Welltower (WELL): Reassessing Valuation After a Strong 3-Month and 1-Year Share Price Rally

Welltower (WELL) has quietly become one of the market’s stronger long term real estate performers, with shares up about 15% over the past 3 months and roughly 50% in the past year.

See our latest analysis for Welltower.

That surge in momentum is hard to miss, with a roughly 15% 90 day share price return and a near 50% one year total shareholder return, suggesting investors are steadily repricing Welltower’s growth and risk profile.

If Welltower’s run has you rethinking your real estate exposure, it could be worth scanning other income oriented opportunities across healthcare via healthcare stocks.

With shares already near record highs and trading just below analyst targets, the key question now is whether Welltower’s premium reflects durable growth, or if there is still room for upside that markets have not fully priced in.

Most Popular Narrative Narrative: 8.2% Undervalued

With Welltower last closing at $190.40 against a narrative fair value near $207.38, the framework behind that gap leans heavily on aggressive growth assumptions.

Significant acquisition activity, including the Amica Senior Living acquisition, is anticipated to provide value through acquisition at a discount and drive revenue growth. Their improved occupancy rates and strong pricing power in the Seniors Housing Operating portfolio are likely to drive revenue and margin expansion.

Curious how this story justifies such a rich future profit multiple for a REIT, and still calls the stock undervalued? The growth, margin, and valuation math behind that conclusion might surprise you. Dive in to see which long term earnings assumptions power this fair value call.

Result: Fair Value of $207.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising macro uncertainty and heavy acquisition spending could pressure occupancy gains, margins, and balance sheet flexibility, which would challenge today’s optimistic growth narrative.

Find out about the key risks to this Welltower narrative.

Another View: Rich Multiples Signal Little Room for Error

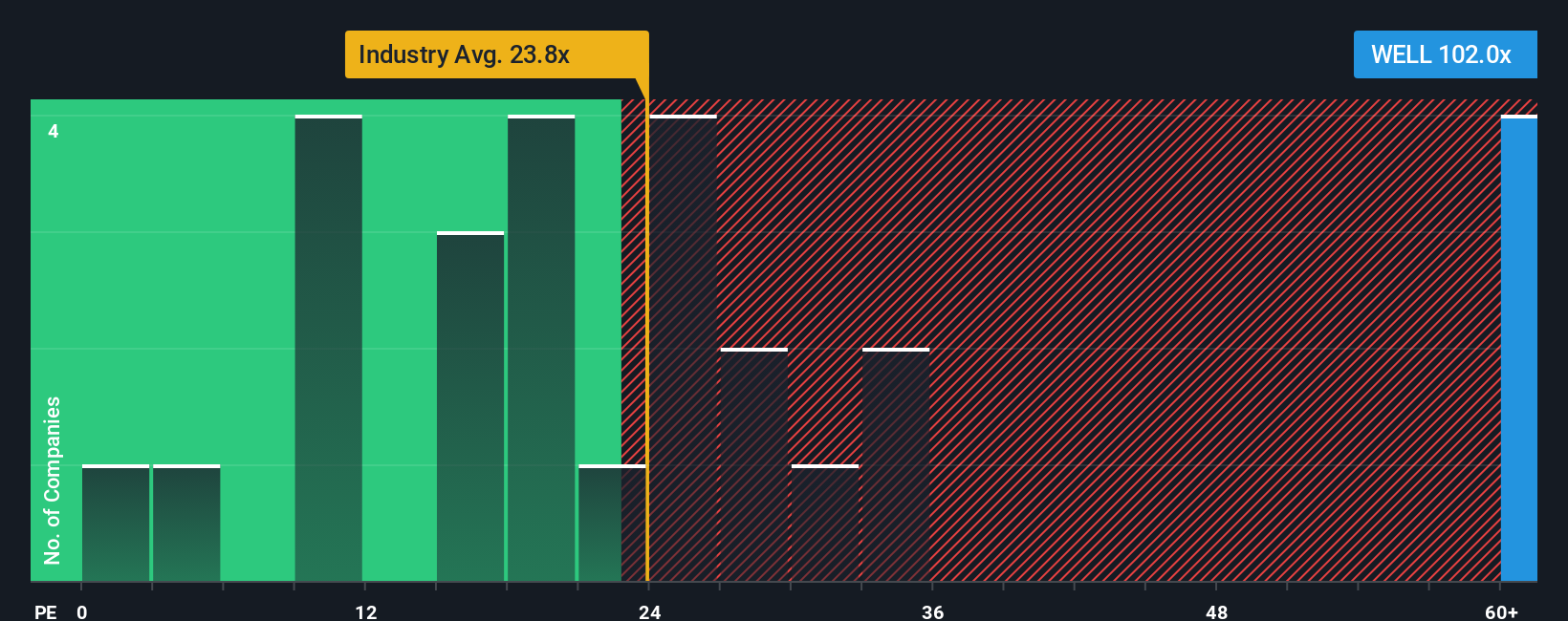

While the narrative fair value suggests upside, the market is already paying a steep price. Welltower trades on a P/E of about 136 times earnings versus 59 times for peers and a fair ratio of 37.5 times. This means expectations are stretched and any stumble could be punished quickly.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Welltower Narrative

If you see the story differently or want to stress test the numbers yourself, you can assemble your own view in minutes: Do it your way.

A great starting point for your Welltower research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider running a focused screen to help identify your next potential opportunity, or you may risk missing the kind of moves that reshaped Welltower’s story.

- Explore potential upside early by scanning these 915 undervalued stocks based on cash flows, where market expectations may lag the underlying cash flow strength.

- Position your portfolio for structural growth by targeting these 25 AI penny stocks, which focus on automation, data intelligence, and digital transformation.

- Support your income strategy by reviewing these 13 dividend stocks with yields > 3%, which may contribute to long term compounding through cash distributions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com