Jibang Consulting: Vehicle electrification and intelligence are accelerating, and the automotive semiconductor market is estimated to reach nearly 100 billion US dollars in 2029

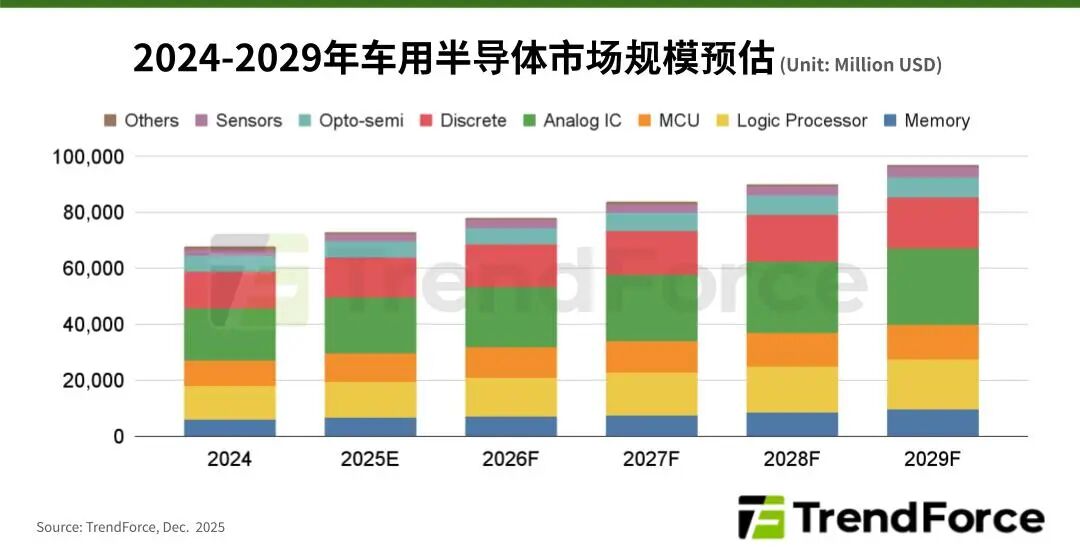

The Zhitong Finance App learned that according to the latest survey by TrendForce Jibang Consulting, as the automotive industry accelerates the electrification and intelligence process, it is expected to increase the global automotive semiconductor market steadily from around US$67.7 billion in 2024 to nearly US$96.9 billion in 2029, with a compound annual growth rate (CAGR) of 7.4% in 2024-2029.

However, the growth rate of various automotive chip markets is extremely uneven. High-performance computing (HPC) chips represented by logic processors and high-end memories have significantly surpassed traditional components such as microcontrollers (MCUs), reflecting the rapid concentration of market value in core technology fields that support intelligence and electrification.

TrendForce Jibang Consulting's research shows that the penetration rate of global electric vehicles (including BEVs, PHEVs, FCVs, and HEVs) in the new car market will rise to 29.5% in 2025, and the automotive industry will also accelerate the pace of intelligence. It depends on core elements such as multi-sensor configurations, high-speed communication, and AI model applications. The transition from decentralized to domain-centralized and centralized electronic architecture (E/E Architecture) is also the key. Multi-sensor configurations with huge amounts of data and AI models with a constantly increasing number of parameters have led to an exponential increase in the demand for computational power in vehicles.

Furthermore, various car manufacturers are integrating functional areas such as body control, remote processing, intelligent driving, and smart cockpit to varying degrees, and the chip industry plays an important role in the process. With chip manufacturers launching cockpit/ADAS integrated (cockpit/ADAS integrated) SoCs, the solution entered the first year of commercialization in 2025. Controller integration helps reduce controller usage, share electronic components, and simplify wiring harness layout, etc., and is expected to further promote the spread of intelligent automobiles. TrendForce Jibang Consulting estimates that the CAGR for automotive logic processors (Logic Processors) 2024-2029 will be 8.6%, higher than the industry average of 7.4%.

Vehicle chip competition heats up: new entrants challenge traditional manufacturers

In a situation where different semiconductor categories are growing at different rates, competition among chip companies is already heating up. Nvidia (Nvidia), which dominates the server sector, and Qualcomm (Qualcomm), a leader in mobile chips, are entering the field of automotive intelligence with high computing chips and a rich software and hardware ecosystem. Chinese businesses such as Horizon Robotics (Horizon) are also rapidly rising due to technological progress, localization policies, and demand for high intelligence. Although the traditional automotive chip industry is under pressure, its broad product portfolio, quality reliability, and close customer relationships are still the cornerstone of competition with many new entrants.

TrendForce Jibang Consulting observed that there are many types of automotive semiconductors, and the advantages and challenges of various manufacturers coexist. The key to grasping the growth trend is to establish strategic alliances with close cooperation between multiple parties and develop software and hardware integration capabilities. Pure hardware performance competition is no longer the only factor that determines victory or loss.