What XPO (XPO)'s CEO-Chairman Power Shift Means For Shareholders

- XPO, Inc. announced that founder Brad Jacobs stepped down as Executive Chairman of the Board on December 31, 2025, moving into a Special Advisor role through June 30, 2026, while CEO Mario Harik assumed the additional position of Chairman.

- This consolidation of leadership under Harik, who has led XPO since 2022, signals an emphasis on continuity of strategy and long-term value creation as Jacobs shifts his focus to building products startup QXO and his private equity activities.

- Next, we’ll examine how Mario Harik’s expanded role as both CEO and Chairman may influence XPO’s investment narrative around technology-driven margin expansion.

We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

XPO Investment Narrative Recap

To own XPO, you generally need to believe that its technology driven LTL model can keep widening margins despite cyclical freight exposure and labor pressures. The Brad Jacobs transition looks more like a governance evolution than a change to that core thesis, with Mario Harik’s combined CEO and Chairman role reinforcing continuity around tech investment as the key short term catalyst and leaving demand cyclicality as the main risk.

Among recent updates, XPO’s Q3 2025 results showed flat year to date revenue and lower net income versus 2024, even as the company continued to invest in its network and buy back shares. Against that backdrop, the leadership consolidation around Harik directly intersects with the technology driven margin expansion story that many investors see as central to offsetting freight market volatility.

Yet, despite the leadership continuity, investors should still weigh how exposed XPO remains to cyclical freight demand and what that means for...

Read the full narrative on XPO (it's free!)

XPO's narrative projects $9.2 billion revenue and $661.0 million earnings by 2028. This requires 4.7% yearly revenue growth and about a $316 million earnings increase from $345.0 million today.

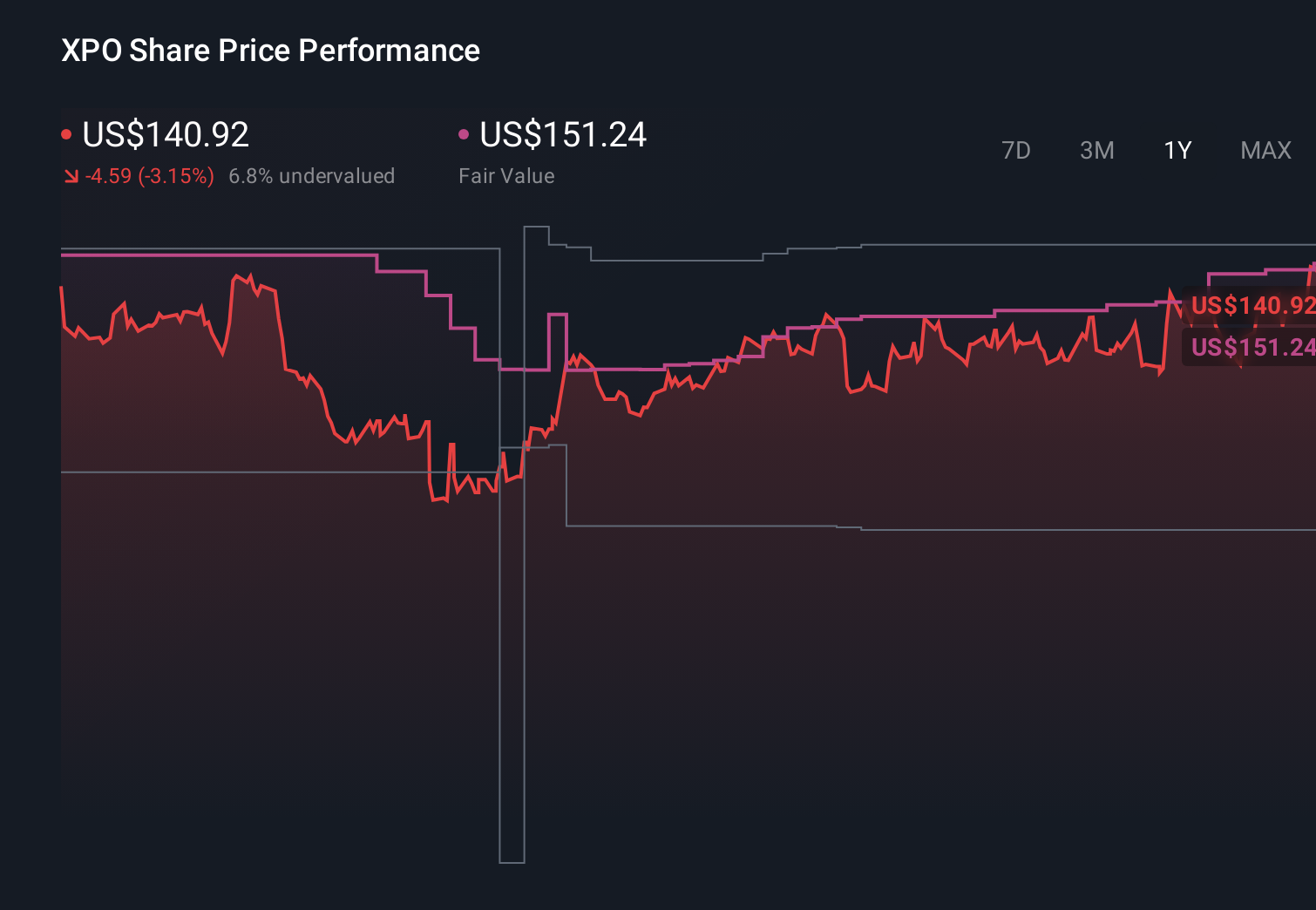

Uncover how XPO's forecasts yield a $151.24 fair value, in line with its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for XPO span roughly US$91.89 to US$158.87, showing how far apart individual views can be. When you set those against the freight demand risk that still hangs over XPO’s concentrated LTL business, it becomes even more important to compare several different valuation and risk frameworks before forming an opinion.

Explore 3 other fair value estimates on XPO - why the stock might be worth as much as 7% more than the current price!

Build Your Own XPO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your XPO research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free XPO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate XPO's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com