Technology One (ASX:TNE): Valuation Check After R&D Spend, Margin Gains and UK/Education Expansion

Recent coverage around Technology One (ASX:TNE) has focused on its substantial research and development spending, improving margins, and rising dividends, while the company also expands further into large addressable markets such as the UK and the education sector.

See our latest analysis for Technology One.

Despite that upbeat operational story, the 1 month share price return of minus 22.7 percent and 3 month share price return of minus 27.2 percent show momentum has cooled. However, the 5 year total shareholder return of about 247 percent still points to a strong long term compounding story.

If Technology One has you thinking about where the next long term winners might come from, it is worth exploring high growth tech and AI stocks for other scalable software and AI driven businesses.

With profits rising faster than revenue and the share price now sitting well below analyst targets, the key question is whether Technology One is temporarily on sale or whether the market is simply pricing in all that future growth.

Most Popular Narrative Narrative: 21.7% Undervalued

Compared with the last close at A$27.31, the most followed narrative points to a higher fair value, framing Technology One as materially mispriced today.

The analysts have a consensus price target of A$36.276 for Technology One based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$45.7, and the most bearish reporting a price target of just A$18.0.

Want to see what kind of revenue runway, margin lift, and future earnings multiple are being baked into that optimistic fair value? The full narrative explains the growth, profitability, and valuation factors that underpin this upside view, step by step, so you can judge whether those expectations are reasonable.

Result: Fair Value of $34.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained ARR growth, rapid SaaS plus adoption, and strong cash generation could support margins and earnings, softening any valuation reset and challenging this undervalued view.

Find out about the key risks to this Technology One narrative.

Another Angle On Value

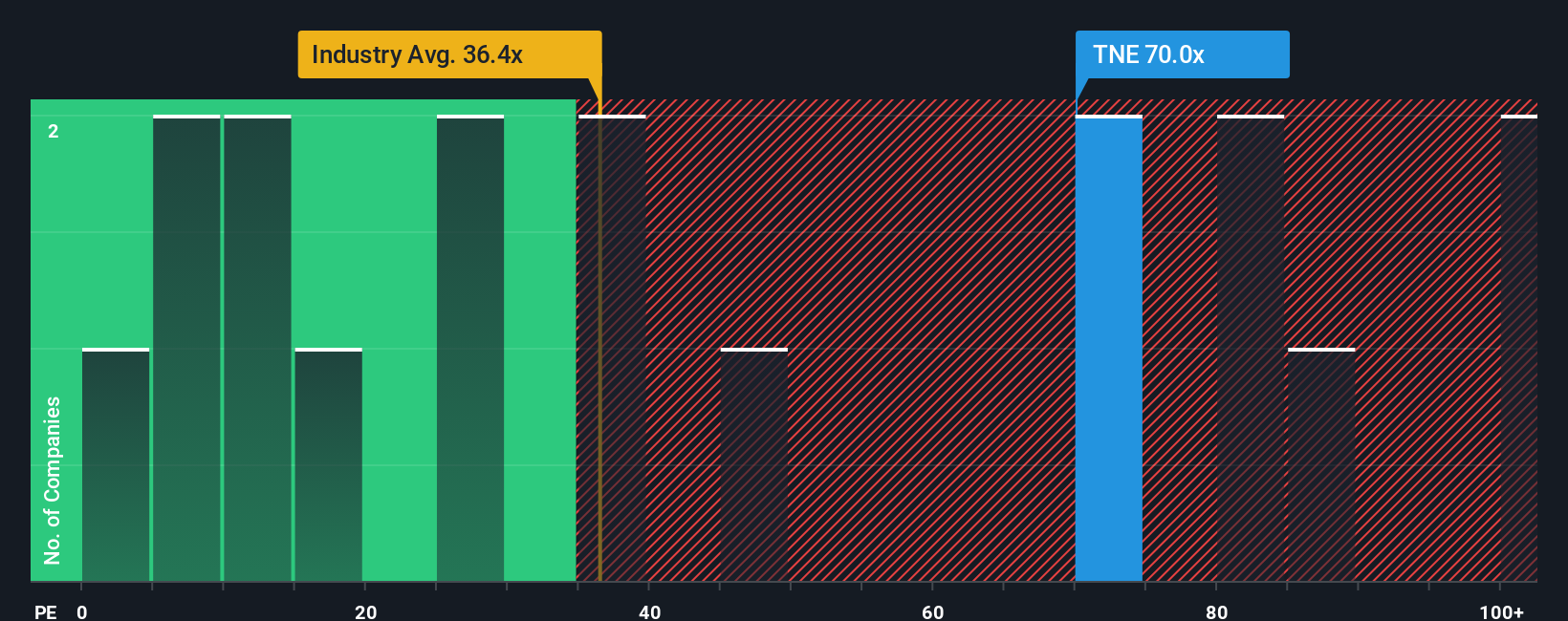

While the narrative implies Technology One is 21.7 percent undervalued, our earnings based comparison paints a different picture. The current P E of 64.8 times towers over the global software average of 26.9 times and a fair ratio of 39 times, suggesting limited margin for disappointment if growth wobbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Technology One Narrative

If you see things differently or want to dig into the numbers yourself, you can shape a custom narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Technology One.

Looking for more investment ideas?

Before you move on, you may wish to explore your next opportunities using the Simply Wall St Screener so potential long term candidates do not slip past unnoticed.

- Target potential mispricings by reviewing these 915 undervalued stocks based on cash flows that pair strong cash flows with compelling valuations and clearer upside.

- Explore the next wave of innovation by scanning these 25 AI penny stocks built around AI engines and scalable digital platforms.

- Grow your income stream by assessing these 13 dividend stocks with yields > 3% that combine yields with fundamentals and staying power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com