December 2025's Top Stocks Estimated Below Intrinsic Value

As December 2025 unfolds, the U.S. stock market faces a challenging period with major indices like the S&P 500 and Dow Jones Industrial Average experiencing consecutive declines amid AI bubble concerns and rising unemployment rates. In such an environment, identifying undervalued stocks becomes crucial for investors seeking opportunities that may offer potential value relative to their intrinsic worth.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (UMBF) | $119.03 | $233.99 | 49.1% |

| Schrödinger (SDGR) | $17.94 | $35.43 | 49.4% |

| Perfect (PERF) | $1.73 | $3.43 | 49.6% |

| Krystal Biotech (KRYS) | $238.55 | $469.98 | 49.2% |

| Freshworks (FRSH) | $12.47 | $23.77 | 47.5% |

| FirstSun Capital Bancorp (FSUN) | $38.54 | $73.32 | 47.4% |

| DexCom (DXCM) | $66.37 | $127.52 | 48% |

| Columbia Banking System (COLB) | $28.91 | $57.43 | 49.7% |

| American Superconductor (AMSC) | $31.21 | $59.18 | 47.3% |

| AbbVie (ABBV) | $223.67 | $419.64 | 46.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Beacon Financial (BBT)

Overview: Beacon Financial Corporation is the bank holding company for Beacon Bank & Trust, offering a range of banking solutions in New England and New York, with a market cap of $2.31 billion.

Operations: The company generates revenue primarily from its banking segment, with reported earnings of $318.12 million.

