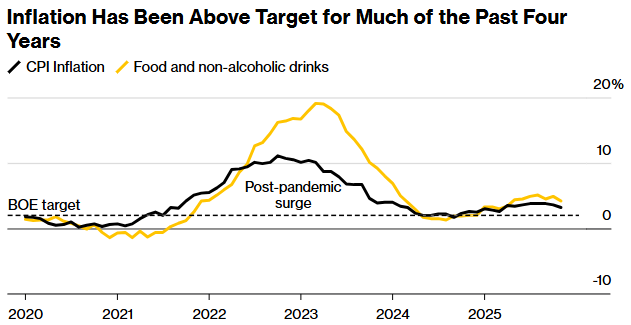

The “cooling” of Britain's CPI in November exceeded expectations, and the Bank of England cut interest rates on Thursday to welcome a “final assist”

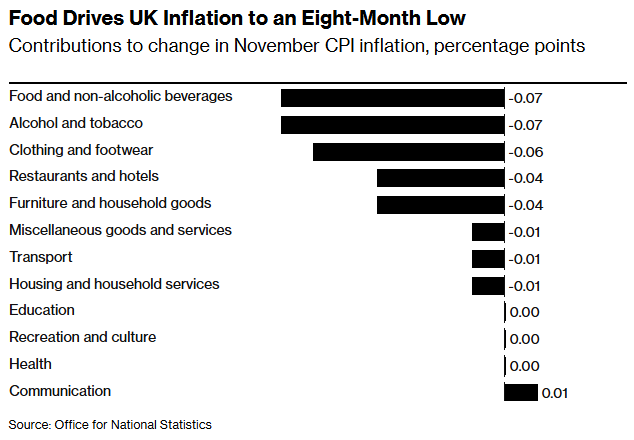

The Zhitong Finance App learned that the UK inflation rate fell to its lowest level in eight months, exceeding expectations. Traders think this is almost certain that the Bank of England will cut interest rates on Thursday. The UK Office for National Statistics said on Wednesday that the CPI rose 3.2% year on year in November, down from 3.6% last month. This was mainly due to falling prices of some foods such as cakes, cookies, and breakfast cereals. It was lower than the 3.5% expected by economists and the 3.4% forecast by the Bank of England.

Meanwhile, the core CPI rose 3.2% year over year in November, lower than the previous value and expectations of 3.4%. As an important indicator for measuring the state of the domestic economy, service prices rose by 4.4%, which is slightly better than the 4.5% increase previously anticipated by the Bank of England.

After the data was released, GBP/USD fell 0.7% to 1.3322. Investors are betting that borrowing costs will drop in the next few months. The market is now fully priced to cut interest rates twice before the end of April next year.

Paul Dales, the UK's chief economist at KITU Macro, said that inflation “has subsided far faster than anyone expected.” He added that this cooling “will definitely be enough to prompt the Bank of England governor to pull out his 'gift pack' tomorrow and give borrowers a Christmas present in advance — cutting interest rates.”

These data give the Bank of England an updated understanding of inflationary pressures before making a decision tomorrow. Bank of England Governor Andrew Bailey is expected to cast a decisive vote at this week's meeting, while the other members of the Monetary Policy Committee are currently evenly matched, with hawks and doves each holding four seats.

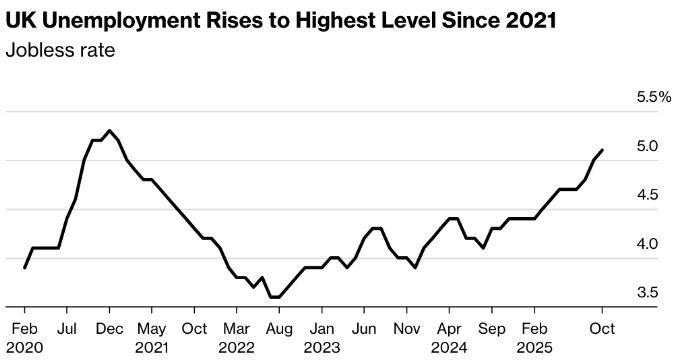

Although the Monetary Policy Committee did not take any action in September and November, signs of a downward trend in inflation and the economy have gradually become apparent since the last meeting. According to data released on Tuesday, the unemployment rate rose to 5.1% in the three months ending October, the highest level in nearly five years. Private sector wage growth fell below 4% for the first time since 2020.

