Top UK Dividend Stocks For December 2025

As the United Kingdom's FTSE 100 index faces challenges due to weak trade data from China, investors are keeping a close eye on dividend stocks as a potential source of steady income amidst market volatility. In such uncertain times, dividend-paying stocks can offer stability and regular returns, making them an attractive option for those looking to navigate the current economic landscape.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 4.00% | ★★★★★☆ |

| Seplat Energy (LSE:SEPL) | 7.69% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.39% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.79% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.14% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 8.23% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 3.73% | ★★★★★☆ |

| Halyk Bank of Kazakhstan (LSE:HSBK) | 5.80% | ★★★★★☆ |

| Begbies Traynor Group (AIM:BEG) | 3.96% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.62% | ★★★★★☆ |

Click here to see the full list of 49 stocks from our Top UK Dividend Stocks screener.

We'll examine a selection from our screener results.

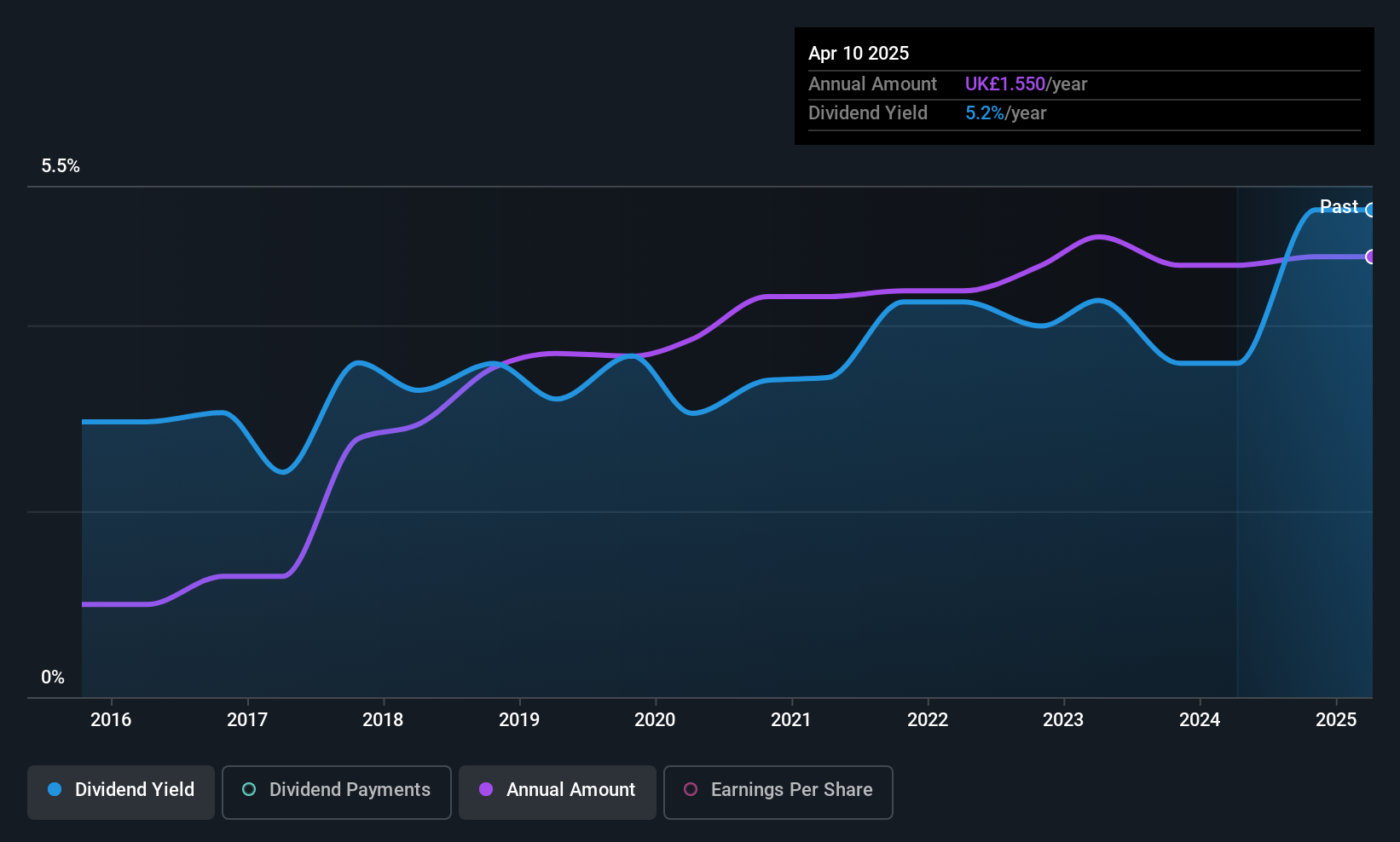

Bioventix (AIM:BVXP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bioventix PLC develops, produces, and distributes sheep monoclonal antibodies for global diagnostic use and has a market cap of £91.44 million.

Operations: Bioventix PLC generates revenue primarily from its biotechnology segment, which amounts to £13.12 million.

