Discovering Undiscovered Gems in Australia for December 2025

As the Australian market navigates a period of mixed performance, with sectors like Materials showing resilience amidst broader retreats in Staples, Health Care, and Energy, investors are keeping a keen eye on potential opportunities within small-cap stocks. In this environment, identifying promising companies often involves looking for those with strategic partnerships or unique market positions that can thrive despite fluctuating economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Joyce | NA | 9.93% | 17.54% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Euroz Hartleys Group | NA | 1.82% | -25.32% | ★★★★★★ |

| Argosy Minerals | NA | -12.81% | -19.89% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Investigator Silver | NA | 54.36% | 52.03% | ★★★★★★ |

| Energy World | NA | -47.50% | -44.86% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Emeco Holdings (ASX:EHL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Emeco Holdings Limited provides surface and underground mining equipment rental and related services in Australia, with a market cap of approximately A$671.41 million.

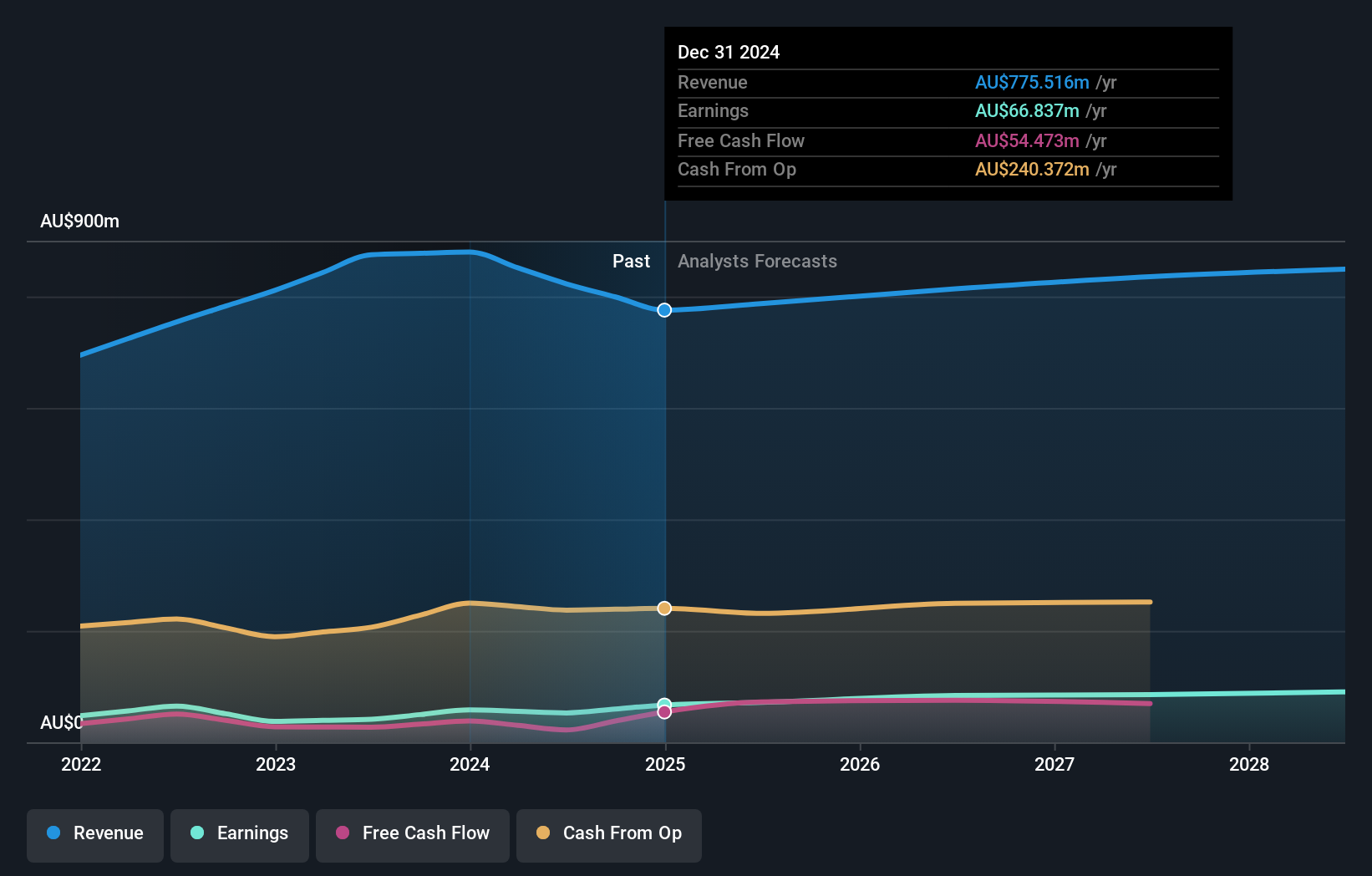

Operations: Emeco Holdings generates revenue primarily through its mining equipment rental services, which account for A$615.39 million, and workshops contributing A$273.47 million. The company's financial performance is influenced by its net profit margin trends, reflecting the efficiency of its operations and cost management strategies.

