Assessing Diversified Healthcare Trust (DHC)’s Valuation as Its 2025 Portfolio and Balance Sheet Plan Takes Shape

Diversified Healthcare Trust (DHC) just laid out a 2025 game plan centered on selling non core properties, targeting $625 million to $635 million in proceeds to chip away at debt and recycle capital.

See our latest analysis for Diversified Healthcare Trust.

That renewed focus on pruning non core assets comes after a big recovery in sentiment, with the share price now at $4.82 and a year to date share price return of 112.33%, while the three year total shareholder return of 692.17% shows how dramatically expectations have shifted.

If DHC’s repositioning has you reassessing the space, it could be worth scanning other listed healthcare landlords through Simply Wall St’s healthcare stocks to see what else fits your strategy.

With the stock already doubling this year and trading only modestly below analysts’ targets despite ongoing losses, investors now face a tougher call: is Diversified Healthcare Trust still mispriced, or is the market accurately baking in its recovery?

Most Popular Narrative Narrative: 8.2% Undervalued

With the narrative fair value sitting at $5.25 against DHC’s $4.82 last close, the story hinges on how capital and margins evolve from here.

Active portfolio repositioning, executing non-core asset sales and focusing on higher growth senior housing and medical office/life science properties, enables the company to concentrate capital on assets with sector tailwinds (strong demand for outpatient care settings) and embedded rent growth, supporting long-term revenue and FFO growth.

Curious how modest top line growth, a major margin reset and a low future earnings multiple can still justify upside from here? The full narrative walks through the exact revenue, profitability and valuation bridge that underpins that $5.25 figure.

Result: Fair Value of $5.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on execution, with high leverage and reliance on ongoing asset sales both leaving the story vulnerable to tighter credit or weaker demand.

Find out about the key risks to this Diversified Healthcare Trust narrative.

Another Angle on Value

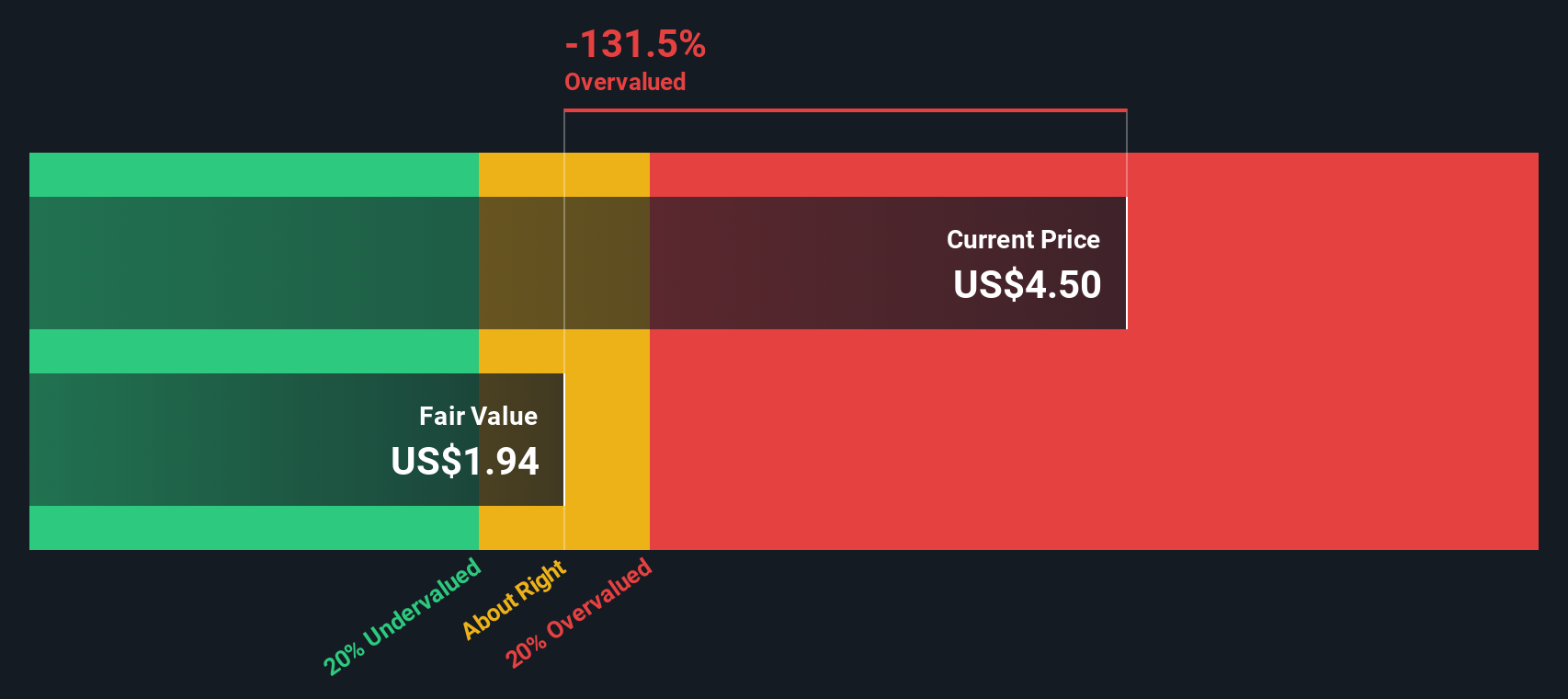

While the narrative fair value suggests upside, our SWS DCF model paints a harsher picture, putting fair value closer to $3.03, meaning DHC screens as overvalued on this lens. Are investors now paying up for the recovery story, or just front running fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Diversified Healthcare Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Diversified Healthcare Trust Narrative

If you see things differently or want to stress test the assumptions yourself, you can build a custom Diversified Healthcare Trust storyline in just minutes using Do it your way.

A great starting point for your Diversified Healthcare Trust research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential opportunity by running focused stock screens on Simply Wall St, so you never leave high conviction ideas on the table.

- Target reliable income streams by scanning these 13 dividend stocks with yields > 3% that combine attractive yields with the financial strength needed to keep those payouts coming.

- Position yourself for the next wave of innovation by zeroing in on these 25 AI penny stocks that stand to benefit most from accelerating adoption of artificial intelligence.

- Hunt for mispriced opportunities using these 915 undervalued stocks based on cash flows that the market may be overlooking based on their future cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com