Dividend Yield: 8.6%

Bioventix PLC, while offering a high dividend yield of 8.57%, faces challenges with sustainability as its dividends are not well covered by earnings or free cash flows, reflected in a payout ratio of 103.3% and a cash payout ratio of 111.8%. Despite stable and growing dividends over the past decade, recent earnings reported a decline to £7.58 million from £8.1 million the previous year, indicating potential pressure on future payouts amidst ongoing revenue headwinds.

- Take a closer look at Bioventix's potential here in our dividend report.

- According our valuation report, there's an indication that Bioventix's share price might be on the cheaper side.

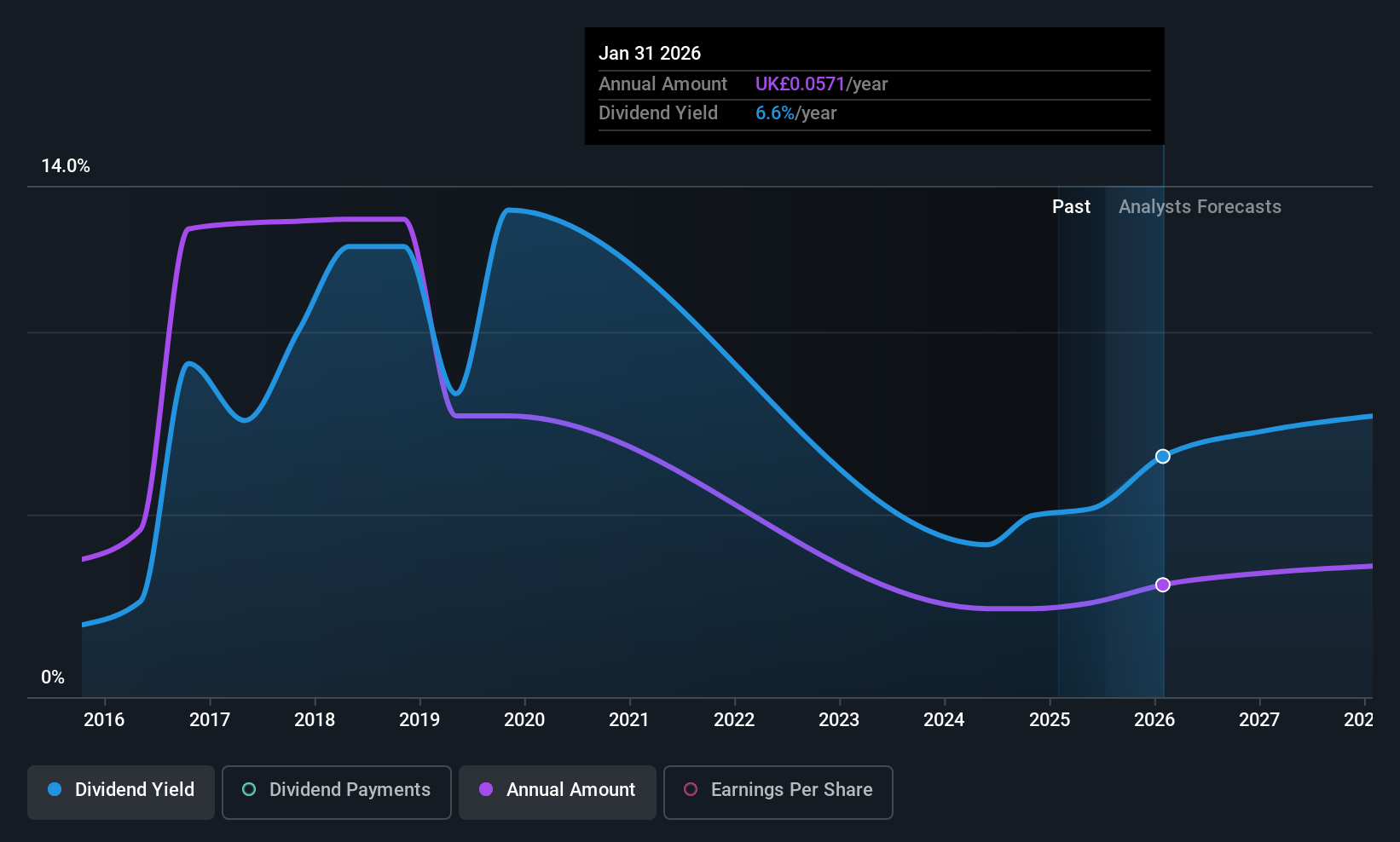

Card Factory (LSE:CARD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Card Factory plc is a specialist retailer offering cards, gifts, and celebration essentials in the UK, South Africa, Republic of Ireland, the US, and internationally with a market cap of £244.57 million.

Operations: Card Factory plc generates revenue through its Partnerships segment (£32.10 million) and Cardfactory Stores (£513.20 million).

Dividend Yield: 6.8%

Card Factory offers an attractive dividend yield of 6.85%, ranking in the top 25% of UK dividend payers, with dividends well covered by earnings and cash flows at payout ratios of 39.8% and 19.7% respectively. However, its dividend history is marked by volatility and unreliability over the past decade. Recent financials show a decline in net income to £5.6 million from £10.5 million year-over-year, despite increased sales to £247.6 million, alongside a proposed interim dividend increase of 4.9%.

