Assessing Victory Capital (VCTR) After New UCITS Funds Expand Its Global Growth Platform

Victory Capital Holdings (VCTR) is quietly extending its global reach by adding three new UCITS funds through its partnership with Amundi, a move that deepens its international toolkit for institutional and retail clients.

See our latest analysis for Victory Capital Holdings.

That push into more global products comes as Victory Capital’s share price, now around $64.21, has been drifting slightly lower in recent months, even though the 1 year total shareholder return of 3.94 percent and especially the 3 year total shareholder return of 160.91 percent still point to strong longer term momentum and growing investor confidence in the company’s earnings power.

If this kind of expansion-focused story appeals to you, it could be a good moment to explore other opportunities via our screener for fast growing stocks with high insider ownership.

With revenue and earnings still growing double digits and the stock trading at a modest discount to analyst targets and intrinsic value estimates, is Victory Capital quietly undervalued here, or is the market already discounting its next leg of growth?

Most Popular Narrative Narrative: 12.8% Undervalued

With Victory Capital’s fair value set above its last close of $64.21 in the most followed narrative, the spotlight shifts to how aggressive those growth assumptions really are.

The strategic realization of substantial expense synergies from the recent acquisition (with $70 million already realized and an additional $40 million anticipated within the next 15 months) increases operational efficiency, which should positively impact net margins and cash flow as integration progresses.

Curious how expense cuts, rising margins, and accelerating earnings all line up into a single valuation story? The narrative connects these levers into one bold long term profit arc. Want to see exactly how those assumptions stack up to justify today’s upside?

Result: Fair Value of $73.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent net outflows and ongoing fee compression could quickly erode those margin gains and force investors to rethink Victory Capital’s longer term earnings power.

Find out about the key risks to this Victory Capital Holdings narrative.

Another Lens on Value

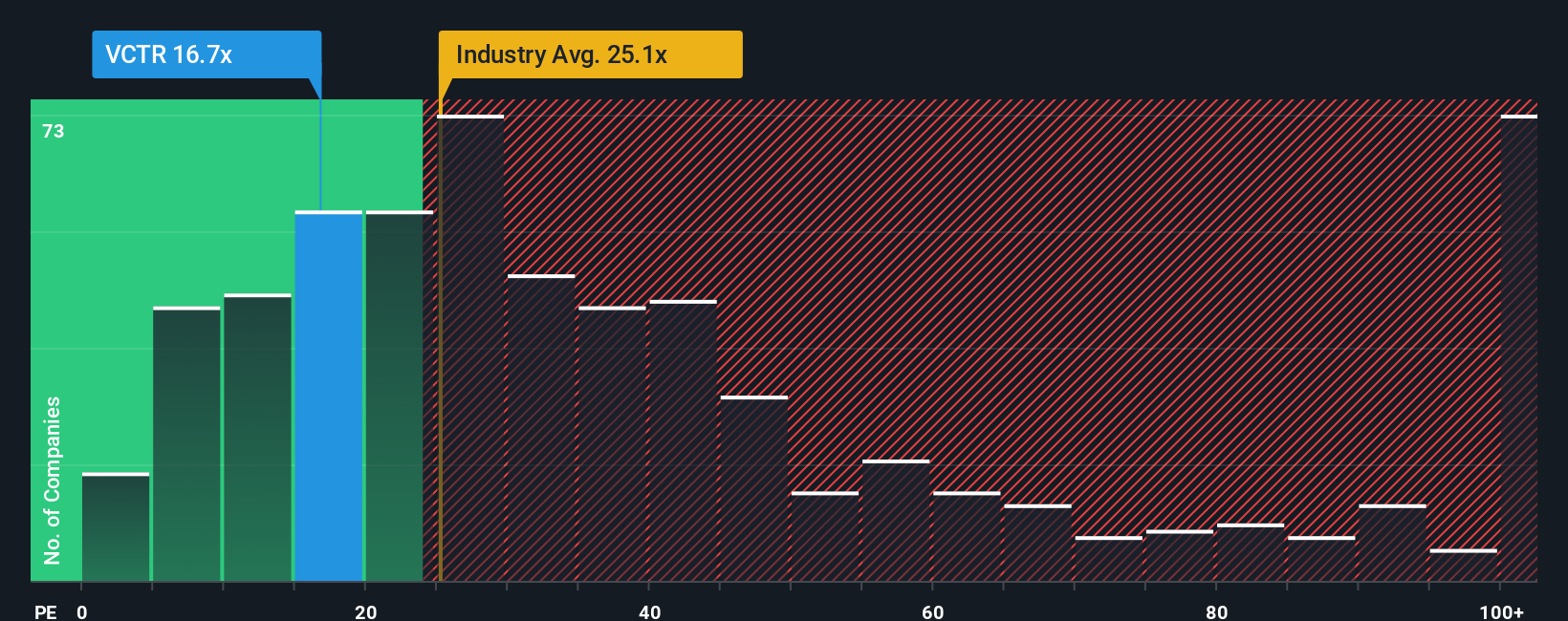

While the narrative points to upside, the current 16.1x price to earnings ratio looks rich against peers at 10.9x, even if it still sits below a 21x fair ratio and the wider industry at 25x. Is the premium a reward for growth, or a cushion that could compress?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Victory Capital Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Victory Capital Holdings.

Looking for more investment ideas?

If you stop here, you could miss out on tomorrow’s winners. Let the Simply Wall Street Screener surface fresh, high conviction opportunities tailored to your strategy.

- Capture potential multi baggers early by scanning these 3625 penny stocks with strong financials with strong balance sheets and room to scale.

- Consider automation and data trends by targeting these 30 healthcare AI stocks that are involved in diagnostics, treatment, and medical workflows.

- Explore income potential and stability by focusing on these 13 dividend stocks with yields > 3% that currently offer cash returns above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com