Evaluating T1 Energy (TE) After Groundbreaking G2_Austin Solar Cell Fab and U.S. Manufacturing Expansion

T1 Energy (TE) just broke ground on its G2_Austin solar cell fab, a $400 to $425 million bet on U.S. manufacturing that could reshape the domestic solar supply chain and T1’s long term earnings mix.

See our latest analysis for T1 Energy.

The stock has been volatile around these announcements, with a 1 day share price return of 7.51 percent and a 30 day share price return of 61.9 percent, building on a 1 year total shareholder return of 209.09 percent, despite weaker three year and five year total shareholder returns.

If you like the growth angle behind T1’s new fab, this could be a good moment to explore high growth tech and AI stocks that are also riding structural demand for smarter energy and infrastructure solutions.

With the stock still trading at a steep discount to analyst targets despite eye catching growth and a transformational fab coming online, is T1 Energy quietly undervalued, or is the market already pricing in that future upside?

Most Popular Narrative Narrative: 22.3% Undervalued

With T1 Energy closing at 5.44 dollars against a narrative fair value of 7 dollars, the valuation case leans heavily on rapid scale and policy tailwinds.

The expansion of U.S. electricity demand, driven by the AI infrastructure build out, electrification of transportation, and onshoring of advanced manufacturing, positions T1 as a key provider of solar modules and storage solutions for a rapidly growing market, supporting sustained topline revenue growth. Robust government policy tailwinds including stackable, transferable Section 45X tax credits and protectionist trade measures are providing T1 with access to funding, margin boosting incentives, and risk mitigation for its U.S. production pipeline, which should improve both earnings quality and net margins.

Curious how high growth, richer margins, and a surprisingly restrained future earnings multiple all add up to that upside case? The full narrative unpacks the math behind it.

Result: Fair Value of $7 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside hinges on sustained U.S. policy support and smooth project financing, and any setback could quickly challenge the bullish valuation narrative.

Find out about the key risks to this T1 Energy narrative.

Another Lens On Valuation

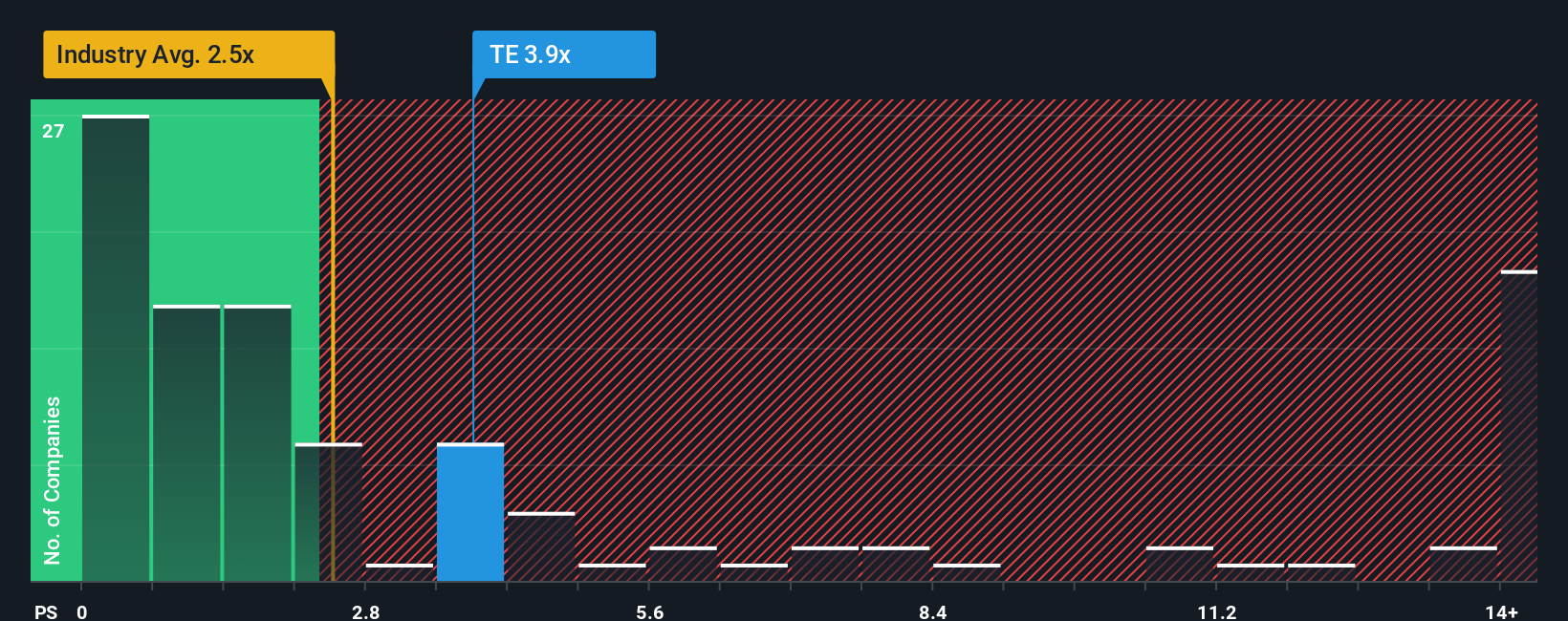

While the narrative fair value of 7 dollars suggests upside, a simple price to sales check is less generous. TE trades at about 2.9 times sales versus a 2.2 times industry average and a 2.7 times fair ratio, hinting that enthusiasm may already be crowding the near term story.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own T1 Energy Narrative

If you would rather challenge these assumptions yourself and dive into the numbers directly, you can build a custom T1 story in just a few minutes, Do it your way.

A great starting point for your T1 Energy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investment move

Before you move on, explore your next idea by using the Simply Wall St Screener to find opportunities that match your approach and risk profile.

- Explore potential in smaller companies by scanning these 3633 penny stocks with strong financials that already show solid balance sheets and improving fundamentals.

- Follow the development of intelligent automation by tracking these 25 AI penny stocks that are generating revenue growth from AI adoption.

- Look for candidates with attractive valuations using these 915 undervalued stocks based on cash flows that trade below their cash flow based fair values.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com