Emeco Holdings, a smaller player in the industry, showcases robust financial health with a net debt to equity ratio of 17.6%, which is considered satisfactory. The company's earnings growth of 42.7% over the past year outpaces the Trade Distributors industry average of 17.1%, indicating strong performance relative to peers. Trading at 62.9% below its estimated fair value suggests potential upside for investors seeking undervalued opportunities. Recent leadership changes include Shaun Treacy joining as an Independent Non-Executive Director, bringing extensive experience in corporate finance and mining strategy, potentially bolstering Emeco's strategic direction and governance framework moving forward.

- Unlock comprehensive insights into our analysis of Emeco Holdings stock in this health report.

Understand Emeco Holdings' track record by examining our Past report.

SHAPE Australia (ASX:SHA)

Simply Wall St Value Rating: ★★★★★★

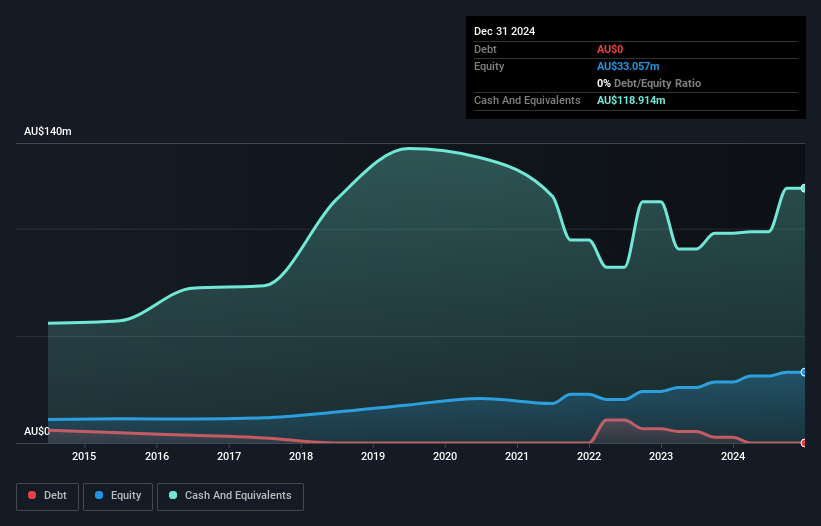

Overview: SHAPE Australia Corporation Limited, with a market cap of A$490.78 million, operates in the construction, fitout, and refurbishment sector for commercial properties across Australia.

Operations: SHAPE Australia generates revenue primarily from its heavy construction segment, amounting to A$956.87 million.

SHAPE Australia, a nimble player in the construction industry, is showcasing impressive growth potential with earnings surging 31.9% over the past year, outpacing the sector's 6.5%. With no debt on its books and trading at 28.3% below estimated fair value, it presents an intriguing value proposition. Despite significant insider selling recently, SHAPE's free cash flow remains positive at A$51.22 million as of June 2025. The company's strategic pivot towards diverse sectors like healthcare and education could drive future revenue streams; however, reliance on office fit-outs may pose challenges amidst evolving work trends and competitive pressures in pricing.