- Click to explore a detailed breakdown of our findings in Card Factory's dividend report.

- The valuation report we've compiled suggests that Card Factory's current price could be quite moderate.

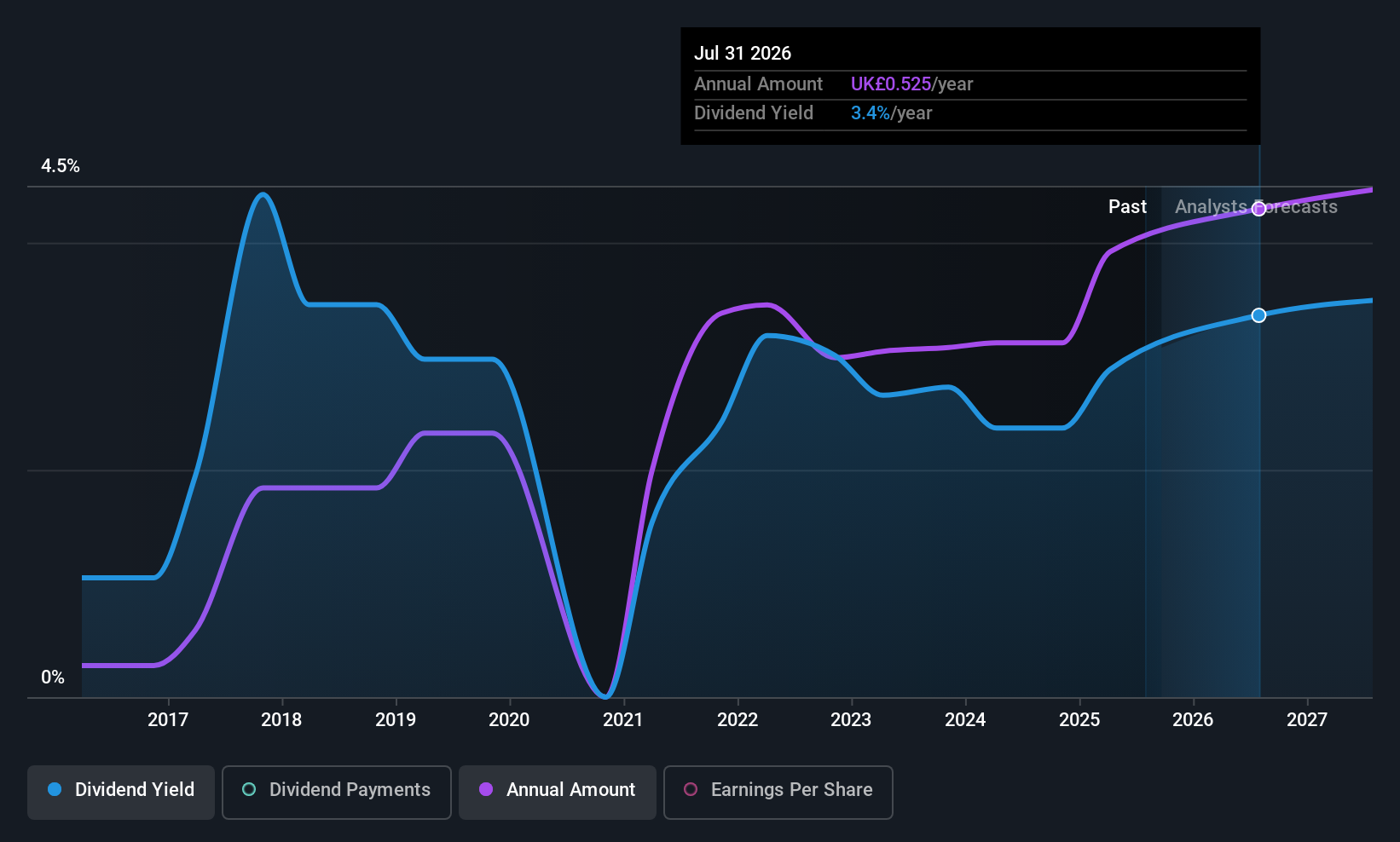

Softcat (LSE:SCT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Softcat plc is a UK-based value-added IT reseller and IT infrastructure solutions provider with a market cap of £2.86 billion.

Operations: Softcat plc generates its revenue primarily from its role as a value-added IT reseller and provider of IT infrastructure solutions, amounting to £1.46 billion.

Dividend Yield: 3.2%

Softcat's dividend history is marked by volatility, yet recent increases suggest improvement. The company's dividends are well covered by earnings and cash flows, with payout ratios of 44% and 72.1%, respectively. While its yield of 3.17% is below the UK market's top tier, Softcat has announced a final ordinary dividend increase to 20.4 pence per share and a special dividend of 16.1 pence per share for fiscal year-end July 2025, reflecting strategic growth efforts including acquisitions in AI services.

- Unlock comprehensive insights into our analysis of Softcat stock in this dividend report.

- Our valuation report unveils the possibility Softcat's shares may be trading at a discount.

Where To Now?

- Investigate our full lineup of 49 Top UK Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com