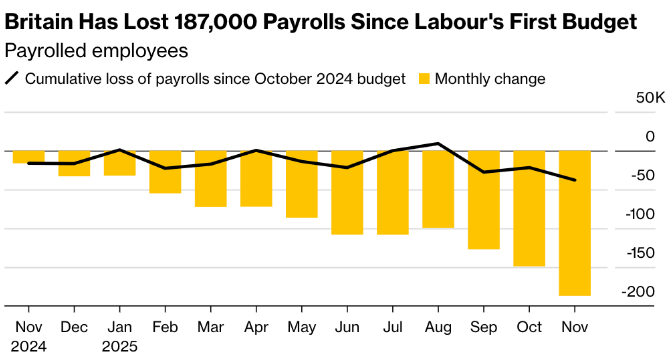

Furthermore, data already released on December 3 shows that on the eve of the Labour government's announcement of the fall budget, the growth of the British service sector slowed in November, the number of employed persons contracted the most since February, and new orders also fell for the first time in four months. In an interview, some companies said that uncertainty about the fall budget to be announced by British Chancellor of the Exchequer Reeves has prompted them to delay investment in new projects. The companies surveyed also said that low consumer and business confidence had an adverse impact on economic growth.

Tuesday's employment report also showed that since the Labor Party government's first budget bill, the number of registered employees has been reduced by more than 187,000; the youth unemployment rate has risen to 13.4%, the highest level in more than a year; and the number of unemployed people aged 18 to 24 was close to 550,000 in October, a record high since 2015.

Furthermore, data released on Friday showed that the UK economy contracted for the second month in a row in October. UK Chancellor of the Exchequer Rachel Reeves welcomed the decline in CPI on Wednesday. She has said that her budget — which includes freezing rail fares, cutting household energy bills, and cutting fuel taxes for drivers — is aimed at reducing voters' living costs. The Bank of England's preliminary analysis shows that these policies will reduce the annual inflation rate by as much as 0.5 percentage points next spring.

The analysis points out that inflation slowed sharply in November, and it is almost certain that the Bank of England will cut interest rates in December. Looking ahead, although the potential cost pressure will take longer to ease, the 2026 annual CPI is likely to fall rapidly.

According to another data from the UK Office for National Statistics, the price pressure on some pipelines has eased. In the year ending November, the cost of factory goods rose 3.4%, and previously hit a two-and-a-half-year high of 3.6% in October. This slowdown in growth was mainly affected by food prices. However, production input prices continued to rise, and fuel and raw material costs rose 1.1% year on year, the fastest growth rate in 12 months. The price of imported goods (which account for about a quarter of the UK's production input) has risen 1.3% over the past year. This increase partly reflects the depreciation of the pound, but so far, there is little evidence that US President Trump's tariff policy prompted goods to enter the UK at discounted prices.

Bailey sided with the hawks on the Monetary Policy Committee in November, saying he needed more evidence that price pressure was falling. And this time around, he is expected to turn side by side with the dovish on Thursday due to growing signs that the UK economy is struggling in the second half of the year.

Furthermore, data released on Wednesday showed that the upward pressure on prices has completely eased; only telecommunication commodity prices have risen. The food inflation rate fell from 4.8% to 4%, while the increase in tobacco and alcohol prices also fell from 5.9% to 4%. Clothing and footwear prices fell 0.6% year over year due to “Black Friday” retailers' sharp price reduction promotions.

Thomas Pugh, chief economist at RSM UK, said: “Inflation is likely to rebound slightly in December as tobacco taxes take effect, food prices are likely to rebound, and Black Friday promotions end. But in addition to predicting the possibility of interest rate cuts tomorrow, today's sharp drop in inflation also opens the door to cutting interest rates again early next year, especially as the labor market continues to weaken.”