The issuance structure lays the groundwork: behind HASHKEY HLDGS (03887)'s net outflow of over HK$80 million on the first day

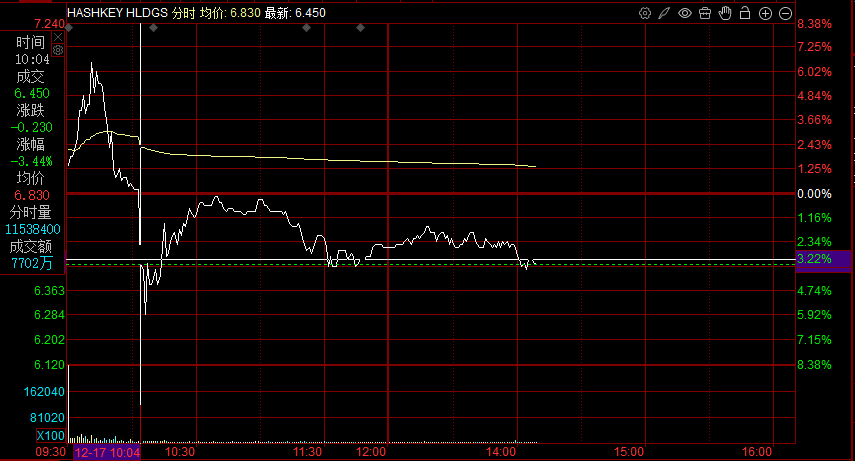

On December 17, HASHKEY HLDGS (03887) was listed on the main board of the Hong Kong Stock Exchange. Although the stock rose to about 6.6% in early trading, it immediately experienced significant selling pressure. The stock price quickly fell back and maintained a volatile downward trend throughout the day. As of press release, the stock price was reported at HK$6.46, down 3.3% from the issue price of HK$6.68, with a total market value of approximately HK$17.86 billion.

In contrast, in the recent Hong Kong stock IPO market, many IPOs showed outstanding performance on the first day of listing. If Xia Technology surged 117.91% on the first day, Baoji Pharmaceutical-B soared 138.82%; Tudatong, Zhuoyue Ruixin, etc. also performed well on the first day. On the first day of its listing, HASHKEY HLDGS presented a pattern of “opening high and moving low, capital outflow”, reflecting the market's cautious attitude towards its valuation and prospects in the current macro and industry environment.

Market context: From sentiment pulses to return to value

According to the Zhitong Finance App, HASHKEY HLDGS staged a classic “pricing game” for new stocks on the first day of listing on the main board of the Hong Kong Stock Exchange. It is a field of perception and behavior between institutions and retail investors under the impression that its stock price is high and low, and the net capital outflow exceeds HK$79.66 million.

The pulsating rise of about 6.6% in early trading can be seen as an inertial reaction to the listing event by pouring fresh capital and short-term speculative trading. However, the rapid collapse of the upward trend and the decline in volume marked a rapid transition of the market to a rational evaluation stage. The key point appeared at 10:04, and the stock price volume broke through the intraday moving average, and the turnover soared to HK$77.02 million. Such a concentrated volume of transactions appears in the process of decline, which is usually a clear signal of selling pressure. It shows that when stock prices fall, not only are sales active, but a certain amount of capital is being accepted. The differences between long and short are intense, but the bears temporarily dominate the direction.

The transaction price of HK$6.450 is significantly lower than the daily average price of HK$6.830 and a decrease of 3.44% from the issue price. This confirms that after the opening of the market, the stock price quickly fell below the average price line and entered a downward channel. Early trading was generally overrun with higher capital.

Simply put, this technical signal of “volume breaking” is extremely indicative. It is not only a reflection of the end of the profit market, but also means that the optimistic expectations that initially supported the stock price were falsified, and the bears gained dominance in the game, thus setting a weak tone for the whole day's trend.

Capital Dialysis: Institutional Departure and Structural Differentiation Undertaken by Retail Investors

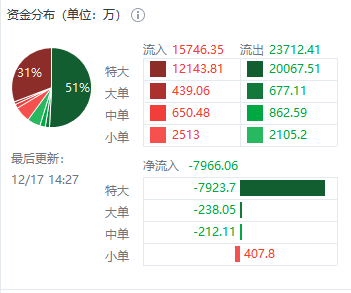

The net capital outflow of over HK$80 million per day is worth paying more attention to its structural characteristics than the total amount. As of 14:27, the capital flow structure of HASHKEY HLDGS has been further clarified, showing a typical pattern of fragmentation with significant outflows of institutional capital and retail capital against the trend.

