How Santos’ Latest Asset Sales and Barossa Focus Will Impact Santos (ASX:STO) Investors

- Santos recently completed the sale of its interests in the Mahalo Joint Venture and the Petrel and Tern fields, raising upfront and contingent cash while lowering future decommissioning obligations as it sharpens its portfolio around core growth projects.

- This shift frees up capital and management attention for higher-priority developments such as Barossa and Pikka, potentially reshaping Santos’ long-term cash flow mix and risk profile.

- Next, we’ll explore how these divestments and Barossa’s progress may influence Santos’ investment narrative and future cash generation.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Santos Investment Narrative Recap

To own Santos today, you need to believe that major projects like Barossa and Pikka can convert heavy upfront spending into resilient long-term cash flows, without blowing out in cost or timing. The recent sales of Mahalo and Petrel/Tern appear incremental rather than game changing for that near term catalyst, but they do modestly reduce decommissioning risk and tidy up the portfolio around those core developments.

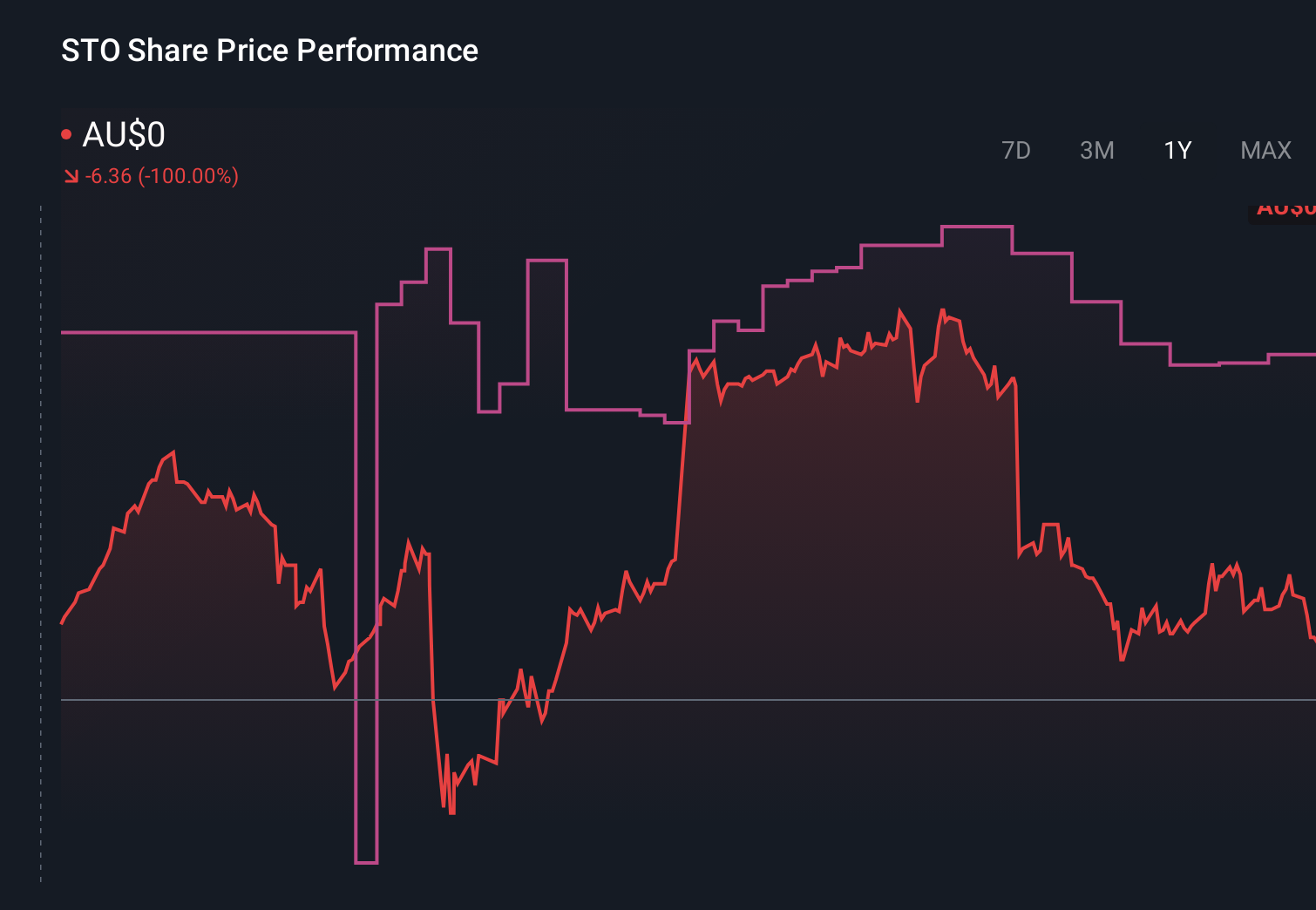

Among recent announcements, the cancellation of the proposed A$28.8 billion takeover at A$8.89 per share has left Santos firmly on a standalone path, with execution on Barossa now even more central to the story. Against that backdrop, the latest divestments look like housekeeping that slightly eases future liabilities while keeping capital focused on the projects that matter most.

Yet, while the portfolio looks cleaner, investors still need to weigh how Santos manages the very large capital outlays and project risks tied to Barossa and Pikka, particularly if...

Read the full narrative on Santos (it's free!)

Santos' narrative projects $6.9 billion revenue and $1.6 billion earnings by 2028. This requires 9.6% yearly revenue growth and about a $0.6 billion earnings increase from $1.0 billion today.

Uncover how Santos' forecasts yield a A$7.53 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span roughly A$7.30 to A$41.80, reflecting very different views on Santos’ potential. When you weigh those against the execution and capital intensity risks around Barossa and Pikka, it becomes even more important to compare several viewpoints before deciding how Santos fits into your portfolio.

Explore 6 other fair value estimates on Santos - why the stock might be worth over 6x more than the current price!

Build Your Own Santos Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Santos research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Santos research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Santos' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com