GameStop (GME) Valuation Check After Influencer Campaign Buzz and Collectibles-Led Profit Improvement

GameStop (GME) just gave investors fresh talking points, pairing a buzzy influencer ad campaign with a quarter that quietly improved profitability while leaning on collectibles as its main growth engine.

See our latest analysis for GameStop.

Those moves have not stopped the roller coaster, but they help explain why a volatile year has left GameStop with a roughly 7.8% one month share price return, yet a deeply negative year to date share price return and still a powerful five year total shareholder return that keeps long term believers interested.

If this kind of turnaround story has your attention, it might be a good moment to scan the market for other contrarian ideas and discover fast growing stocks with high insider ownership.

With profits up, sales sliding and collectibles surging, GameStop still trades below many estimates of intrinsic value. This raises a key question for investors: is this a genuine buying window, or is the market already pricing in a brighter future?

Most Popular Narrative Narrative: 81.4% Undervalued

With GameStop last closing at $22.28 against a narrative fair value of $120, the gap is huge and invites a closer look at the thesis driving it.

GameStop’s Q1 2025 financials, combined with an amazing shareholder community, just showed its takes-money-to-buy-whiskey strategy at work, demonstrating its status as a compelling investment as the retail investors have been saying for years while fighting a corrupt legacy media, bots, social media manipulation and hedge funds. Gamestop delivered a stellar adjusted EPS of $0.17, beating estimates by 325%, and achieved a $44.8 million net profit, reversing last year’s $32 million loss.

According to prime_is_back, this valuation leans on a sharp earnings turnaround, ambitious profit margins and a future earnings multiple more often seen in fast growing tech names. Want to see how those moving parts combine to justify a triple digit fair value and what kind of long term growth path they are banking on? Read on to unpack the full narrative behind that number.

Result: Fair Value of $120 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained sales declines or a sharp reversal in Bitcoin prices could quickly compress margins and challenge the lofty earnings and valuation assumptions.

Find out about the key risks to this GameStop narrative.

Another Angle on Value

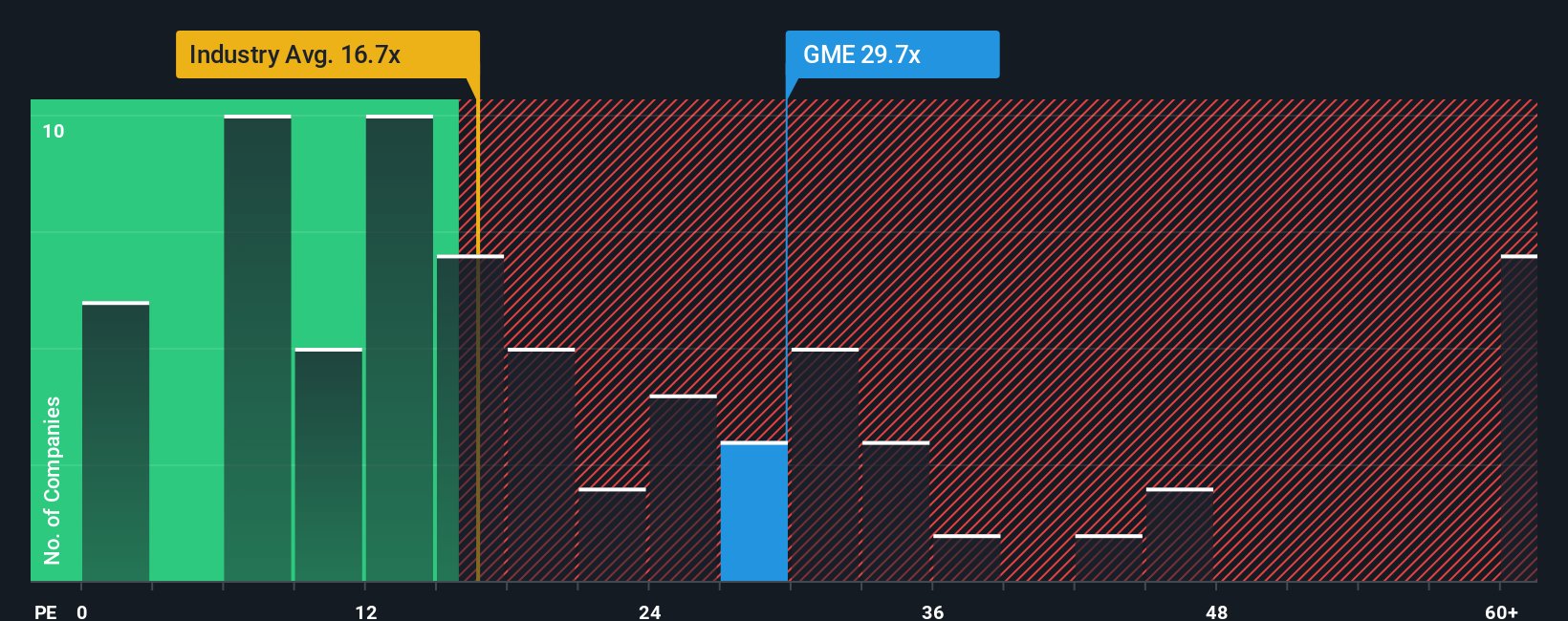

That bullish narrative leans on future earnings power, but today GME trades at about 23.7 times earnings, richer than both peers at 20.2 times and the broader US specialty retail group at 20.6 times. If sentiment cools, that premium could shift from a valuation cushion to a potential valuation risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GameStop Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft a personalized view in under three minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding GameStop.

Looking for more investment ideas?

Before you move on, you can scan fresh opportunities on Simply Wall St, where data-backed screeners highlight potential opportunities.

- Explore income-oriented ideas with these 13 dividend stocks with yields > 3% that may help support your portfolio through different market conditions.

- Review companies involved in intelligent automation using these 25 AI penny stocks.

- Assess businesses involved in digital asset infrastructure with these 80 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com