KKR (KKR) Valuation Check as Short-Term Momentum Cools but Long-Term Returns Stay Strong

KKR (KKR) has been drifting lower over the past week, but the bigger story is how the stock has swung from a strong past month to a weaker past 3 months and year.

See our latest analysis for KKR.

That mix of a recent 11.22% 1 month share price return and a weaker year to date share price return of 10.60 percent suggests momentum has cooled for now. Even so, the 3 year total shareholder return of 195.25 percent still points to a powerful longer term story.

If KKR’s shifting momentum has you rethinking where to find durable returns, it could be worth scanning fast growing stocks with high insider ownership as a fresh source of ideas.

With earnings still growing, revenue dipping and the shares trading below analyst targets, investors now face a key question: Is KKR quietly undervalued after its pullback, or is the market already pricing in the next leg of growth?

Most Popular Narrative: 15.5% Undervalued

With KKR last closing at $133.38 against a narrative fair value near $158, the valuation case appears constructive and rests on some aggressive long term assumptions.

Expansion of credit and asset based finance platforms, with KKR now a leader in a $6 trillion+ market poised for further growth, provides a broader and more durable base of fee related earnings while also increasing the potential for performance fees as these businesses scale. This diversification reduces earnings volatility and supports long term earnings growth.

Want to see what kind of revenue decline can still support outsized earnings growth and a premium multiple, all discounted at a single hurdle rate? The full narrative explains how margin expansion, scaling fees and future valuation expectations together are used to support that higher fair value estimate.

Result: Fair Value of $157.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained fundraising challenges or weaker performance fees from alternative assets could quickly erode the optimistic earnings and valuation assumptions that underpin this narrative.

Find out about the key risks to this KKR narrative.

Another View: Rich Multiples, Different Story

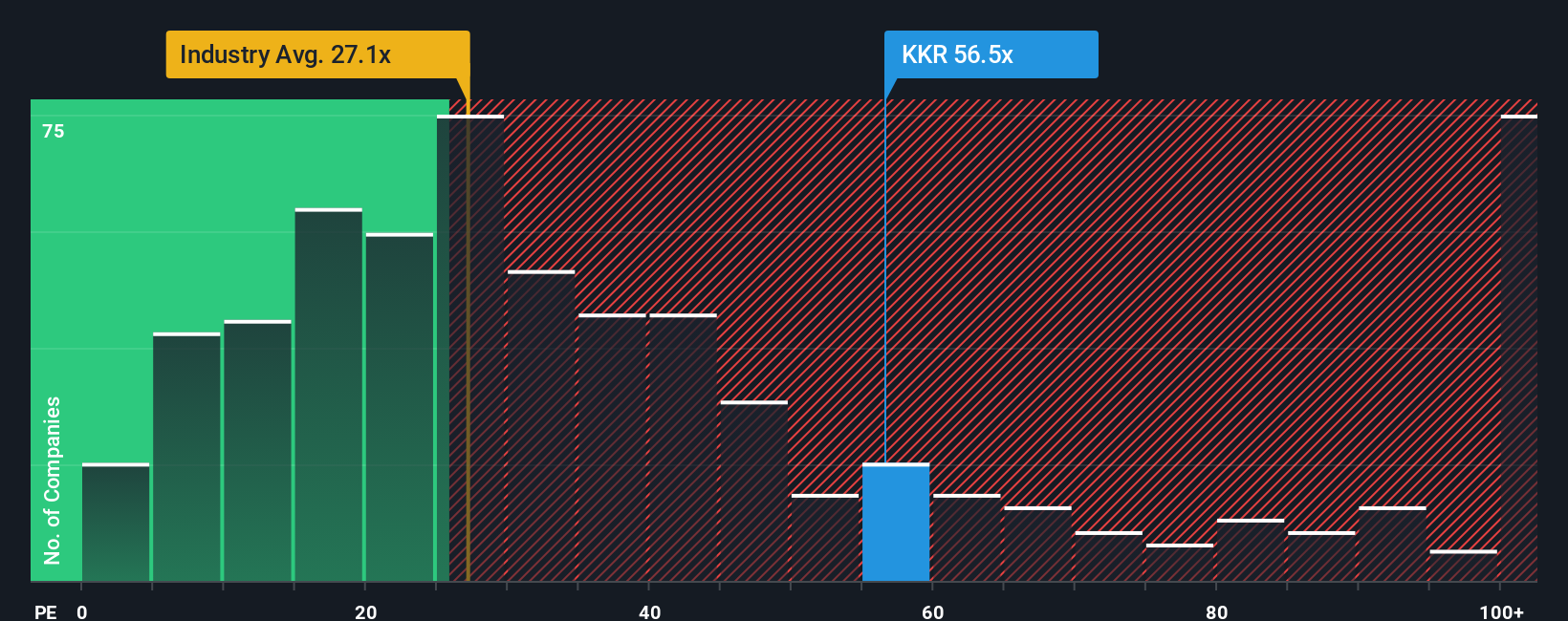

On simple valuation metrics, KKR looks far less forgiving. Its P/E of 52.3x is much higher than both peers at 37.1x and the US Capital Markets average of 25.5x, and even above a fair ratio of 26.9x. This raises the risk that future disappointment could hit the share price hard.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own KKR Narrative

If you see things differently or want to dig into the numbers yourself, you can craft a custom KKR storyline in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding KKR.

Ready for your next investing move?

Before you settle on KKR alone, use the Simply Wall St Screener to hunt for fresh, data backed ideas that other investors might be missing.

- Capture potential market mispricings by targeting companies trading below intrinsic value using these 915 undervalued stocks based on cash flows grounded in discounted cash flow fundamentals.

- Ride structural growth themes by focusing on innovation leaders through these 25 AI penny stocks that could reshape entire industries with intelligent automation.

- Strengthen your income stream by filtering for reliable cash generators via these 13 dividend stocks with yields > 3% offering yields above 3 percent with sustainable payout ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com