The Bull Case For Accenture (ACN) Could Change Following New Palantir AI Business Group Expansion

- In recent days, Accenture and Palantir, Anthropic, and Snowflake have each announced new business groups with Accenture to accelerate enterprise-scale AI and data solutions across multiple regulated and data-intensive industries.

- By embedding thousands of AI-skilled professionals and forward deployed engineers directly with clients, these alliances position Accenture at the center of complex, large-scale AI deployments that many enterprises may struggle to execute alone.

- We’ll now examine how Accenture’s new Palantir-focused AI business group could influence its existing investment narrative around Gen AI adoption.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Accenture Investment Narrative Recap

To own Accenture, you need to believe it can stay a go to partner for large scale digital and AI transformation, converting deep client relationships into steady revenue and dividend growth. Near term, the key catalyst is how upcoming earnings and bookings reflect demand for AI led projects, while the biggest risk remains margin pressure from higher delivery costs and pricing competition. The new Palantir alliance does not materially change these near term drivers yet.

Among the recent announcements, the expanded Anthropic partnership is especially relevant, as it aims to move clients from small AI pilots to production deployments across regulated sectors like financial services, healthcare and the public sector. This speaks directly to the same Gen AI adoption theme as the Palantir group and could influence how investors judge the durability of Accenture’s AI related consulting and managed services pipeline.

Yet while these AI partnerships look promising, investors should also be aware of growing pressure on operating margins and what that could mean for...

Read the full narrative on Accenture (it's free!)

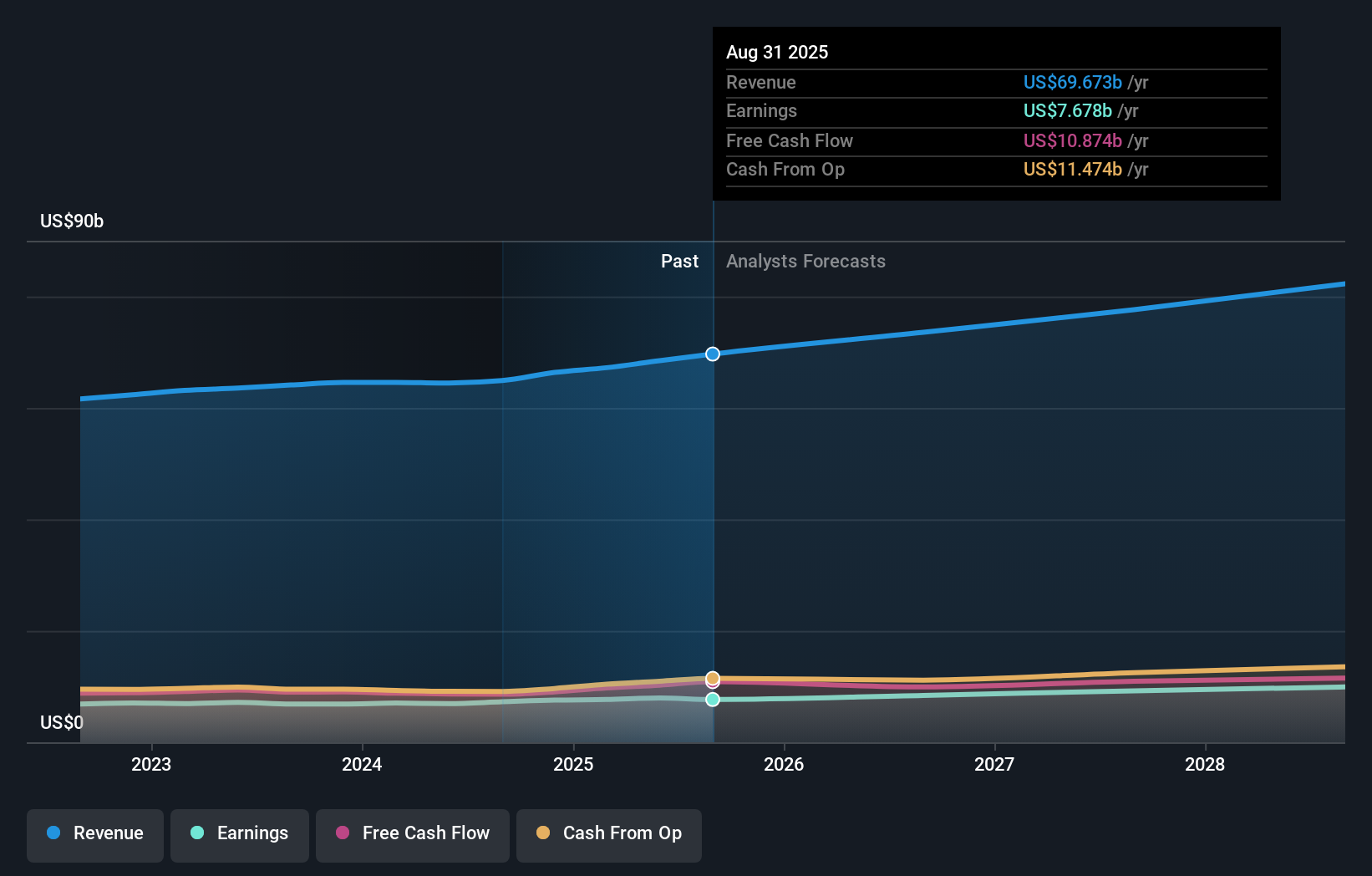

Accenture’s narrative projects $81.5 billion revenue and $10.0 billion earnings by 2028. This requires 6.0% yearly revenue growth and a roughly $2.1 billion earnings increase from $7.9 billion today.

Uncover how Accenture's forecasts yield a $280.58 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Twelve members of the Simply Wall St Community currently value Accenture between US$202 and US$294 per share, highlighting a wide spread of expectations. When you set those views against the earnings sensitive catalyst of upcoming AI related project bookings, it underlines why understanding several different risk and growth scenarios can be useful before making a decision.

Explore 12 other fair value estimates on Accenture - why the stock might be worth 26% less than the current price!

Build Your Own Accenture Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Accenture research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Accenture research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Accenture's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com