UK Penny Stocks To Watch: Ten Lifestyle Group Leads Our Top 3 Picks

The UK market has been experiencing some turbulence, with the FTSE 100 index recently closing lower due to weak trade data from China, highlighting ongoing global economic challenges. Despite these broader market fluctuations, there are still opportunities for investors willing to explore less conventional avenues. Penny stocks, often associated with smaller or newer companies, continue to offer potential growth at lower price points when backed by strong financials and fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.14 | £474.95M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.925 | £155.52M | ✅ 4 ⚠️ 2 View Analysis > |

| On the Beach Group (LSE:OTB) | £2.255 | £326.76M | ✅ 5 ⚠️ 1 View Analysis > |

| Ingenta (AIM:ING) | £0.79 | £11.93M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.6425 | $373.5M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.458 | £176.58M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.475 | £71.23M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.465 | £40.08M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.11 | £178.63M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 304 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Ten Lifestyle Group (AIM:TENG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ten Lifestyle Group Plc provides concierge services to private banks, premium financial services, and high-net-worth individuals across various regions including Asia, the Middle East, Africa, and the Americas, with a market cap of £68.71 million.

Operations: Ten Lifestyle Group Plc has not reported specific revenue segments.

Market Cap: £68.71M

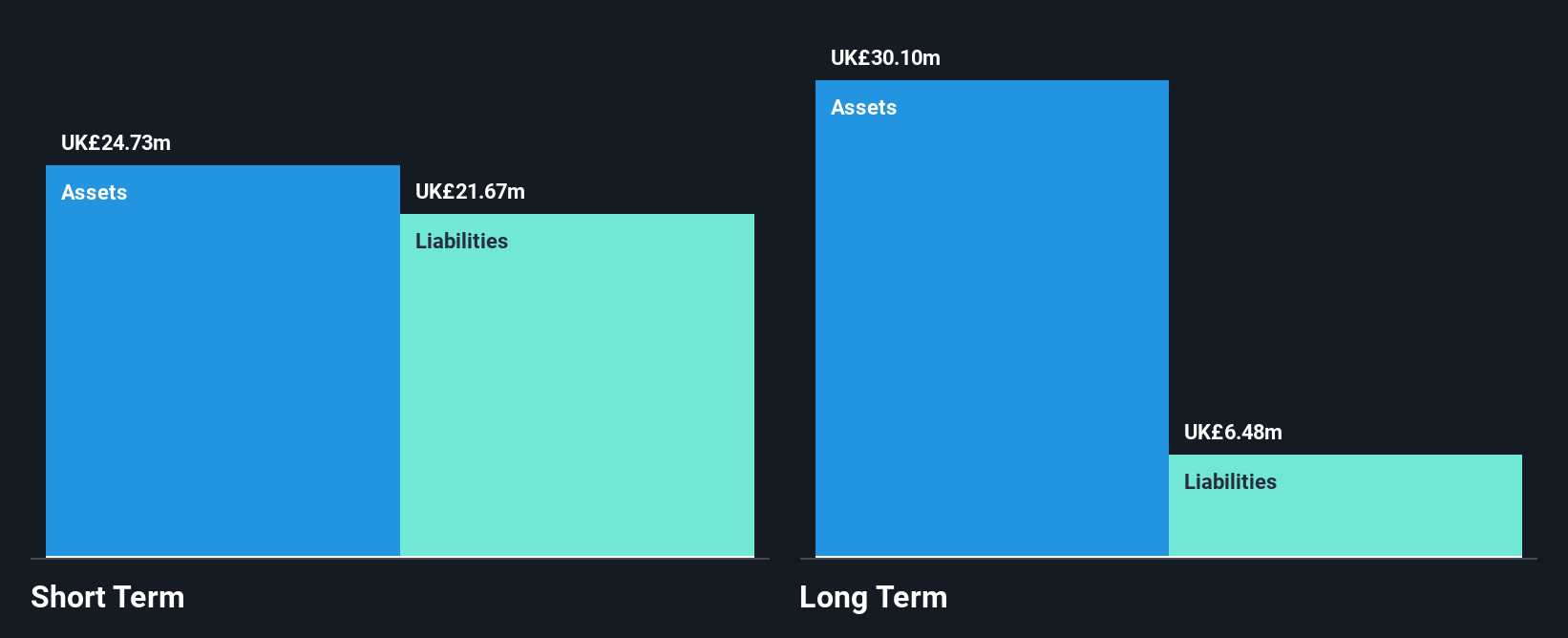

Ten Lifestyle Group Plc has demonstrated robust financial health with short-term and long-term assets exceeding liabilities, and its debt well covered by operating cash flow. The company has achieved significant earnings growth, with a 134.8% increase over the past year, surpassing industry averages. Its net profit margins have improved from 1.5% to 3.4%, and it trades at a substantial discount to estimated fair value. Despite low return on equity at 9%, the company maintains high-quality earnings and reduced debt levels over five years, indicating effective financial management in the penny stock landscape of the UK market.