SKS Technologies Group (ASX:SKS)

Simply Wall St Value Rating: ★★★★★★

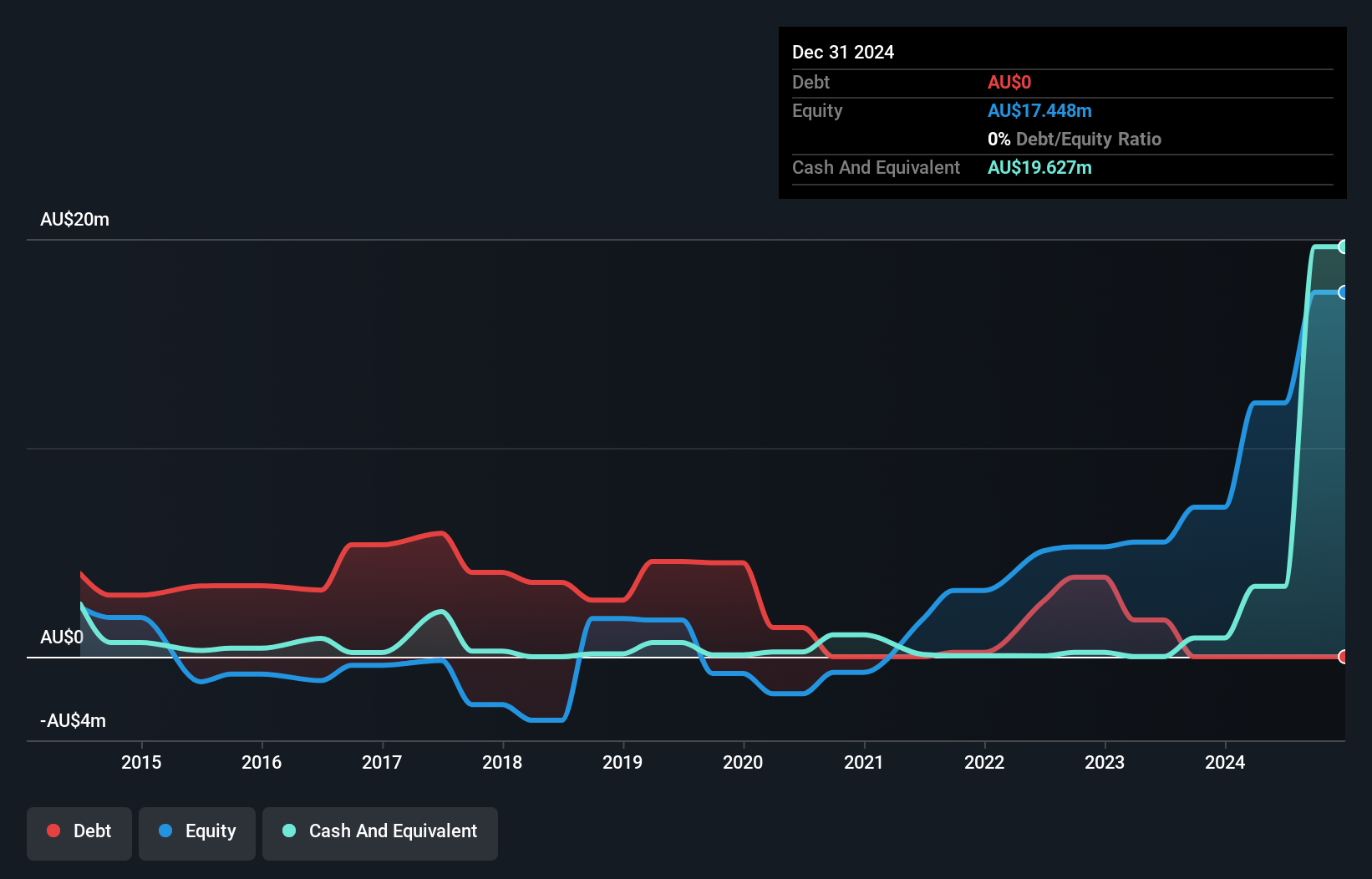

Overview: SKS Technologies Group Limited operates in Australia, focusing on the design, supply, and installation of audio visual, electrical, and communication products and services with a market capitalization of A$471.45 million.

Operations: SKS Technologies Group generates revenue primarily from the Lighting and Audio-Visual Markets, amounting to A$261.66 million.

SKS Technologies Group is making waves with its impressive earnings growth of 111.8% over the past year, outpacing the Electrical industry’s 10.1%. The company has no debt, ensuring interest coverage isn't a concern and highlighting its robust financial health. With a significant revenue increase of 92% and tender activity up by 46%, SKS is capitalizing on digital infrastructure demand across sectors like commercial and education. Despite being fairly priced at A$2.88 against a target of A$3.1, risks such as customer concentration and rising labor costs could affect future cash flow stability.

Seize The Opportunity

- Delve into our full catalog of 58 ASX Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com