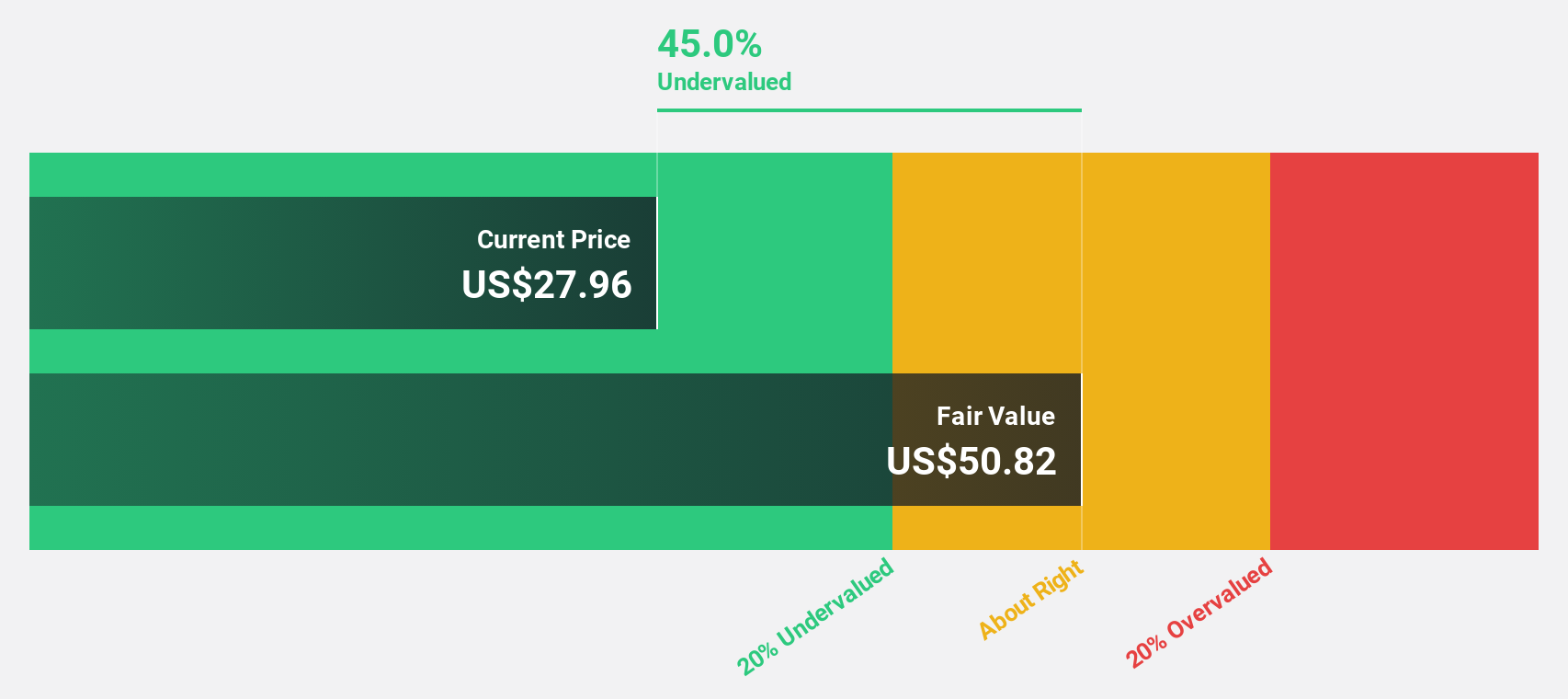

Estimated Discount To Fair Value: 44.8%

Beacon Financial is trading at US$27.72, significantly below its fair value estimate of US$50.2, suggesting strong undervaluation based on cash flows. Despite a forecasted revenue growth of 40.2% annually, recent financial performance shows challenges with a net loss of US$56.26 million in Q3 2025, compared to a net income the previous year. The company's profit margins have declined due to large one-off items and increased net charge-offs totaling US$15.86 million for the quarter ended September 2025.

- Our growth report here indicates Beacon Financial may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Beacon Financial stock in this financial health report.

Griffon (GFF)

Overview: Griffon Corporation operates through its subsidiaries to offer home and building, as well as consumer and professional products across the United States, Europe, Canada, Australia, and other international markets; it has a market cap of approximately $3.55 billion.

Operations: The company's revenue is derived from two main segments: Home and Building Products, which generated $1.58 billion, and Consumer and Professional Products, which brought in $935.74 million.

