Is Microsoft (MSFT) Still Fairly Valued After a Recent 7% Pullback in Its Share Price?

Microsoft (MSFT) has pulled back roughly 7% over the past month even as its earnings growth stays solid, which is exactly the kind of setup long term investors like to examine more closely.

See our latest analysis for Microsoft.

That recent 7% slide in the 30 day share price return comes after a strong year to date share price return of about 14%, while the three year total shareholder return has more than doubled. This suggests long term momentum is still intact even as near term enthusiasm cools.

If Microsoft’s move has you rethinking your tech exposure, this is a good time to explore other leading names through our curated set of high growth tech and AI stocks.

With revenue and profits still growing double digits, and the stock trading at a meaningful discount to analyst targets, investors now face a key question: Is Microsoft undervalued, or is the market already pricing in its future growth?

Most Popular Narrative: 13.4% Overvalued

According to PicaCoder, the narrative fair value of $420 sits below Microsoft’s last close of $476.39, setting up a tension between growth and price.

Microsoft is currently digging away the foundation that makes it different. It is trapped in a perfect storm, losing the AI tech war to Google, burning cash on infrastructure without guaranteed ROI, cannibalizing its own seat-based revenue, and antagonizing users with a buggy, bloatware-filled operating system.

Curious how steady double digit growth, rich margins, and a punchy future earnings multiple can still point to downside from here? Unpack the full narrative to see which long term assumptions pull Microsoft’s fair value below today’s price and why the growth runway may not offset them.

Result: Fair Value of $420 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid AI monetization, resilient Windows demand, or smoother OpenAI collaboration could sustain premium growth and challenge the bearish long term assumptions.

Find out about the key risks to this Microsoft narrative.

Another View: Market Metrics Point the Other Way

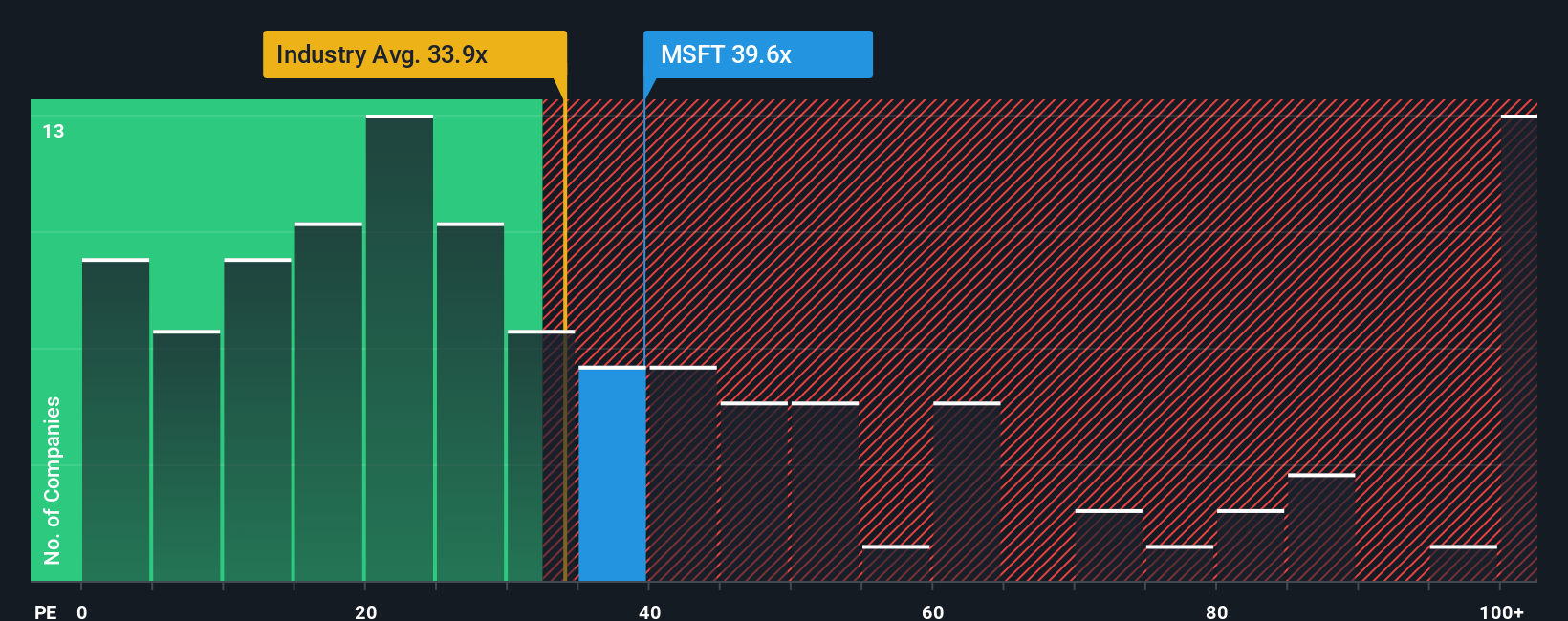

While the narrative fair value pegs Microsoft as 13.4% overvalued at $420, simple valuation checks paint a different picture. Our model suggests the shares trade about 21% below fair value, and the current P/E of 33.7 times screens cheap compared with a fair ratio of 52.6 times. Could sentiment be understating the earnings power behind those numbers?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Microsoft for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Microsoft Narrative

If you see things differently or want to dive into the numbers yourself, you can build a personalized Microsoft story in just minutes: Do it your way.

A great starting point for your Microsoft research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next investing move?

Step beyond Microsoft and look for your next opportunity with the Simply Wall St Screener, where data backed ideas can help you act decisively before the market catches on.

- Seek to stabilize your portfolio with reliable cash generators by targeting income focused opportunities through these 13 dividend stocks with yields > 3% that may help support returns in choppy markets.

- Position yourself at the front of technological disruption by searching for high potential innovators using these 25 AI penny stocks before their prospects are fully recognized.

- Explore your upside potential by focusing on quality companies trading below what their cash flows imply via these 915 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com