Scandic Hotels (OM:SHOT) Enters Stuttgart: How the New German Hotel Expansion Shapes Its Valuation

Scandic Hotels Group (OM:SHOT) has just opened its first hotel in Stuttgart, the 174 room Scandic Stuttgart Europaviertel, marking a fresh step in its push to grow across key German cities.

See our latest analysis for Scandic Hotels Group.

The Stuttgart opening fits neatly into a strong year for Scandic, with the 1 year total shareholder return of 46.66 percent and robust revenue growth suggesting investors see its expansion strategy as adding durable momentum rather than extra risk.

If this kind of growth story interests you, it could be a good moment to see what else is out there and explore fast growing stocks with high insider ownership.

But with the shares up more than 360 percent year to date and trading just above the average analyst target, is Scandic still trading below its intrinsic value, or is the market already pricing in that future growth?

Most Popular Narrative: 6.1% Overvalued

Scandic Hotels Group last closed at SEK94.45, modestly above the most popular narrative fair value of SEK89.01, which rests on detailed long term forecasts.

In order for you to agree with the analyst's consensus, you would need to believe that by 2028, revenues will be SEK25.2 billion, earnings will come to SEK1.3 billion, and it would be trading on a PE ratio of 17.4x, assuming you use a discount rate of 10.0%.

Curious how steady mid single digit growth, rising margins, and a lower future earnings multiple can still argue for upside from here? The full narrative spells out the logic.

Result: Fair Value of $89.01 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer pricing in Finland and weaker booking trends amid geopolitical tension could easily derail the steady margin and earnings improvements that analysts are banking on.

Find out about the key risks to this Scandic Hotels Group narrative.

Another View: Earnings Multiple Sends a Different Signal

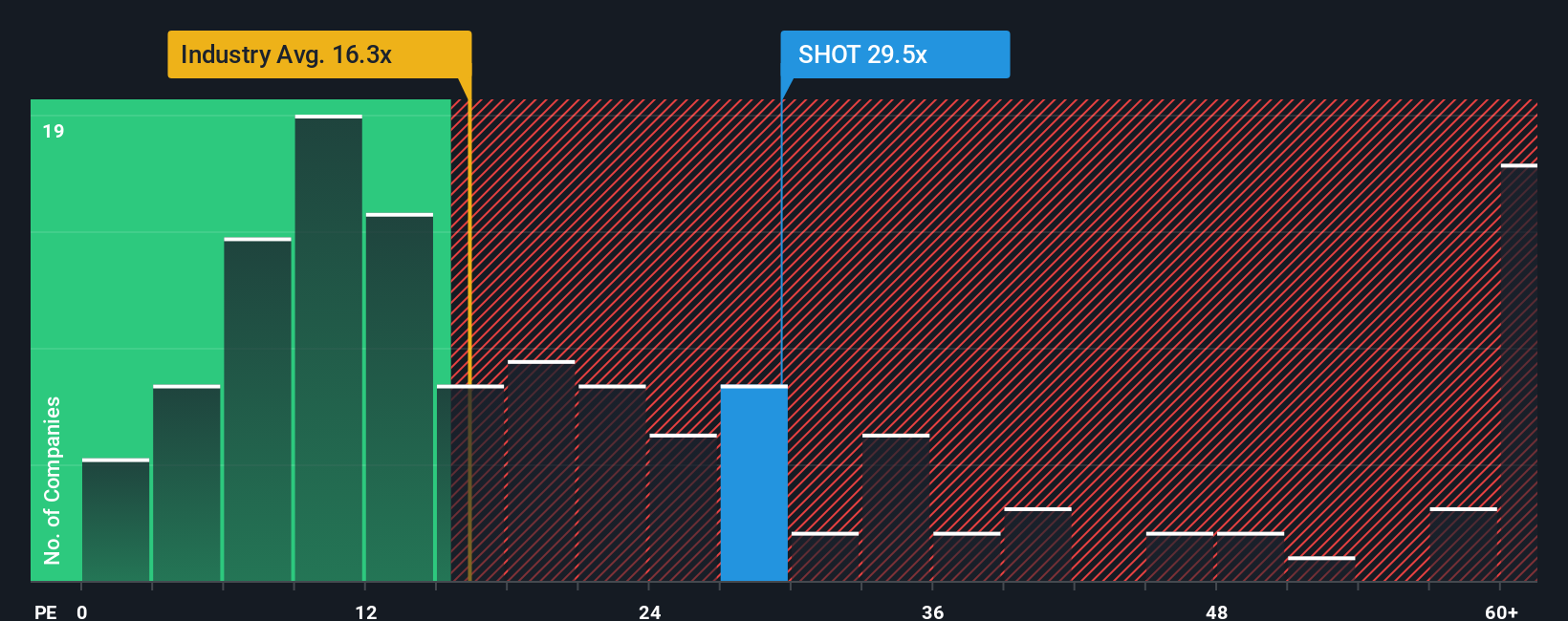

While the narrative based fair value points to modest overvaluation, Scandic's current price to earnings ratio of 29.2 times looks punchy versus European hospitality peers at 16.3 times, even if it lines up with a fair ratio of 29.7 times. That gap to peers suggests limited room for disappointment if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Scandic Hotels Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Scandic Hotels Group Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalized view on Scandic in minutes, Do it your way.

A great starting point for your Scandic Hotels Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, you may wish to consider using the Simply Wall St Screener to uncover fresh, data driven opportunities that many investors may not be focusing on.

- Seek overlooked value by targeting companies trading at attractive prices using these 915 undervalued stocks based on cash flows grounded in cash flow fundamentals.

- Explore structural shifts in medicine and diagnostics with these 30 healthcare AI stocks using artificial intelligence developments.

- Identify higher potential opportunities in emerging digital finance by tracking innovation and momentum through these 80 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com