Among them, there was a net outflow of HK$79.237 million from oversized orders, accounting for more than 99% of the total net outflow, indicating that institutions and large companies concentrated on reducing their holdings on the first day of listing. The net outflow of the large order was HK$2.385,500. The direction was the same as that of the oversized order, further confirming the cautious attitude of the main capital. The net outflow of Chinese orders was HK$2.1211 million, following the main trend. The net inflow of HK$4,078 million from small orders reflects the reverse layout of some retail investors during the stock price correction process and assumed the role of phased liquidity.

The structural differentiation of capital clearly indicates that “smart money” represented by institutional investors, cornerstone shareholders, and major professional investors chose a firm and concentrated reduction in holdings on the first day of listing. The logic behind this behavior may include believing that issuance pricing fully or excessively reflects recent expectations; risk aversion to the global regulatory uncertainty faced by the digital asset-related industry; or implementing a more conservative liquidity management strategy in the context of tight overall market conditions.

At the same time, small capital recorded a net inflow of about HK$4.08 million, forming a stark contrast. This reflects that some retail investors see the stock price pullback as an opportunity to “pull back”. This countertrend behavior of retail investors, although providing necessary liquidity and mitigating the decline in the short term, has also led to a shift in chips from institutions with firm funding and sensitive information to retail investors with scattered funding and stronger emotional drive. This change in the chip structure usually increases the subsequent volatility of stock prices.

Does the fragmentation in distribution popularity indicate future market pressure?

HASHKEY HLDGS issued a total of about 241 million shares, of which the Hong Kong public sale portion accounted for only 10% (approximately 24.0572 million shares). The issue price was set at HK$6.68 per share, and the final net capital raised was approximately HK$1,479 million. From the issuance structure to equity distribution, there is an intrinsic logical correlation between this series of arrangements and its performance of “opening high and low, leaving institutions” on the first day of listing.

Although the Hong Kong public sale was oversubscribed by about 394 times, compared to the recent subscription multiples of some popular IPOs, this figure reflects the relative rationality of retail investors' enthusiasm for new developments. What is more noteworthy is that the international sale section was only subscribed about 5.46 times, and the final distribution accounted for as much as 90%. This shows that international institutional investors have been cautious in the pricing stage, paving the way for the rapid outflow of institutional capital after listing to a certain extent.

The launch attracted well-known institutions including UBS Asset Management, Fidelity, and Dinghui Investment as cornerstone investors, and the lineup was impressive. Although this provides an endorsement for issuance, Cornerstone shares usually have a sales ban period and do not enter secondary market circulation for a short period of time. At the same time, the company's shares are highly concentrated — the largest shareholder held nearly 60% of the shares after listing, and the top 25 shareholders collectively held more than 95% of the shares. This is certainly beneficial to the stability of the corporate governance structure, but it also means that the proportion of shares that actually circulate freely in the secondary market is extremely low. A small circulation market may increase stock price fluctuations, and also make it easier for the entry and exit of large sums of money to have a significant impact on the market. This is consistent with the phenomenon of large orders dominating outflows on the first day.

In short, since most of the shares in circulation are locked in or highly concentrated, the sale of a small amount of institutional capital can easily put significant pressure on stock prices. This also explains why the net outflow on the first day may seem small, but it is enough to suppress the trend throughout the day. Furthermore, the issue price was finally set at the lower end of the range, and the subscription ratio for international sales was mediocre, which already suggests that approval from international institutions is limited. The trend on the first day of listing can be seen as a continuation and disclosure of this attitude.

Based on a comprehensive analysis of HASHKEY HLDGS's performance on the first day of listing, its stock price trend is essentially rational pricing instead of emotional catalysis, and capital flow revealed significant differences in risk appetite and investment logic between different capital metals. This kind of “institutional sale, retail sale” chip transfer may increase the subsequent volatility of stock prices. Furthermore, the issuance structure and equity concentration have amplified the effects of market games. Whether the company can meet growth expectations and effectively manage industry policy risks in the future will be the key to reversing capital flows and rebuilding the valuation consensus.