Starbucks (SBUX) Valuation Check as Strikes, Legal Pressures and Niccol’s Transformation Strategy Converge

Starbucks (SBUX) is in the spotlight as its largest ever U.S. barista strike, fresh legal challenges, and an aggressive transformation push under CEO Brian Niccol collide. This confluence of events is giving investors plenty to reassess.

See our latest analysis for Starbucks.

Despite the strikes, lawsuits, and transformation drive, Starbucks’ 1 year total shareholder return of minus 5.2 percent and year to date share price return of minus 7.7 percent suggest momentum has been fading rather than breaking out. This is the case even with a modest recent bounce and a latest share price of 85.08 dollars.

If you are reassessing Starbucks after these headlines, it may also be worth scanning fast growing stocks with high insider ownership as a way to spot other compelling stories taking shape in the market.

Between labor unrest, legal overhangs, and a sweeping revamp under Brian Niccol, Starbucks now trades below analyst targets even as earnings grow faster than sales. Is this a mispriced turnaround, or is future growth already baked in?

Most Popular Narrative: 9.7% Undervalued

With the narrative fair value sitting modestly above the last close, the story turns on whether Starbucks can truly convert strategy into sustained earnings power.

The international growth strategy and focus on local execution in key markets, such as China, are expected to mitigate risk and drive future growth, positively impacting Starbucks’ global revenue and earnings. The rollout of the Green Apron service model, focusing on labor rather than equipment, is expected to improve throughput and reduce service times, leading to increased transaction growth, potentially impacting revenue and margins.

Curious how a traffic focused service overhaul and a bolder global push can still justify a premium future earnings multiple? The narrative’s math might surprise you.

Result: Fair Value of $94.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slipping comparable sales and a sharp margin squeeze from higher labor costs could still derail the recovery story that investors are leaning into.

Find out about the key risks to this Starbucks narrative.

Another Lens on Value

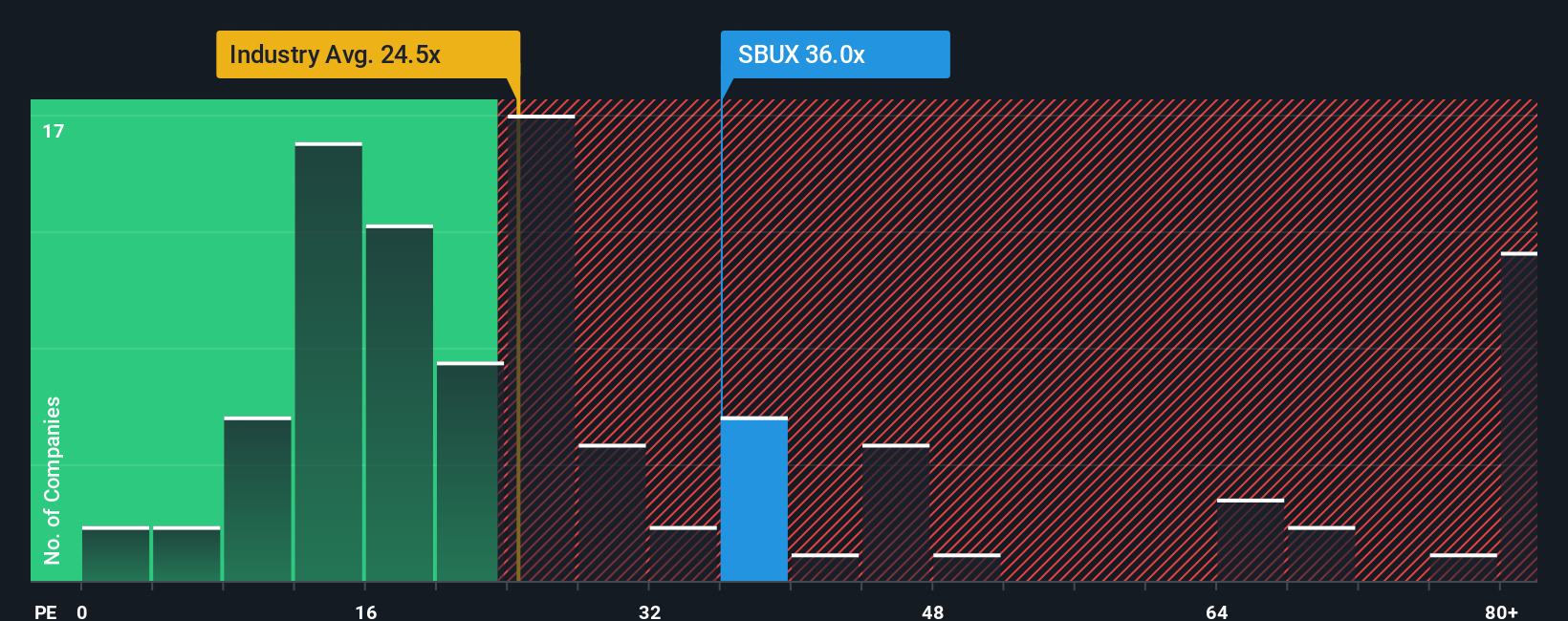

While the narrative points to a fair value near 94 dollars, the earnings multiple tells a tougher story. At roughly 52 times earnings versus a fair ratio near 36.8 times and an industry average around 24.1 times, Starbucks looks richly priced, leaving little room for execution missteps.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Starbucks Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Starbucks research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If Starbucks is just one piece of your strategy, make your next move count by handpicking high potential opportunities now, before the market fully recognizes them.

- Capture potential mispricings by scanning these 915 undervalued stocks based on cash flows that may offer different characteristics than mature blue chips like Starbucks.

- Explore the next technology wave by reviewing these 25 AI penny stocks that are involved in evolving areas of the market.

- Strengthen your income stream by reviewing these 13 dividend stocks with yields > 3% that can support long term return objectives regardless of short term market noise.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com