new product launches and promotional activities, helping the regional market recover and rebound.

The wristwatch market includes smartwatch and bracelet products. Among them, the smartwatch market shipped 120 million units globally in the first three quarters of 2025, up 7.3% year on year; while China's smartwatch market shipped 40.4 million units, up 21.8% year on year. Global shipments in the first three quarters of 2025 were 32.86 million units, up 21.3% year on year; China's bracelet market volume was 18.39 million units, up 42.5% year on year.

Global wrist wear market performance in the first three quarters of 2025

HUAWEI

In the first three quarters of 2025, the cumulative shipment volume of the Huawei wristband market ranked first in the world. Huawei's new global products in the third quarter of 2025 are centered around the Watch GT 6 series, with significant iterative upgrades. The new product is equipped with the Hongmeng 6.0 system and Kirin chip. The screen brightness and battery life have been greatly improved, and it is more professional and comprehensive in sports performance such as mood monitoring, riding simulation power and accurate positioning, and health monitoring functions such as HRV. The pace of its overseas market expansion is accelerating, further expanding local offline retail channels with new product launches and local partners, and seizing the market through localized preferential strategies such as interest-free instalments.

millet

In the first three quarters of 2025, Xiaomi performed well in the global wrist device market, making it the fastest growing brand among the top 5 global manufacturers this year with a huge shipment volume of 27.9 million units. The core driving force comes from the precise layout of the entry-level market, where the Xiaomi Mi Band 10 and Redmi Watch series stand out due to their cost-effective advantages. In terms of regional markets, China, Latin America and Southeast Asia are growing rapidly. On the channel side, Xiaomi has relied on mobile phone offline channels to further expand its market advantage through online and offline collaboration and ecological product bundling strategies.

Apple

In the third quarter of this year, Apple launched the Apple Watch S11, Apple Watch SE3, and Apple Watch Ultra 3 products, respectively, equipped with 5G cellular network functions to push the smartwatch market into the 5G era. Apple still has a leading position in the mid-to-high-end market based on iOS ecological stickiness and brand potential. At the same time, in the first three quarters of this year, Apple increased price discounts and trade-in strategies to stimulate sales in many regions around the world to cope with the current diversification of the market pattern and the fierce competition of falling prices.

Samsung

In the third quarter of 2025, Samsung launched three new smartwatch products: Galaxy Watch 8, Galaxy Watch 8 Classic, and Galaxy Watch Ultra (2025), covering different consumer needs and further improving the smartwatch product echelon. Samsung also successfully reversed the decline in shipments in the first half of the year with the release of three new products and promoted a year-on-year increase in cumulative wrist device shipments in the first three quarters of 2025.

backgammon

In the first three quarters of 2025, Backgammon ranked in the top five in the global wrist wear market. Its Little Genius brand has steadily ranked first in shipments in the Chinese children's watch market with rich product layout, steady channel construction, and brand social potential. Furthermore, by using the Southeast Asian and European children's watch markets as a springboard, BBK is gradually moving into overseas markets.

China's wrist wear market performance in the first three quarters of 2025

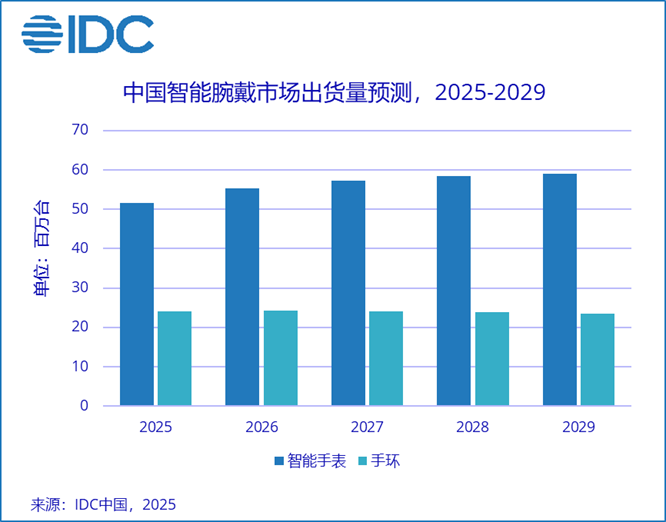

China's wrist wear market forecast for the next five years:

According to IDC data, the Chinese wristband market is expected to ship 79.58 million units in 2026, an increase of 5.1% over the previous year. Among them, adult smartwatches shipped 37.47 million units, up 8.2% year on year; children's watch market shipped 17.91 million units, up 5.4% year on year; bracelet market shipped 24.21 million units, up 0.4% year on year.

Increased public health awareness and the rise of healthy lifestyles will drive the continued growth of adult smartwatches. The diversification of supply-side new product layout and price promotion provides consumers with more choices. Meanwhile, the increase in the proportion of products in the 1,000 yuan range and below has further reduced users' switching costs. The shift in intergenerational attitudes has also significantly increased the acceptance of smartwatches among young people and the elderly.

The children's smartwatch market is expected to usher in restorative growth: the market is in the inventory digestion stage in 2025, and is expected to achieve a restorative recovery in 2026; at the same time, continuous product iteration by leading manufacturers will provide an important driving effect for market growth.

As an entry-level wristband product, the bracelet still has a large user base and a broad potential customer base, and the market is expected to continue growing in 2026. Its core growth engine stems from cost-effective advantages and accurate scenario adaptation. On the one hand, the lower price threshold meets the basic needs of the public; on the other hand, manufacturers continue to optimize core functions and appearance, taking into account practicality and fashion.

Pan Xuefei, director of research at IDC China, believes that the wristband market has entered a new stage of “value competition”. Leading manufacturers are focusing on finding the next value highlights in the market through full-price product layout and technology iteration, including health function upgrades, AI applications, and 5G and satellite communications. From the user perspective, the release of intergenerational demand and the penetration of the sinking market will also gradually open up the industry's long-term growth ceiling.