Does RemeGen’s Index Debut on Shanghai’s Health Care Benchmark Reframe the Bull Case For RemeGen (SEHK:9995)?

- In December 2025, RemeGen Co., Ltd was added to the Shanghai Stock Exchange Health Care Sector Index, marking its inclusion among China’s listed healthcare names tracked by this benchmark.

- This index inclusion can increase RemeGen’s visibility to institutional investors that track or reference sector indices, potentially influencing how the company is positioned in healthcare-focused portfolios.

- With this new index inclusion as a backdrop, we’ll examine how RemeGen’s expanding profile within China’s healthcare sector shapes its investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is RemeGen's Investment Narrative?

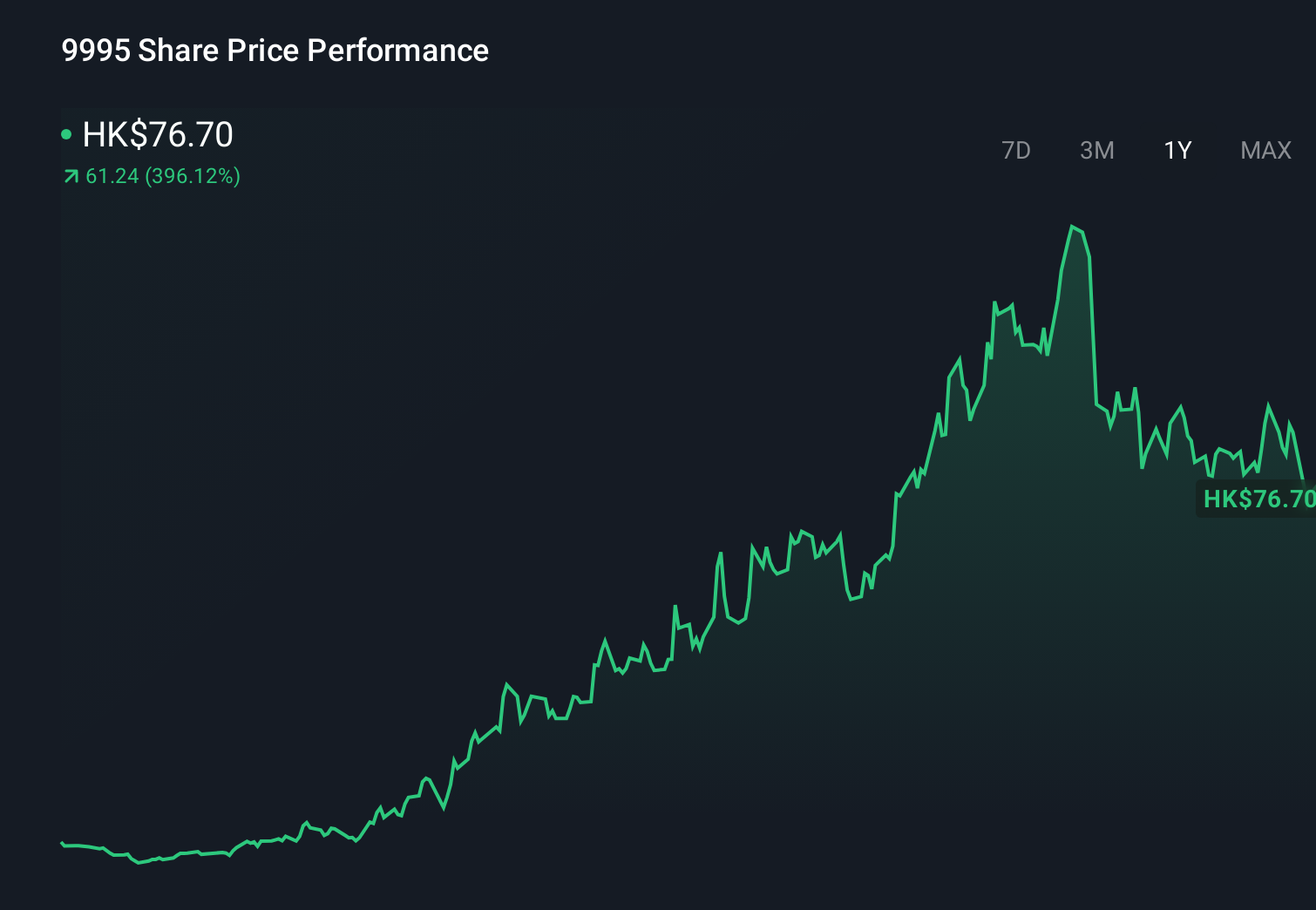

To own RemeGen, you need to believe its expanding drug portfolio and global partnerships can eventually turn fast-growing revenue of C¥2,227.82 million into sustainable profits, despite sizeable losses of C¥947.63 million and a volatile share price after a very large year-to-date rise. The key near term catalysts still sit with execution on its licensed Telitacicept deal, progress on Disitamab Vedotin and new filings such as the RC48-C016 BLA. The Shanghai Stock Exchange Health Care Sector Index inclusion mainly adds visibility and potential liquidity rather than changing the core business outlook, and recent price moves suggest the market has not treated it as a game changer so far. The biggest risks remain execution, funding and clinical or regulatory setbacks, even with this higher profile.

However, one key funding risk may matter more than the index headline for shareholders. RemeGen's shares have been on the rise but are still potentially undervalued by 30%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on RemeGen - why the stock might be worth as much as 43% more than the current price!

Build Your Own RemeGen Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RemeGen research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free RemeGen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RemeGen's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com