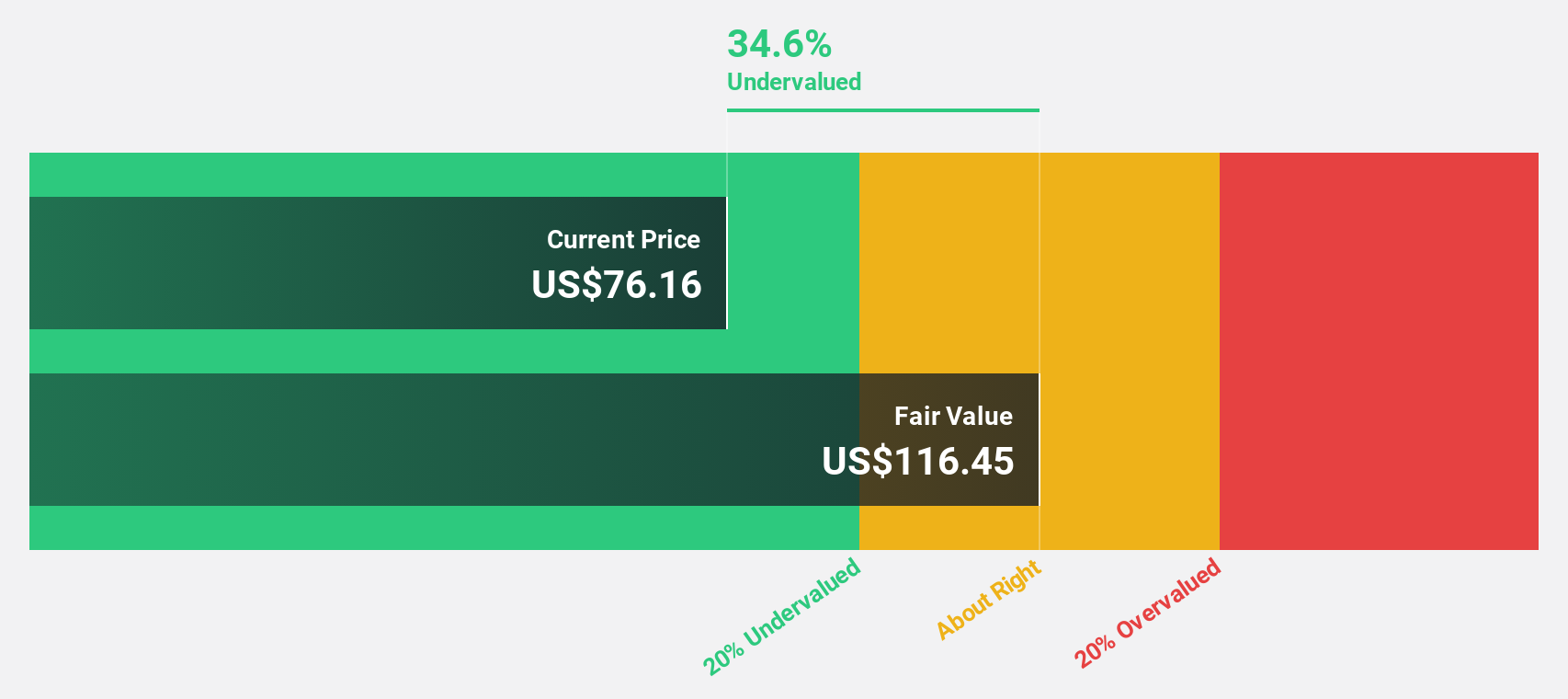

Estimated Discount To Fair Value: 43.1%

Griffon Corporation, trading at US$76.8, is considerably undervalued with an estimated fair value of US$134.86. Despite a forecasted earnings growth of 33.8% annually, recent results show a decline in net income to US$43.64 million for Q4 2025 from the previous year due to large one-off items impacting profitability and reduced profit margins from 8% to 2%. The company carries substantial debt but maintains strong potential for future earnings growth above market averages.

- Our expertly prepared growth report on Griffon implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Griffon's balance sheet health report.

REV Group (REVG)

Overview: REV Group, Inc. designs, manufactures, and distributes specialty vehicles and related aftermarket parts and services in North America and internationally, with a market cap of approximately $2.89 billion.

Operations: The company's revenue is primarily derived from its Specialty Vehicles segment, which generated $1.81 billion, and its Recreational Vehicles segment, contributing $649.20 million.

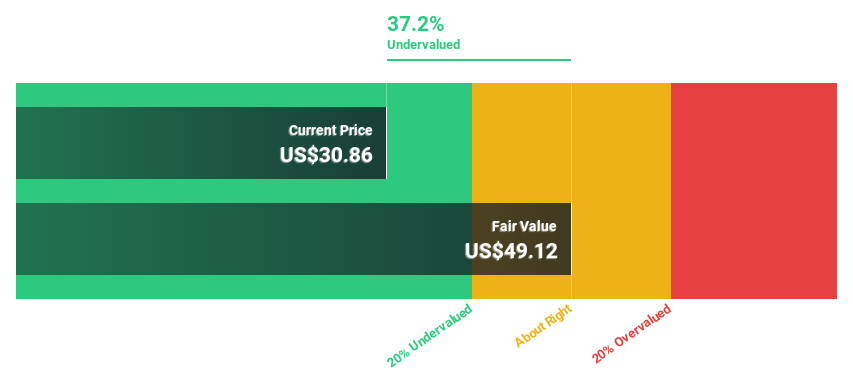

Estimated Discount To Fair Value: 33.1%

REV Group, Inc. is trading at US$60.03, significantly undervalued with an estimated fair value of US$89.76. Despite a year-over-year drop in net income to US$95.2 million for 2025 and decreased profit margins from 10.8% to 3.9%, the company's earnings are forecasted to grow by 26.83% annually, outpacing the broader U.S market growth expectations of 16.1%. The upcoming merger with Terex Corporation may further influence its valuation dynamics.

- According our earnings growth report, there's an indication that REV Group might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of REV Group.

Taking Advantage

- Delve into our full catalog of 204 Undervalued US Stocks Based On Cash Flows here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com