- Navigate through the intricacies of Ten Lifestyle Group with our comprehensive balance sheet health report here.

- Examine Ten Lifestyle Group's earnings growth report to understand how analysts expect it to perform.

Intuitive Investments Group (LSE:IIG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Intuitive Investments Group Plc focuses on investing in early and later-stage ventures, with a market cap of £250.94 million.

Operations: Intuitive Investments Group Plc has not reported any revenue segments.

Market Cap: £250.94M

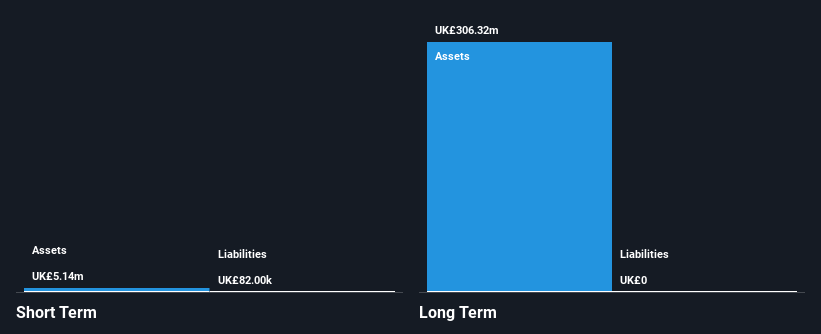

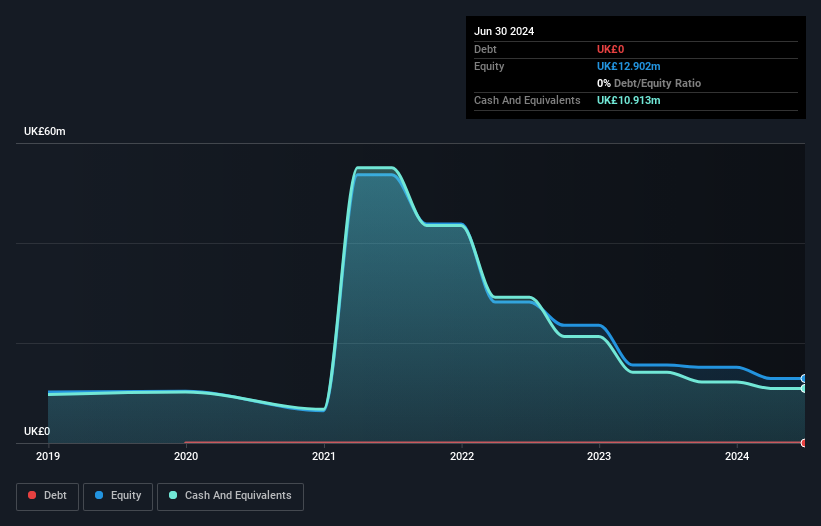

Intuitive Investments Group Plc, with a market cap of £250.94 million, remains pre-revenue as it reported negative revenue of GBP 3.34 million for the year ending September 30, 2025. The company is unprofitable with a net loss of GBP 4.28 million and has seen increasing losses over five years at an annual rate of 22.2%. Despite its financial challenges, IIG benefits from having no debt or long-term liabilities and stable weekly volatility at 4%. Its short-term assets significantly exceed liabilities, though its cash runway was limited to two months before raising additional capital recently.

- Dive into the specifics of Intuitive Investments Group here with our thorough balance sheet health report.

- Assess Intuitive Investments Group's previous results with our detailed historical performance reports.

PensionBee Group (LSE:PBEE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PensionBee Group plc offers online retirement saving services in the United Kingdom and the United States, with a market cap of £378.27 million.

Operations: The company's revenue of £36.69 million is generated from its Internet Information Providers segment.

Market Cap: £378.27M

PensionBee Group plc, with a market cap of £378.27 million, is unprofitable but has shown consistent improvement by reducing losses at 31.7% annually over the past five years. The company maintains a robust financial position with short-term assets (£38.3M) exceeding both short and long-term liabilities, and it benefits from being debt-free for five years. Recent initiatives include launching a 1% match program in the U.S., incentivizing consolidation of old retirement accounts, which aligns with its mission to simplify retirement savings management and could strengthen its market presence amid growing revenue expectations of £36.69 million annually.

- Unlock comprehensive insights into our analysis of PensionBee Group stock in this financial health report.

- Assess PensionBee Group's future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Jump into our full catalog of 304 UK Penny Stocks here.

- Curious About Other Options? This technology could replace computers: discover the 28 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com